Reading: Putting it All Together

Completion requirements

View

By now, we have all the necessary tools to conduct a firm valuation and estimate a confidence interval of potential firm values. The next step is to briefly show how to get from the overall value of the company to its theoretical share price.

2. Summary of the DCF Approach

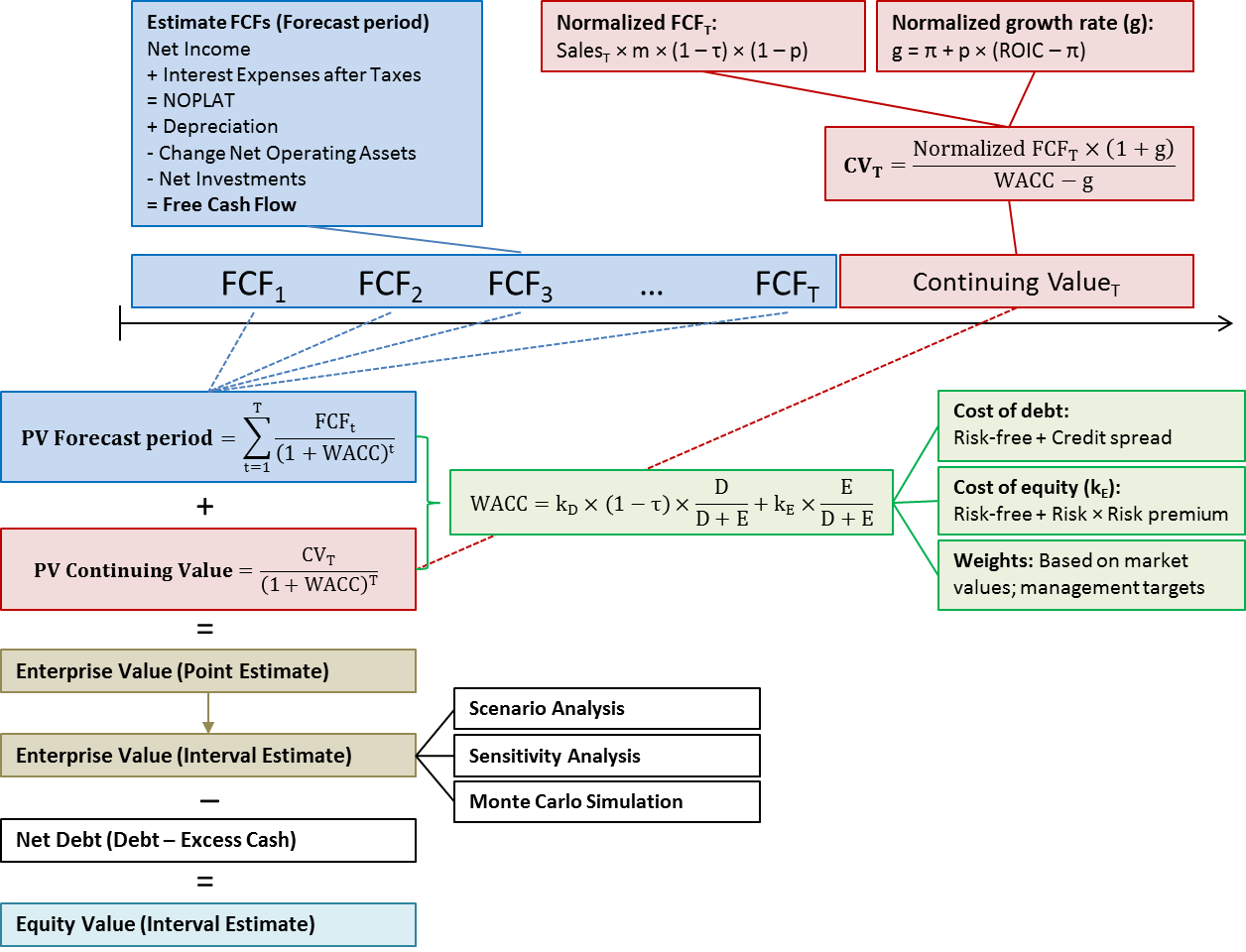

By now, we have covered all the relevant aspects of a state-of-the-art implementation of the discounted cash flow valuation approach. The following graph summarizes the most important steps we took on this journey and how the various pieces fit together.

In words, the major steps that bring us from a "blank sheet of paper" to the DCF value of the firm's equity can be summarized as follows:

- Estimate the firm's future cash flows. Identify the sources and uses of funds, how much money the firm will generate for its providers of capital, and how much liquidity it will need going forward to finance its operating business as well as its investment activities. The financial plan of the firm, which is a core element of the business plan, will provide important answers to these questions. The separate modules Financial Analysis and Financial Planning show how to compile (and understand) a financial plan.

- Assess the riskiness of the firm's future cash flows. Generally speaking, this riskiness is determined by the firm's operating business (i.e., the industry in which it operates) as well as its financing policy (the debt-equity choice). The separate module Cost of Capital shows how to assess these elements and derive the cost of capital.

- Model "Continuing Value." Usually, the cash flow forecasts from (1) cover a limited number of years. The third major step is to think about what might happen with the firm after this explicit forecast period. Will the firm continue to exist? How might cash flows evolve? Etc. The separate module Continuing Value shows how to find answers to these and similar important questions.

- Think about Measurement Error. Each valuation is the result of many assumptions. These assumptions might (and often will) be affected by measurement error. We therefore have to understand what the key value drivers are and how measurement error in these value drivers will affect the valuation result. The chapter Coping with Measurement Error shows how to assess these issues.