Reading: Startups as Real Options

4. Binomial Trees: Introduction

4.4. Valuing the Right to Sell with Binomial Trees

The previous examples have illustrated the use of option pricing in situations where we can buy an asset (e.g., an investment opportunity). These are so-called Call Options. As we have discussed in the introductory chapter, managerial flexibility can also mean that we can dispose of an asset or a project. The right to sell something is called a Put Option.

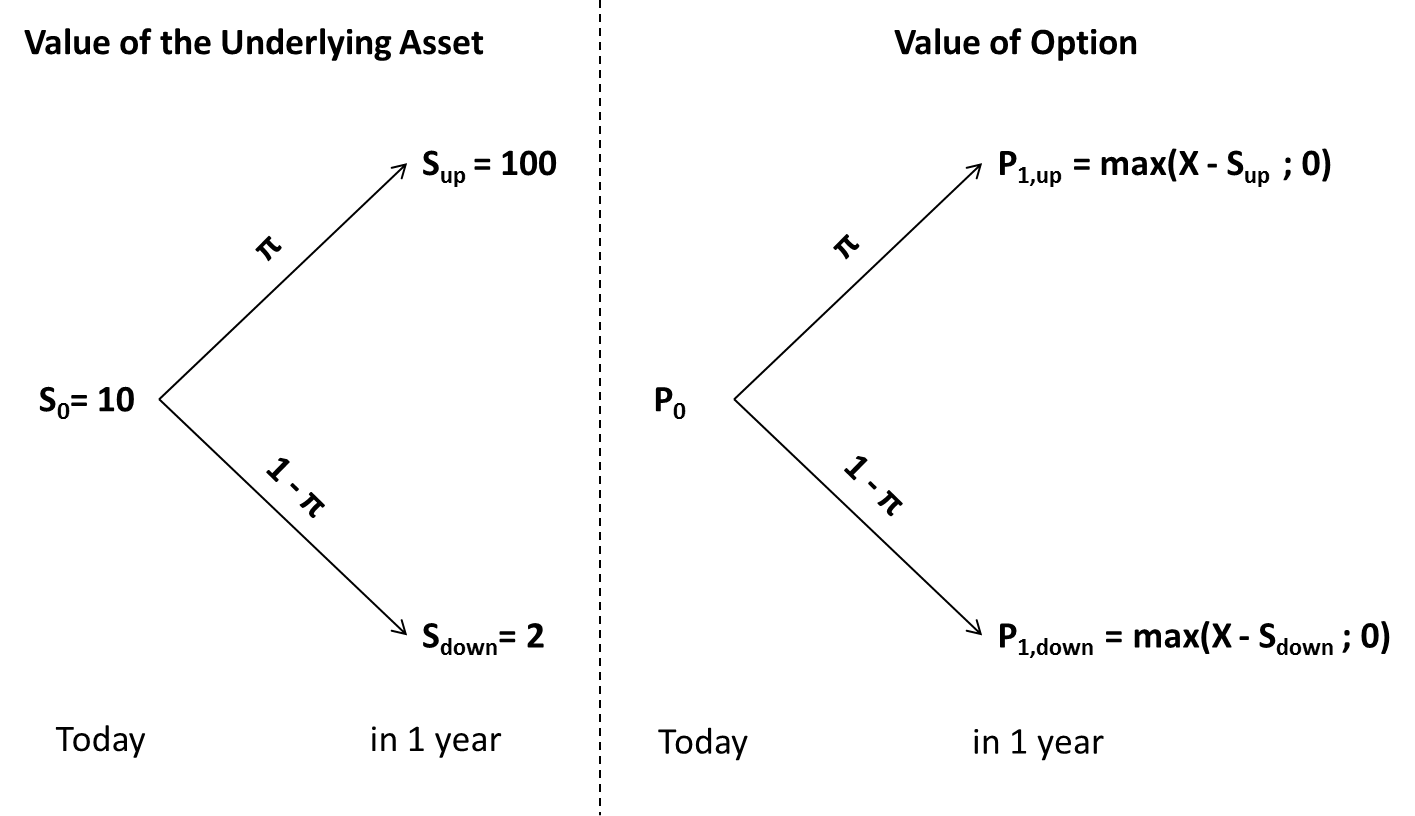

In this section, we illustrate how we can use the same logic as before to value such put options. For the sake of brevity we use a right to sell on an underlying asset that does not pay any dividends:

Suppose we own a piece of land on which we want to search for gold. The current value of the land (S) is 10 million. We have already contracted a study team to explore whether there is gold in the ground. If there is gold, the value of the property increases to 100 million (u = 10). If not, it drops to 2 million (d = 0.2). The previous owner has granted us the right to sell him back the land at a price of 6 million (X). The risk-free rate of return is 5%. What's the value of this right to sell the land back to the previous owner (put option)?

The following graph summarizes the situation:

The first thing we can do is back out the risk-neutral probability of an increase in the asset value, using the exact same procedure as before:

\( \pi = \frac{ (1+R) - d}{u - d} = \frac{ 1.05 - 0.2}{10 - 0.2} = 0.0867 \)

The probability of a price increase to 100 million is therefore only 8.67%.

Now what's the payoff of the right to sell in 1 year?

- If the value of the land increases to 100 million in 1 year because there is gold, we will most likely not want to sell it back to the previous owner for 6 million. Consequently, the right to sell will be worthless (P1,up = 0)

- If, in contrast, the value of the land drops to 2 million, selling it back to the previous owner for 6 million is attractive. In this case, the right to sell will have a value of 4 million, i.e., how much more we get when selling it to the previous owner (6 million) compared to selling it on the market (2 million). P1,down = 4 million.

With this information, we can now value the put option: In 1 year, it will be worthless with probability 8.67% or have a value of 4 million with probability 91.33%:

\( P_0 = \pi \times \frac{P_{1,up}}{1+R} + (1-\pi) \times \frac{P_{1,down}}{1+R} = 0.0867 \times \frac{0}{1.05} + 0.9133 \times \frac{4}{1.05} = 3.48 \) million.

Based on this information, the right to sell therefore has a value of 3.48 million.