Reading: Debt Policy in a Perfect World

3. A Levered Firm

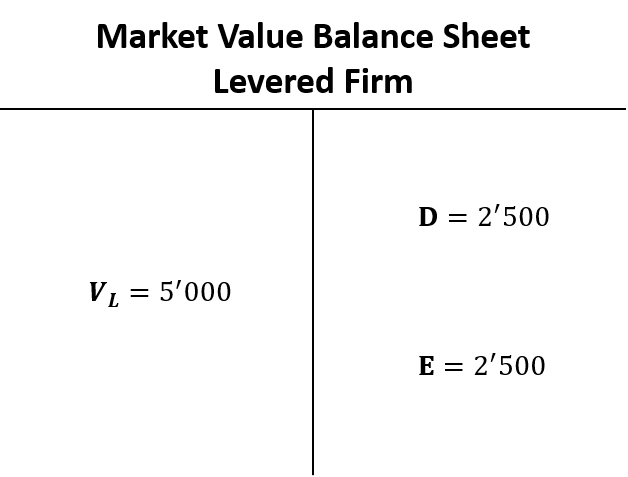

Let us now assume that the firm decides to replace half of its equity, namely 250 shares with a total value of 2'500, with debt that carries an interest rate of 10% per year. Under the revised capital structure, debt outstanding (D) will therefore be 2'500. Moreover, there will be 250 shares left (=500 - 250) for a total value of equity (E) of 2'500. In a later section, we will see in more detail how a firm can actually change its capital structure. For the moment, we simply assume that half of the shares outstanding are converted into debt at their prevailing market value. Under the revised financing policy, the market value balance sheet of the levered firm is:

Implications of revised financing policy

How does this change in financing policy (from unlevered to levered) affect the valuation and return expectations of the firm as well as its providers of capital? The following table summaries the main steps of the analysis. Detailed explanations follow below.

| Recession | Normal | Boom | Expected | |

| EBIT | 300 | 600 | 900 | 600 |

| - Interest expenses | 250 | 250 | 250 | 250 |

| Earnings before taxes | 50 | 350 | 650 | 350 |

| - Taxes | 0 | 0 | 0 | 0 |

| Net income | 50 | 350 | 650 | 350 |

| Debt cash flow | 250 | 250 | 250 | 250 |

| Equity cash flow | 50 | 350 | 650 | 350 |

| Total cash flow to capital | 300 | 600 | 900 | 600 |

| Return to capital | 6.0% | 12.0% | 18.0% | 12% |

| Return to debtholders | 10.0% | 10.0% | 10.0% | 10% |

| Return to shareholders | 2.0% | 14.0% | 26.0% | 14% |

| Earnings per share (EPS) | 0.20 | 1.40 | 2.60 | 1.40 |

- Interest payments: Because of debt financing, the firm has a contractual obligation to make interest payments. Given an interest rate of 10%, annual interest payments are 250 [= 2'500 × 0.1]. Since these interest payments reflect a contractual obligation, they are independent of the firm's future state of the world (as long as the EBIT is sufficiently large). Put differently, debtholders receive a payment of 250 regardless of whether the firm finds itself in the recession, normal, or boom scenario, respectively.

- Equity cash flows: Shareholders, in contrast, have a so-called residual claim. They receive the money that is left after all contractual debt payments have been made. In the recession scenario, all that is left for the shareholders is a cash flow of 50 (= 300 - 250), in the normal scenario, the equity cash flow is 350 (= 600 - 250), and in the boom scenario, the equity cash flow is 650 (= 900 - 250).

- Risk of the debt cash flow: Note that, in this particular example, EBIT always exceeds the contractual interest payments. Therefore, the debtholders always receive their "fair" compensation of 250. Put differently, the expected return to debtholders is 10% [= 250/2'500] regardless of the future state of the world. Therefore, given our assumptions, the firm's debt is actually risk free at the moment.

- Asymmetric risk profile: More generally speaking, the upside potential for the debtholders is limited. The maximum they can get is the contractual annual interest payment of 10%. While the upside potential is limited, debtholders bear a downside risk: If the firm generates insufficient cash flows to cover the debt claims, debtholders could incur a loss. We will get back to this asymmetry in the payoffs to debtholders and shareholders later on. As we will see, this an asymmetry can have a significant impact on the behavior of the involved parties as well as the optimal structure of a financing deal.

- Shareholders' return expectations: Let us now turn to the shareholders. How does the revised financing policy affect their return expectations? Remember that, under the revised financing policy, the total value of equity is 2'500:

- In the recession case, shareholders receive an annual cash flow of 50, which implies a return on equity of 2% [= 50/2'500]

- In the normal case, the annual cash flow is 350 and the shareholders' return is 14% [= 350/2'500].

- Finally, In the boom case, shareholders receive 650 per year, for a return on equity of 26% [= 650/2'500]

- On average, shareholders therefore expect to earn a return of 14% under the revised financing policy.

- Similarly, EPS ranges from 0.2 to 2.6, with an average expected value of 1.4.

Discussion

The above analysis reveals three noteworthy changes from the original financing policy without debt to the revised financing policy with 50% of debt on the balance sheet:

- Higher returns for shareholders: For the shareholders, the average expected return increases from 12% for the unlevered firm to 14% for the levered firm.

- Higher risk for the shareholders: The risk of the equity claim also increases! While the equity return of the unlevered firm is between 6% and 18%, the levered firm has equity returns between 2% and 26%. So shareholders expect to earn much less in the recession scenario (2% vs. 6%), but they earn much more in the boom scenario (26% vs. 18%).

- Earnings per share increase: With the new financing policy, average earnings per share increase from 1.2 to 1.4. Therefore, each shareholder receives more money!

Are shareholders better off?

The crucial question is whether the revised financing policy is (financially) more valuable for the shareholders. The answer is NO: The average equity return increases because the equity claim becomes riskier; not because the firm generates more money!

Let's look at this more carefully:

- Total cash flow to capital (debt plus equity) does not change: Going back to the table above, we can see that the total cash flow to capital (debt plus equity) under the revised financing policy is the same as under the original financing policy with no debt: 300 in the pessimistic outcome, 600 in the expected outcome, and 900 in the optimistic outcome.

- Overall firm value (V) does not change: If the two policies generate identical cash flows for the providers of capital, the overall value of the firm must be the same as well. As the market value balance sheets show, firm value (V) is 5'000, regardless of how the firm is financed.

- The equity return goes up because equity becomes riskier: In the unlevered firm, shareholders only bear the business risk (i.e., the fact that EBIT is uncertain). In the levered firm, in contrast, shareholders bear business risk as well as financing risk. The higher expected equity return is a compensation for the additional financing risk that the new financing policy imposes on the shareholders!

- The net effect on the valuation is zero: When we capitalize the average expected cash flow to equity (350) at the average expected return under the revised financing policy (cost of equity of 14%), we see that the overall value of equity is indeed 2'500:

Equity value = \( \frac{\text{Equity cash flow}}{\text{Cost of equity}} = \frac{350}{0.14}\) = 2'500.

Similarly, we can value the firm's debt as:

Debt value = \( \frac{\text{Debt cash flow}}{\text{Cost of debt}} = \frac{250}{0.1} \) = 2'500

So the overall value of the firm remains at 5'000:

Value of levered firm = Debt value + Equity value = 2'500 + 2'500 = 5'000.

- Higher EPS does NOT mean that shareholders are better off: Using the same argument, it is easy to see that the higher earnings per share (EPS) under the revised financing policy do NOT make shareholders richer. When we capitalize the higher EPS (1.4 vs. 1.2) at the higher cost of equity (14% vs. 12%), it is not surprising to see that the theoretical stock price remains at 10:

Stock price = \( \frac{EPS}{\text{Cost of equity}} = \frac{1.4}{0.14} \) = 10.

Before moving on, let us briefly summarize the most important takeaways.