Reading: Valuing Financing Alternatives

2. Financing Alternatives

2.2. Convertible Preferred

We can use the same logic to value the other deal structures. In the case of the convertible preferred, we have defined the following deal elements:

- Liquidation preference of 15.1 million

- Conversion: 1:1 into 40% of common stock

- Conversion value: 37.8 million

The corresponding payoff charts were as follows:

The claim of the VC is similar to the one discussed in the previous section. The two differences are:

- The liquidation preference is set at 15.1 million instead of 17.1 million

- The VC has a conversion option. This conversion option is equivalent to a call option on 40% of the firm's equity with an exercise price of 37.8 million.

Consequently, the portfolio that replicates the payoffs of the convertible preferred is:

| Description | Variable | Value (millions) |

| Own the firm | S | 15.0 |

| Grant the entrepreneur a call option with X = 15.1 | -C(X = 15.1) | -5.66 |

| Own 0.4 call options with X = 37.8 (conversion option) | 0.4 × C(X = 37.8) | 0.4 × 1.62 = 0.65 |

| Total Portfolio Value | 10.0 |

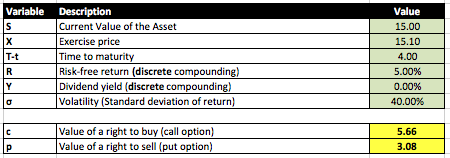

The option granted to the entrepreneur was valued as follows:

And the VC's conversion option was valued as follows (remember, the VC receives 0.4 of these options):

Discussion

From the point of view of the VC, a convertible preferred with liquidation preference of 15.1 million and a conversion option for 40% of the common equity constitutes a "fair" deal. It has the same value as the straight preferred. So from a pure valuation point of view, the VC should be indifferent between the two deal alternatives.

To find the fair value of the financing instrument, we have used the same technique as before: We have built a portfolio that generates the exact same payoffs as the convertible preferred (replicating portfolio). Not surprisingly, we will use the same technique also for the financing instruments that are the subject of the following sections.