Reading: Accounting Framework

1. The Accounting Framework

1.3. Linking the Balance Sheet and Income Statement

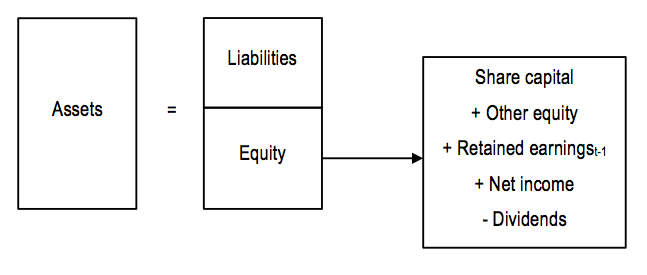

The balance sheet and income statement are not independent financial statements. The part of the net income, which is not distributed as a dividend to the shareholders is added to the firm's retained earnings, which are part of the equity. Therefore, the retained earnings at the end of any year t correspond to the retained earnings at the end of the previous year (t-1) plus the part of the net income earned during that year which has not been paid out as dividends:

Retained earingst = Retained earningst-1 + Net incomet - Dividendst

The following figure summarizes the basic accounting equation:

In the case of Hershey, we know from the income statement that the firm has generated a net income of 513 million. The annual report also states that the firm has paid cash dividends of 476 million in 2015. Consequently, of the net income of 513 million, 476 million were paid out to shareholders and 37 million [= 513 - 476] were retained in the company.

A quick look at the balance sheet shows that retained earnings did indeed increase by 37 million, from 5'861 million in 2014 to 5'898 million in 2015.