Solution: Clean Water Discussion

Abschlussbedingungen

Anzeigen

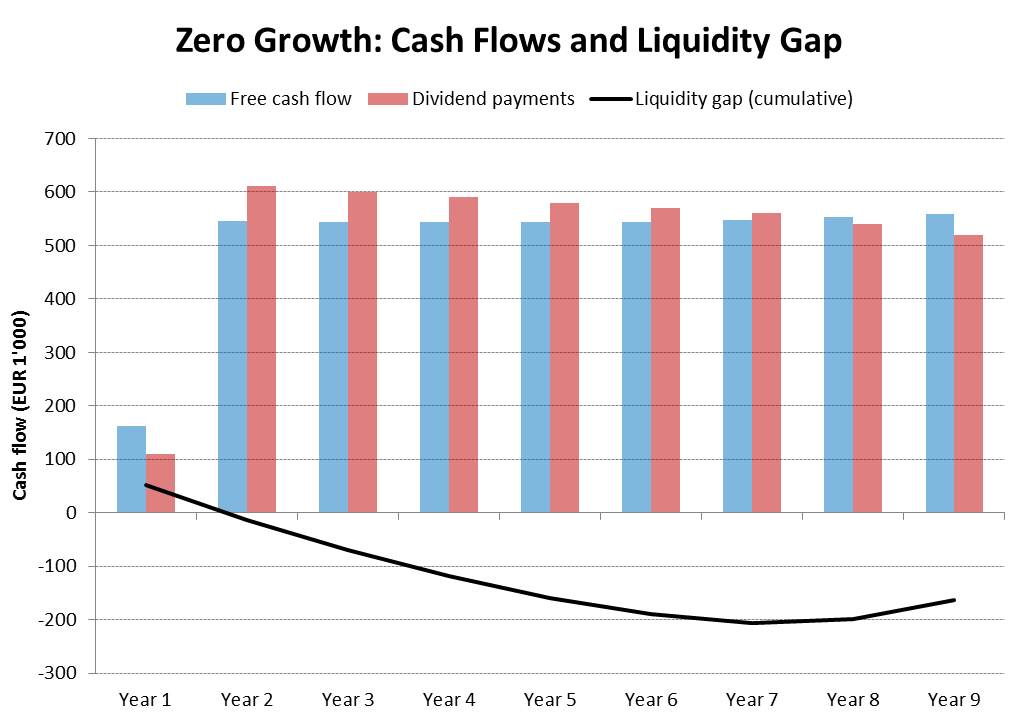

2. Zero-growth Scenario

The business plan assumes growth in revenues from a geographic expansion of the business. What if this growth does not materialize? The following figure shows the cash flow patterns if net revenues remain constant over the first 6 years.

Without growth, the required dividend payments will exceed the firm's FCF for up to 7 years. Moreover, the graph shows that the revolving credit line of 100'000 will not suffice to bridge the liquidity gap. Consequently, the buyer would have to find additional sources of financing. Most likely, this would mean that he would have to raise an additional 100'000 in equity.