Reading: Introduction to Financial Planning

A solid financial plan is the basis of every valuation exercise and every significant management decision. The financial plan allows us to identify the firm's capital needs as well as its ability to generate cash. It also unveils the various sources and uses of funds. This section shows how to set up a financial plan.

2. Setting the Stage

The financial plan ventures a glimpse into the financial future of a company. It provides detailed information about how the firm is expected to generate money (sources of funds) and how that money will be spent (uses of funds). Financial planning is a core element of financial management and it is an indispensible management tool:

- Financial health of the company: The financial plan provides information about the current as well as the anticiapted financial health of the company (e.g., will the firm generate enough money to repay the bank loans?)

- Warning flags: The financial plan allows managers to identify potential profitability risks and liquidity gaps before they materialize.

- Assessment of the firm's strategy: Most importantly, the financial plan reflects the financial implications of the firm's strategy. Before taking strategic decisions, managers must know how these decisions affect the financials of the firm and whether they contribute to thefinancial targets.

- Identification of value drivers: Properly implemented, the financial plan also allows managers to identify the most important value drivers. It therefore shows managers on which dimensions they should focus their attention.

- Valuation and investment decisions: The financial plan is a key ingredient of every serious valuation. Without a financial plan, we cannot value projects or firms. And without a valuation, we generally cannot make profound investment decisions.

This course discusses the key elements of financial planning.

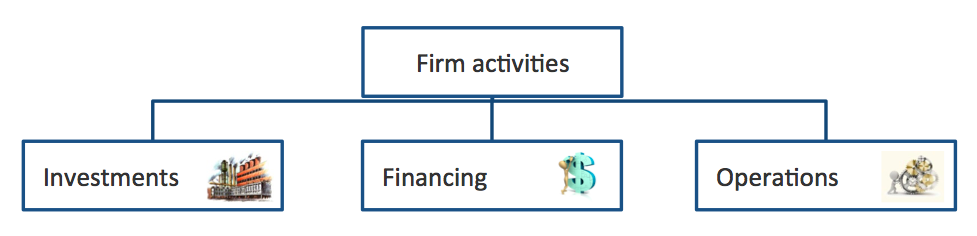

To structure the investigation and to better understand the sources and uses of funds, it makes sense to divide the firm's activities into three components: Investment activities, operating activities, and financing activities:

- The investment activities define define the (long-term) assets the firm owns. The assets in place the firm uses to produce and sell its goods and services are the result of its investment activities.

- The firm's operating activities summarize how the firm uses its assets to produce and sell its goods and services.

- Finally, the financing activities define how the firm's assets are financed (typically debt and equity) and how cash is returned to the providers of capital.

The challenge ahead of us is to define a structured approach to identify the cash flows associated with these three sets of activities and to compile them to a financial plan. Specifically, we want to estimate the following three types of future cash flows:

- Investment cash flow: Reflects all cash in- and outflows related to the firm's investment activities.

- Operating cash flow: Reflects all cash in- and outflows related to the actual production and sale of the firm's goods and services.

- Financing cash flow: Reflects all cash inflows and outflows related to the firm's financing activities.

To get a first impression, the following table assigns typical corporate actions to the three types of cash flows:

|

Cash flows from operating activities |

Cash flows from investment activities |

Cash flows from financing activities |

|

Sales for cash Purchases of material Salary payments Taxes etc. |

New investments Replacement investments Divestments etc. |

Interest payments Dividend payments Raising of debt Repayment of capital etc. |

As we will see in the next section, the financial statements of a firm, in principle, follow the same logic. Its operating activities are summarized in the income statement whereas the balance sheet contains information about investment activities (long-term assets) as well as financing activities (financial liabilities and equity). We can use this information to identify the relevant cash flows and compile the cash flow statement. Before doing so, it makes sense to take a quick look at the necessary accounting framework.