Reading: Division of Returns

Reading assignment for the section "Division of Financial Returns"

3. Liquidation Preference

3.3. Convertible Preferred

The most common way for the VC to participate in the upside of the firm is to ask for an optional conversion right. With this right, the VC can convert his shares of preferred stock to common stock, usually at a ratio of 1:1. The typical formulation in the term sheet is as follows:

Optional Conversion:

The Series A Preferred initially converts 1:1 to Common Stock at any time at option of holder, subject to adjustments for stock dividends, splits, combinations and similar events and as described below under “Anti-dilution Provisions.”

Clearly, the VC only exercises his conversions right if the common stock he receives from conversion is more valuable than the preferred stock he owns before conversion. The following example illustrates these trade-offs.

Example

Let us go back to our hypothetical firm and adjust the example as follows:

- There are currently 15 million shares of common stock outstanding (including shares reserved for employee stock options)

- For his investment of 10 million, the VC receives 10 million shares of preferred stock

- The VC asks for an optional conversion right as formulated above (1:1 conversion)

- In exchange for the upside participation, the VC is willing to lower his liquidation preference from 17.1 million to 15.1 million (including dividends).

How does this modified deal structure affect the payoff at maturity for the VC and the entrepreneur?

- With his conversion right, the VC can choose between (up to) 15.1 million liquidation preference and 10 million shares of common stock.

- The VC will choose the 10 million shares of common stock only if their value is larger than 15.1 million.

- If the VC exercises his conversion right, there will be 25 million shares of common stock outstanding (15 million currently owned by the entrepreneur plus 10 million new shares for the VC). Consequently, the VC will own 40% of the firm's common equity after conversion [= 10/25 = 0.4].

- Consequently, the VC will exercise his conversion right if 40% of the firm's equity are more valuable than 15.1 million. This is the case if the value of the firm is (at least) 37.8 million [0.4*37.8 = 15.1].

These considerations imply the following for the VC:

- As long as the value of the firm is below 37.8 million, hold on to the 10 million shares of preferred stock.

- If the value of the firm is 37.8 million or higher, exercise conversion right. Give away the preferred in return for common.

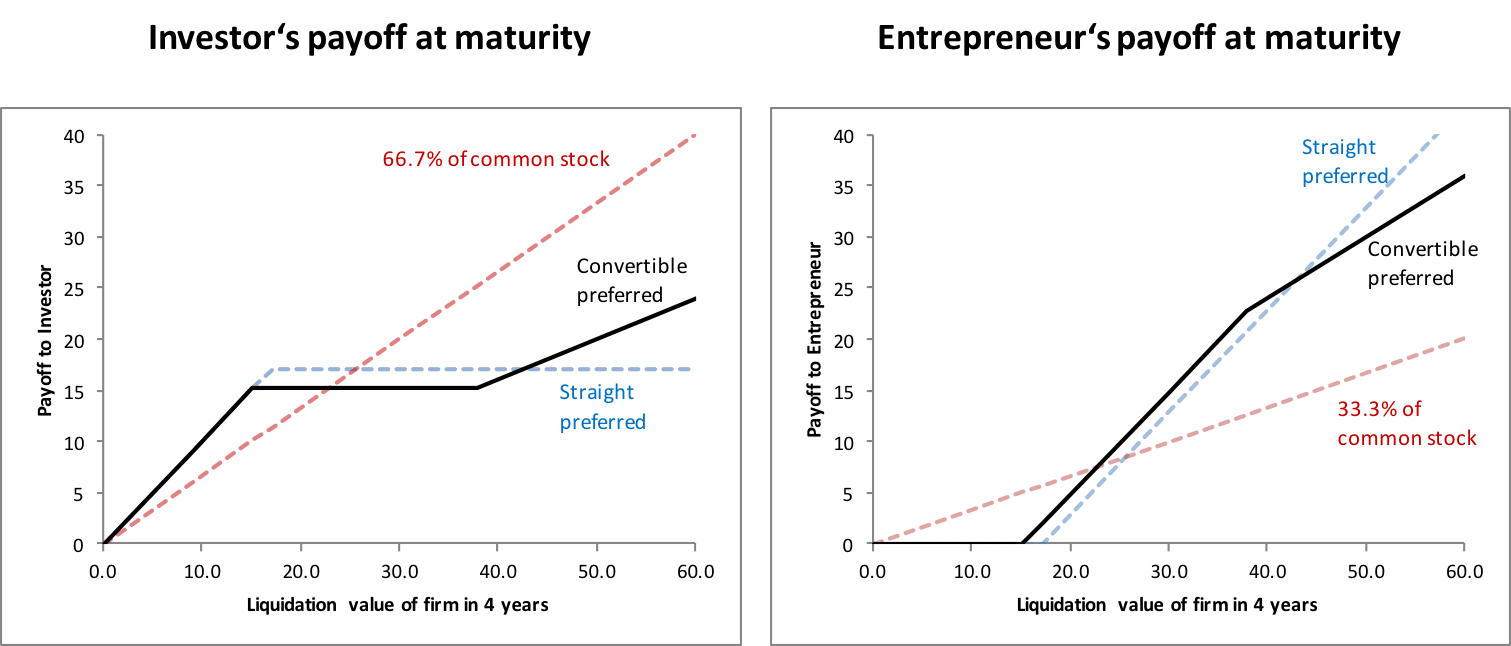

The following graph shows the resulting payoff at maturity (black line) for the investor (chart to the left) as well as the entrepreneur (chart to the right). For comparison, the charts also include the payoffs of the two previously discussed financing alternatives, namely common stock (red line) and straight preferred (blue line)).

Let us look at some numerical examples to better understand the payoffs of this new financing structure:

- Scenario 1: Liquidation value of 12 million:

- VC: he VC does not convert his shares. With his liquidation preference of 15.1 million, he takes the full liquidation proceeds of 12 million.

- Entrepreneur: Zero payoff.

- Scenario 2: Liquidation value of 25 million:

- VC: The VC has to decide between a liquidation preference of 15.1 million and 40% of the firm's common equity. At a firm valuation of 25 million, an equity stake of 40% has only a value of 10 million [= 0.4*25]. Consequently, theVC does not exercise the conversion option and takes the liquidation preference instead.

- Entrepreneur: For the entrepreneur, this means that she will own 100% of the equity at a valuation of 25 - 15.1 = 9.9 million.

- Scenario 3: Liquidation value of 50 million:

- VC: Now conversion is worthwhile for the VC. At a firm valuation of 50 million, a 40% stake has a value of 20 million, which is higher than the liquidation preference of 15.1 million. Consequently, the VC will exercise the conversion option and exchange his preferred shares for a 40% ownership stake in the company (10 million shares of common stock).

- Entrepreneur: For the entrepreneur, this implies that she will end up holding 60% of the firm's equity, at a value of 30 million [=0.6*50].

Discussion

In this section, we have introduced convertibility to the financing options of the VC. With the conversion option, the VC can also participate in the upside of the company. Therefore, the new financing structure allowed us to cure the main disadvantage of the previously discussed financing structure with straight preferred.

In many instances, it will make sense to make sure that the VC participates in the upside. After all, VCs generally provide more than "just" money. Their expertise, management skills, and network are often very valuable. With a conversion option, the VCs actually have an incentive to bring in these skills and add value for the company. Consequently, the conversions option contributes to a better alignment of the incentives of the VC and the entrepreneur.

Convertible Preferred vs. Convertible Bond

Again, the payoff chart of the convertible preferred (with a 1-time liquidation preference) is factually identical to that of a convertible bond, that is, a debt security that can be converted into a certain number of shares of common stock. We have discussed the key differences between these two instruments in the preceding section: Before conversion, the convertible bond is a debt security (a bond or note) with all the associated rights and privileges, whereas the convertible preferred is an equity security with weaker rights and privileges.