Reading: WACC for Listed Firms

So far, we have seen what the WACC is and how we use it in firm valuation. This section takes a brief look at how to estimate the WACC in practice.

4. Putting Everything Together

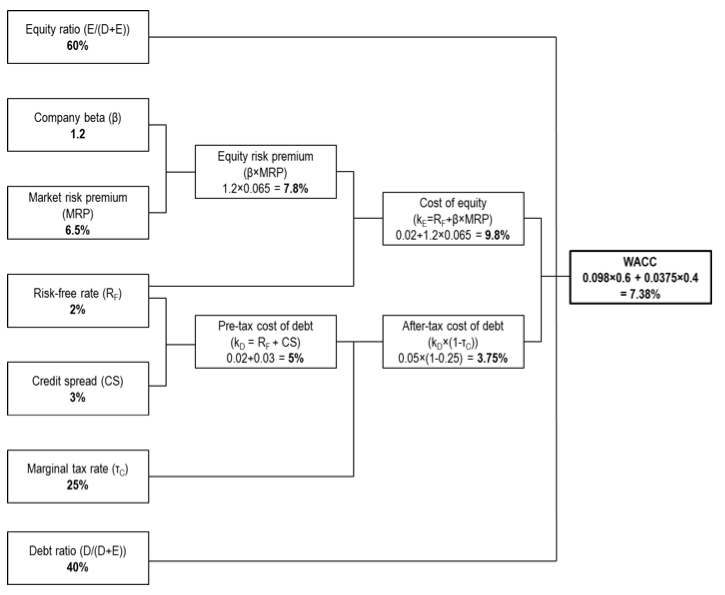

To conclude, let's now compute the WACC of a hypothetical company. Suppose we have collected the relevant information in the following table:

|

Variable |

Description |

Estimate |

|

E/(D+E) |

Equity ratio |

60% |

|

β |

Beta of the stock |

1.2 |

|

MRP |

Market risk premium |

6.5% |

|

RF |

Risk-free rate of return |

2.0% |

|

CS |

Credit spread of the debt |

3.0% |

|

τC |

Marginal tax rate |

25% |

|

D/(D+E) |

Debt ratio |

40% |

Based on this information, we can estimate the firm's WACC. The following figure illustrates the procedure step-by-step. According to our estimates, the WACC is 7.38%.

In the following chapter, we discuss the relevant steps to estimate the WACC of a company if there is important information missing about the company or if the company decides to adjust its capital structure.