Reading: Leverage and Cost of Capital

These notes summarize some basic ideas that help us understand the relation between financial leverage and the cost of capital.

2. Leverage, Cost of Equity, and the Cost of Debt

We can use the preceding considerations to derive the relation between the cost of assets (\( k_A \)) and the cost of debt (\( k_D \)) and equity (\( k_E \)). The following table summarizes the levered firm's balance sheet at market values:

Since the balance sheet in in balance (Debt + Equity = Assets), the riskiness of the assets must correspond to the overall risk of the firm's debt and equity. Put differently, the total return claimed by the firm's debt and equity holders must correspond to the return the firm earns on it's assets, on average:

\( Assets \times k_A = Debt \times k_D + Equity \times k_E \)

In the above example, the average dollar return earned on the firm's assets is \( Assets \times k_A = 1.25 \times 0.2 = 0.25 \). Of this amount, the debt holders claim \( Debt \times k_D = 0.727 \times 0.1 = 0.0727 \). The rest, namely \( Equity \times k_E = 0.523 \times 0.34 = 0.1778 \), is claimed by the shareholders.

We can rearrange the above equation and write:

\( k_A=k_D \times \frac{D}{(D+E)}+k_E \times \frac{E}{(D+E)} \)

where:

D = Debt

E = Equity

\( k_A \) = Overall cost of capital (required return on assets)

\( k_D \) = Cost of debt (required return on debt)

\( k_E \) = Cost of equity (required return on equity).

The relation states that the overall cost of capital corresponds to the weighted average cost of debt and equity. The same relation holds, under given assumptions, also in the presence of corporate taxes. The purpose, here, however, is to discuss some regularities involving financial leverage that hold in general, regardless of tax considerations. We will come back to taxes later on.

Solving the above equation for the cost of equity, \( k_E \), yields the following relation:

\( k_E=k_A+(k_A-k_D) \times\frac{D}{E} \).

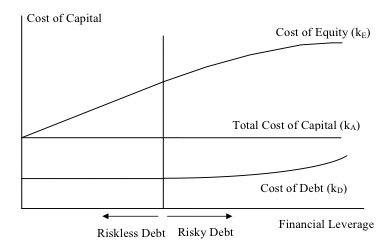

From this expression, we see that the cost of equity is a positive function of the firm's financial leverage (D/E).That is consistent with the numerical example in the preceding section.The following graph plots this relation.

As one can see, leverage increases the cost of equity. Graphically, this is represented by the positive slope of the cost of equity curve. Ignoring taxes, leverage leaves firm value unaffected. Hence, if the expected return on equity increases with leverage, it must be because of higher risk. Of course, shareholders don't need managers to increase their return by boosting risk. They can do that on their own by increasing the leverage of their own portfolio.

The graph also shows that leverage increases the cost of debt. As soon as debt becomes risky, investors require higher average returns on debt.

The graph allows us to rectify one of the most popular misconceptions in finance, namely the argument that, since debt commands a lower required rate of return, it is a cheaper source of capital than equity and should therefore be preferred to it. The answer is that, properly compared, debt is not cheaper:

- The argument that debt is cheaper than equity makes an incomplete comparison.

- To see this, suppose an all-equity financed firm wants to undertake a scale-expanding project, i.e., a project that is operationally identical to the rest of the firm. Suppose that the cost of equity is 20% and that the firm can borrow at 10% (cost of debt). While it is true that 20% is larger than 10%, it is incorrect to say that the all-inclusive cost of debt financing is 10%.

- The reason is that if we finance the project with debt, we also increase leverage and thereby we raise the cost of the outstanding equity. This increase in the cost of equity has to be factored into our comparison of the cost of the debt financing alternative.

- Thus, we should really be comparing the 20% of equity financing with the all-inclusive cost of debt financing (debt at 10%, and current equity at more than 20%).

- As the diagram shows, that all-inclusive cost (the average of more than 20% for the equity capital and 10% for the debt capital) is 20% as well.