Reading: Debt Policy in a Perfect World

5. Implications for the Cost of Capital

5.1. The Overall Cost of Capital

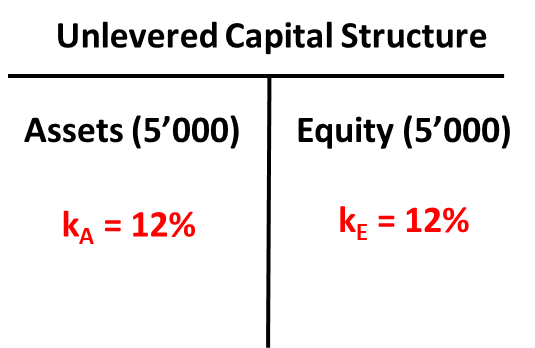

In our example, the equity value (E) of the unlevered firm is 5'000 and the average return the shareholders expected to earn is 12% (\(k_E\)). Because the firm has no debt outstanding (D = 0), the value of the firm's assets is also 5'000 [V = D + E = 0 + 5'000]. Moreover, since equity is the sole source of capital, the overall return to capital (kA) is also 12%.

This information is summarized in the following balance sheet at market values:

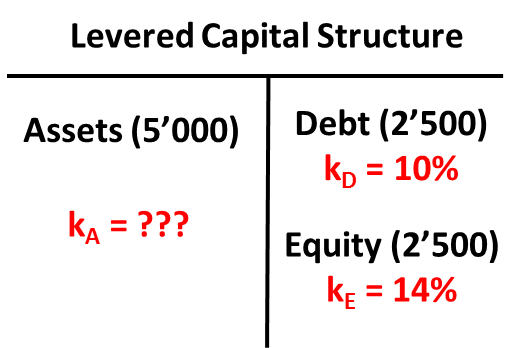

Under the proposed levered capital structure, the firm would have 2'500 of debt outstanding that commands a rate of return of 10% (kD). Moreover, we have seen that the market value of the firm's equity would be 2'500 as well and that the shareholders expect to earn an average rate of return of 14% (kE). The following balance sheet at market values summarizes this information:

What are the implications of the revised financing policy for the overall cost of capital?

- Debtholders require an annual compensation of D × kD = 2'500 × 0.10 = 250.

- Shareholders require an annual compensation of E × kE = 2'500 × 0.14 = 350.

Therefore, the total compensation required by the providers of capital is 250 + 350 = 600. This is the dollar return the firm is expected to earn, on average, on its assets: A × kA = 600. Since the value of the firm's assets is 5'000 (A = D + E), the firm's cost of assets kA is 600/5'000 = 12%. More formally, summarizing the equations above:

\( D \times k_D + E \times k_E = (D+E) \times k_A \)

If we rearrange this expression and solve it for kA:

\( k_A = k_D \times \frac{D}{D+E} + k_E \times \frac{E}{D+E} \)

In our example:

\( k_A = 0.10 \times \frac{2'500}{2'500+2'500} + 0.14 \times \frac{2'500}{2'500+2'500} \) = 12%.

In words:

- The overall cost of capital (kA) is the weighted average of the costs of the various sources of capital (in our case debt and equity).

- Intuitively, this would seem to make sense. If half of the capital costs 10% and the other half of the capital costs 14%, capital, on average, costs 12%.

Equally importantly, the numbers imply that the overall cost of capital is the same for the levered and the unlevered firm. In both cases, we find a kA of 12%. Put differently, the overall cost of capital (kA) is UNRELATED to the financing policy of the firm.

Again, this would seem to make intuitive sense:

- Remember that the change in financing policy leaves the firm's assets unaffected. All the firm does is borrow money to return it to shareholders. Put differently, according to our assumptions, the assets of the levered and the unlevered firm are identical.

- If the firm's business activities do not change, the risk and return characteristics of these activities do not change either. The firm's operating risk remains the same; it is unrelated to the firm's financing policy.

- The cost of assets kA is a measure of the compensation that investors require to bear the firm's operating risk.

- Because the balance sheet is in balance, the overall cost of the left-hand side (the assets) must be equivalent to the overall cost of the right-hand side (debt and equity).

- So if the overall cost of the left-hand side (kA) does not change, also the overall cost of the right-hand side (kD and kE) does not change. Put differently, the firm cannot distribute more or less to its providers of capital than it generates on its assets.

To illustrate, remember the company Hershey's that we have considered at the beginning of this module. Hershey's produces chocolate (that's the firm's business activity). A bar of chocolate is a bar of chocolate, regardless of wheterh the company is financed with debt or equity.

- The consumers' willingness to buy chocolate does not depend on the financing policy of Hershey's (at least not under our assumptions).

- Similarly, the business relations with the suppliers and the other operating stakeholders do not depend on the firm's financing policy.

- The overall risk of the firm's activities, the firm's operating risk kA, is determined by the risk of its business model, i.e., the production and sale of chocolate.

- The firm's financing policy simply determines how the compensation that is associated with the firm's business risk is split among the various providers of capital.

In more figurative language, financing decisions determine how the bar of chocolate is split between the providers of capital (debt and equity). They do not, however, affect the size and the taste of that bar of chocolate (i.e., the value and the risk characteristics of the firm).