Reading: Division of Returns

Reading assignment for the section "Division of Financial Returns"

3. Liquidation Preference

3.7. Summary and Conclusions

This chapter has introduced the standard instruments that are used for venture financing. We started out with common equity and then made important adjustments to make the deal more suitable for the preferences, incentives, and expectations of both the VC and the entrepreneur. The tools that we have used were the following:

- Liquidation Preference: Makes sure that the VC receives his return first. The entrepreneur only participates in the proceeds of the firm if the liquidation value is larger than the VC's liquidation preference.

- Convertibility: Allows the VC to convert his shares of preferred stock into common equity and thereby participate in the upside potential of the firm. This gives the VC an incentive to bring in his skills to maximize the value of the firm.

- Participation: The VC can also participate in the upside potential by asking for a share in the proceeds that exceed the liquidation preference (possibly with a cap).

The resulting securities that we have discussed were the following:

- Common equity

- Straight preferred

- Convertible preferred

- Participating preferred (full participation or with a cap).

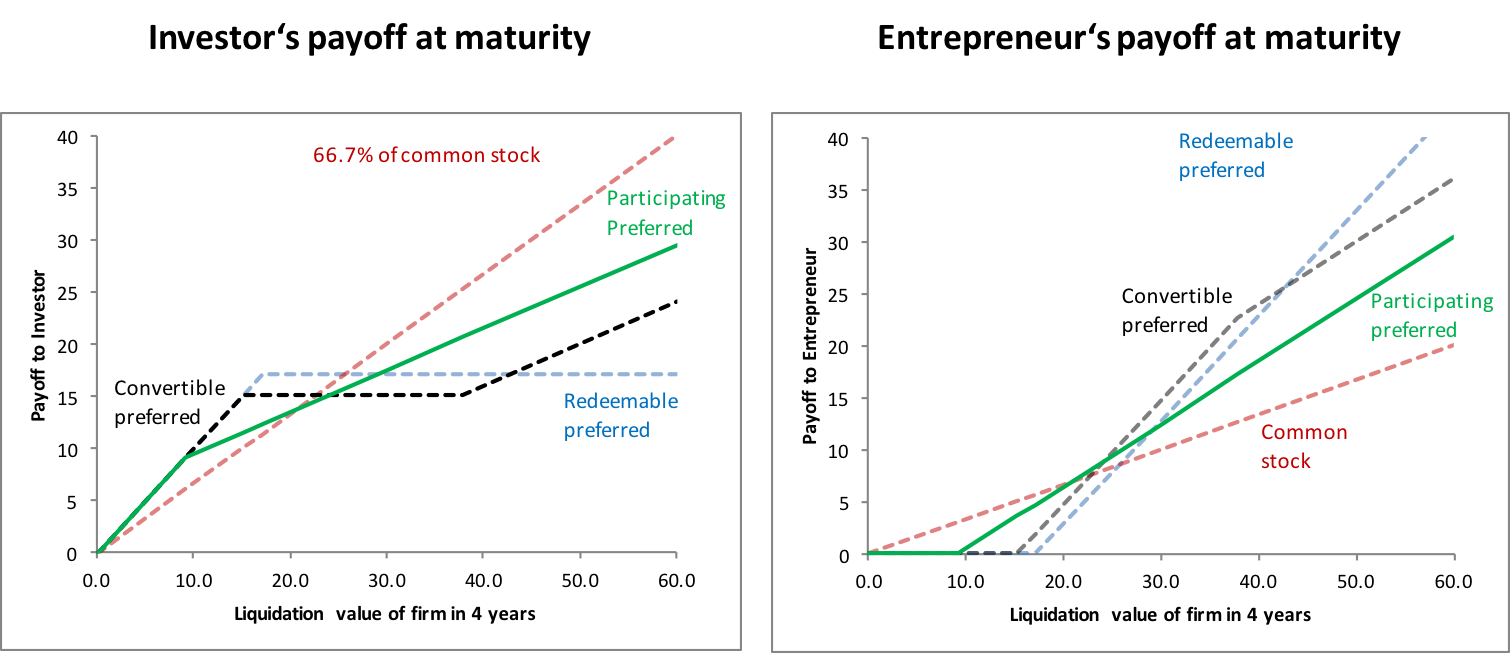

These forms of financing differ with respect to how they allocate downside protection and upside participation between the VC and the entrepreneur. For the VC, a better downside protection typically goes in hand with a smaller upside participation, and vice versa. The following graphs, once again, summarize the four main instruments that we have considered.

With the right choice of financing instruments, several typical challenges of financial deal making can be addressed. For example:

| Challenge | Solution |

| The entrepreneur insists on a valuation that is excessively high from the point of view of the VC (i.e., the share in common equity the entrepreneur is willing to offer is too small, according to the VC) | The VC can ask for a larger liquidation preference (e.g., with a straight preferred or a convertible preferred). |

| The entrepreneur wants to maintain control over the firm | Again, the VC can ask for a larger liquidation preference. In the extreme, with a straight preferred, the entrepreneur can maintain 100% of common equity (if things go well), regardless of potential valuation gaps today! |

| The VC is not convinced that the entrepreneur is as optimistic as she claims to be | The VC can offer alternative deal proposals, e.g., common equity and convertible preferred. If the entrepreneur is indeed optimistic, she will choose the deal with convertible financing, as it promises her a much larger payoff if things go well (see chart above). If, in contrast, she opts for equity financing, the VC learns that the entrepreneur might not be as optimistic as she claims to be. |

| The entrepreneur wants to make sure that the VC has an incentive to get actively involved in the company and contribute to value maximization | In this case, the entrepreneur should push for financing structures that have a high upside potential for the VC, e.g., Participating Preferred or Common Stock. |

These considerations also show that the various deal structures allow us to separate ownership (cash flow rights) from control (voting rights). For example, when we opt for a straight preferred with a significant liquidation preference, most of the cash flow rights go to the VC whereas the entrepreneur maintains most of the voting rights.

We have already discussed the separation of ownership of control earlier in this module in the context of multiple classes of common stock with different voting rights. There, we have argued that one of the main drawbacks of such a structure is that it is not dynamic (i.e., the structure does not change unless the board or the shareholder's meeting decide to change it).

In the context of venture financing, the situation is different. The preferred securities are typically not built to last. As we will discuss briefly in the next section and in much more detail in the chapter Exit Provisions (Liquidity), preferred securities are either converted in common stock or redeemed at the end of the VC's investment period. Consequently, the separation of ownership and control is only temporary in nature.