Reading: Adjusting the Capital Structure

3. Coping with Excess Cash

3.6. Extension: Alternative Forms of Payout

For the sake of completeness, let us briefly consider alternative forms of payout for the 250 billion that Pear intends to distribute to its shareholders. In particular, let us consider:

- Open market buyback program at the post-announcement stock price of 112.5

- Dividend payment

Open Market Buyback Program

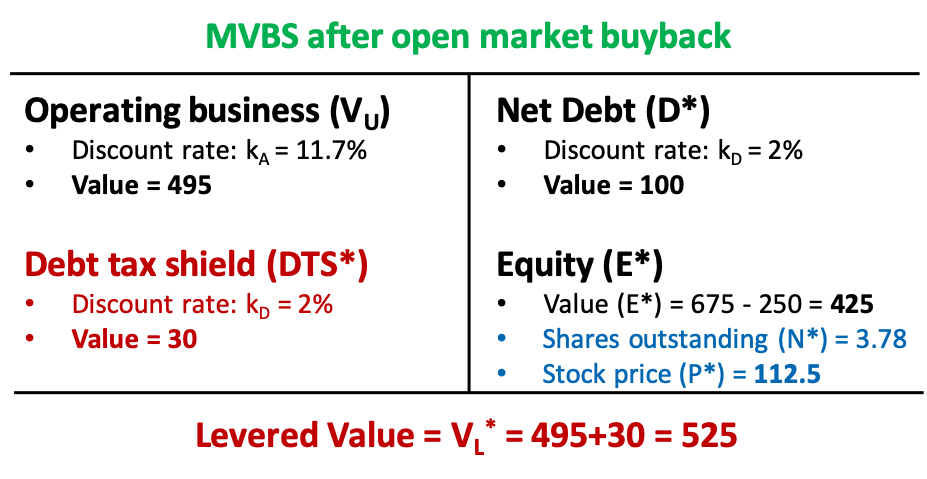

From the preceding section we know, that the firm's equity value under the new capital structure (E*) will be 425 billion. If Pear repurchases shares at a price of 112.5, it will repurchase a total of 2.22 billion shares (NR), so that the number of shares outstanding (N*) drops to 6 - 2.222 = 3.778 billion. Consequently, the stock price after the transaction (P*) will remain at its post-announcement level of 112.5 (=425/3.778).

After an open market buyback program, the firm's market value balance sheet (MVBS) will therefore be:

Dividend Payment

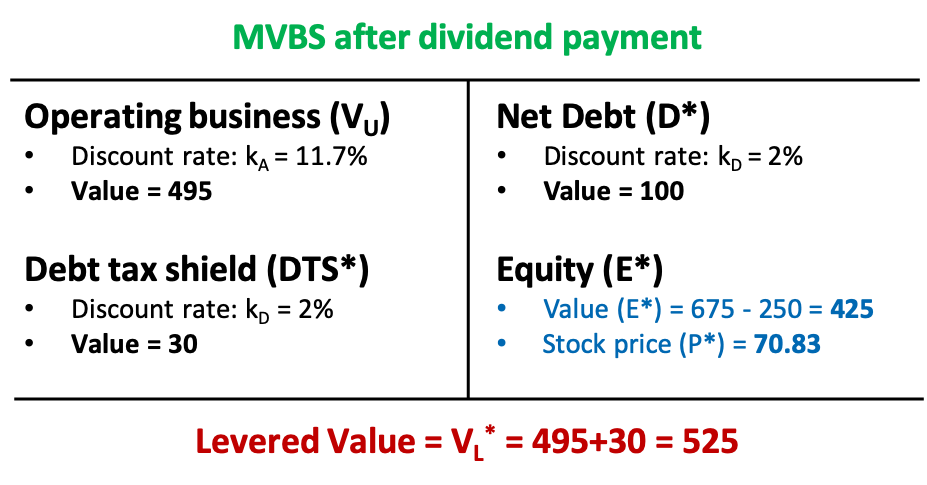

Instead of repurchasing shares, the firm could also distribute an extraordinary dividend. Given a total payout of 250 billion and 6 billion shares outstanding, the dividend per share would be 41.67:

\(\text{Dividend per share}=\frac{\text{Total payout}}{\text{Number of shares}} = \frac{250}{6}=41.67\).

After the dividend payment, Pear's market value of equity (E*) would still be 425 billion (see above). Consequently, the stock price (P*) would drop by 41.67 from 112.5 to 70.83:

\(P^*=\frac{E^*}{N^*}=\frac{425}{6}=70.83\).

Total shareholder wealth would remain at 112.5 per share, i.e., a cash dividend of 41.67 plus one stock valued at 70.83. The firm's market value balance sheet (MVBS) would present itself as follows:

Taken together, the same conclusion applies as before: Shareholder value increases because the firm changes its financing policy and therefore receives favorable tax treatment. How the firm distributes the money to its shareholders, in contrast, is value neutral.