Reading: Valuing Financing Alternatives

Completion requirements

View

2. Financing Alternatives

2.4. Participating Preferred (With Cap)

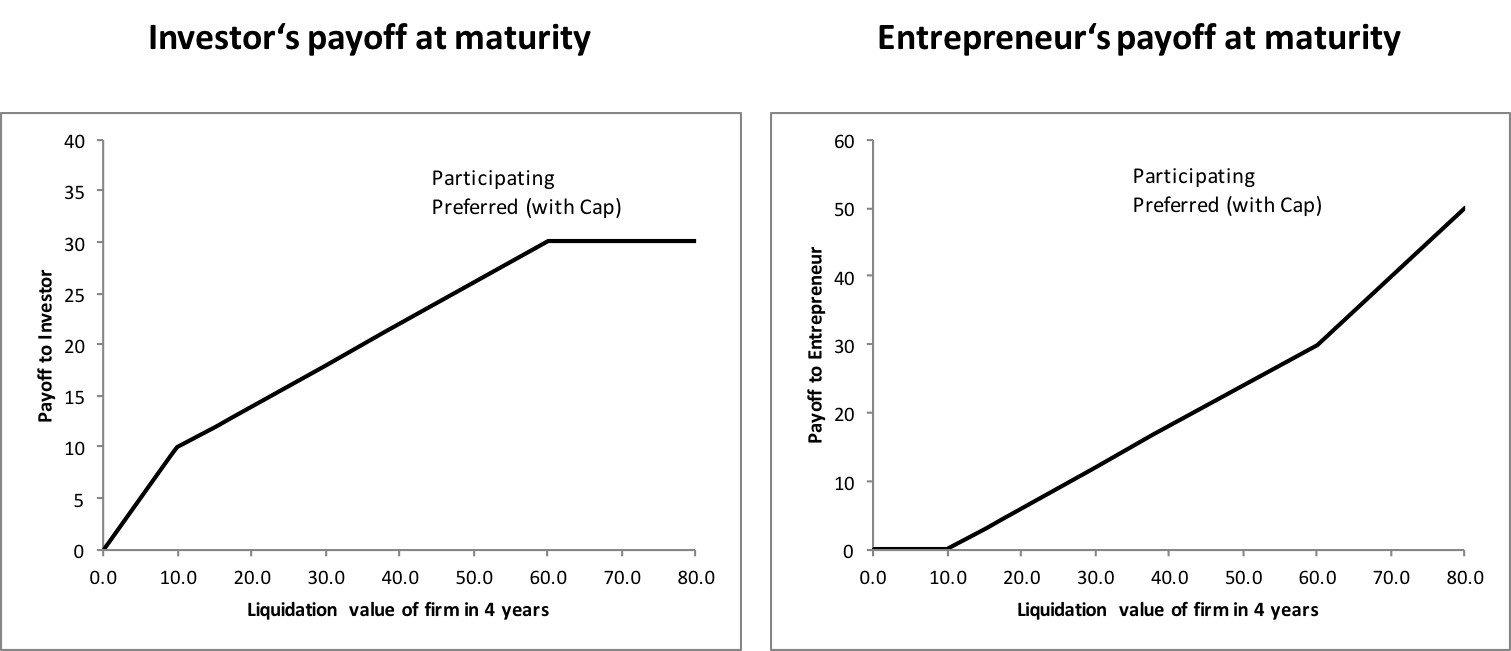

The Participating Preferred with a cap that we have considered had the following characteristics:

- Liquidation preference of 10.0 million

- Thereafter, the VC participates pro rata on an as-converted basis (40%)

- The maximum participation is 30.0 million. Given the terms above, this maximum participation is reached at a liquidation value of 60 million.

The corresponding payoff charts were as follows:

Also for this instrument, we can find a portfolio that exactly replicates the payoffs at maturity. The resulting portfolio is similar to the one before. The two differences are:

- Liquidation preference stops only at 10 million (so the exercise price of the 0.6 options granted to the entrepreneur is 10.0)

- There is a cap at a liquidation value of 60 million. The cap implies that the VC gives the remaining 40% of his claims to the entrepreneur. Therefore, from the point of view of the VC, this cap is equivalent to 0.4 call options short with exercise price 60.

Replicating Portfolio:

| Description | Variable | Value (millions) |

| Own the firm | S | 15.0 |

| Grant the entrepreneur 0.6 call options with X = 10.0 | -0.6 × C(X = 10.0) | -0.6 × 7.88 = -4.7 |

| Grant the entrepreneur 0.4 call options with X = 60.0 | -0.4 × C(X = 60.0) | -0.4 × 0.62 =-0.3 |

| Total Portfolio Value | 10.0 |

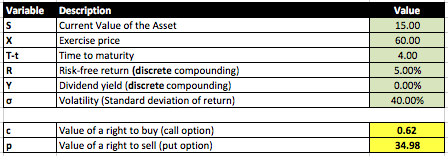

The first option granted to the entrepreneur was valued as follows (remember, the entrepreneur receives 0.6 of these options):

The second option granted to the entrepreneur was valued as follows (remember, the entrepreneur receives 0.4 of these options):