Reading: Division of Returns

Reading assignment for the section "Division of Financial Returns"

2. Dividend Terms

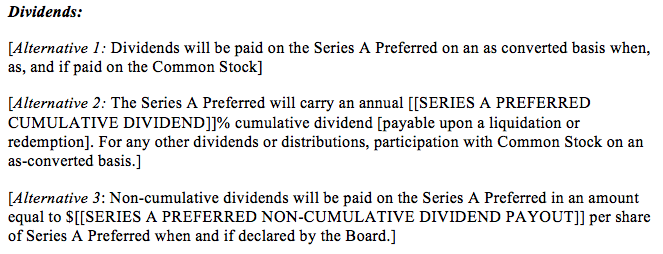

Let us start with the easiest provisions with respect to preferred returns: Dividends. The following extract from the term sheet template of the National Venture Capital Association (NVCA) summaries the standard dividend terms:

A careful inspection of the three formulations reveals that they have different implications with respect to the following three dimensions:

- Is there a fixed dividend claim of the Series A Preferred stockholders against the company?

- What happens if the firm misses a dividend payment?

- Do Series A Preferred stockholders have preference over common stockholders?

The following table summarizes the most important considerations:

| Alternative 1 | Alternative 2 | Alternative 3 | |

| Fixed Dividend Claim |

No fixed claim. It is at the discretion of the board of directors to declare a dividend. |

Fixed claim. Series A stockholders are entitled to an annual dividend that corresponds to a predetermined percentage of the invested capital. No board decision is necessary for this dividend. Moreover, if the board declares a dividend for the common stockholders, Series A stockholders also participate in this additional dividend. |

Fixed claim. Series A stockholders are entitled to a fixed annual dividend. Unlike in Alternative 2, however, the board of directors has to declare that dividend. If the board does not declare a dividend, no payment will be made to the Series A stockholders. |

| Missing Dividends |

Dividends are "Non-Cumulative" Since the Series A stockholders have no predefined dividend claim against the company, the firm also cannot "miss" a dividend payment. |

Dividends are "Cumulative" This means that any fixed dividend that the firm misses to pay will accrue on the issue price of the Series A. For example, if an investor has invested 1 million and the firm misses to pay a dividend of 5%, the investor's capital claim increases to 1.05 million at the time of liquidation or redemption. |

Dividends are "Non-Cumulative" If the board of directors decides against paying out a dividend, the missed dividend does not accrue on the issue price. |

| Preference |

No preference With respect to dividend payments, Series A stockholders are treated like common stockholders. |

Strong preference Series A stockholders receive preferential treatment compared to common stockholders. Their minimum dividend is contractually fixed. Common stockholders, in contrast, only receive a dividend if the board of directors declares one (in which case Series A also participates). |

Weak preference Series A receives preferential treatment also in this case. However, the preference is less strong since the board first has to declare a dividend. |

Consequently, Alternative 2 clearly grants Series A stockholders the strongest dividend rights whereas Alternative 1 grants Series A stockholders the weakest dividend rights.

These considerations also show that one has to be very careful when drafting and negotiating term sheets. As in all legal documents, every single word counts. In the above case, for example, it helps if the entrepreneur (and the investor) understands the difference between cumulative and non-cumulative dividends. With a preferred dividend fixed at 5% and an investment horizon of 7 years, a deal with "cumulative" dividends could result in a 35% higher financial claim against the company than an otherwise identical deal with "non-cumulative" dividends.

Dividend terms determine whether or not investors receive preferential treatment during their investment period (and how strong this preference is). The next key element that we consider, the so-called liquidation preference, allocates the financial returns of the venture at the end of the investment period (exit or liquidation). As it turns out, these terms can have even more far-reaching implications on "who-gets-what" than the dividend terms.