Reading: The Relevance of Taxes

2. Revised Capital Structure

Let us assume that there is an otherwise identical firm that generates an EBIT of 600. The sole difference is that this firm has 2'500 of debt outstanding at an interest rate of 10%. Consequently, this firm has annual interest expenses of 250 [= 2'500 × 0.1], which lower the taxable income accordingly from 600 to 350:

| Fully Equity Financed | Revised Financing Policy | |

| EBIT | 600.0 | 600.0 |

| - Interest expenses | 0.0 | 250.0 |

| Earnings before taxes | 600.0 | 350.0 |

| - Taxes (35%) | 210.0 | 122.5 |

| Net income | 390.0 | 227.5 |

| Debt cash flow | 0.0 | 250.0 |

| Equity cash flow | 390.0 | 227.5 |

| Total payment to capital | 390.0 | 477.5 |

With this lower tax base, annual income taxes drop to 122.5 [= 350 × 0.35], down from 210 for the fully equity financed firm. Consequently, debt financing reduces the firm's tax burden by 87.5 each year. These tax savings increase the cash flows that are available for distribution to the providers of capital accordingly:

- In the fully equity financed firm, shareholders receive an annual payment of 390, as shown in the first column of the table above.

- With the revised financing policy, debtholders receive their contracutal interest payments of 250. Shareholders receive what's left over after all other claims have been satisfied, i.e., the net income of 227.5. The total payment to the providers of capital is, therefore, 477.5 [= 250.0 + 227.5].

Under the revised financing policy, the total payment to the providers of capital increases by 87.5 each year. This additional cash flow comes from the fact that on each dollar of interest expenses, the firm saves 35 cents in taxes. Consequently, the annual tax savings due to interest payments are 87.5:

Interest tax savings = Interest expenses × Tax rate = 250 × 0.35 = 87.5.

These interest tax savings constitute an additional source of value to the shareholders. Remember from the previous page that the value of the fully equity financed firm (the unlevered firm value, VU) was 3'250.

If the firm makes annual iterest tax savings of 87.5 and if we assume, for the moment, that the riskiness of these annual tax savings corresponds to the riskiness of the firm's debt, we can use the cost of debt (kD) of 10% as the discount rate to compute the present value of all future expected interest tax savings. This present value is the so-called Debt Tax Shield (DTS).

Debt tax shield = \( \frac{\text{Interest tax savings}}{\text{Cost of debt}} = \frac{87.5}{0.1} \) = 875.0

In words, the value of the levered firm (VL) is 875 higher compared to that of the unlevered firm (VU) because of the expected future interest tax savings (DTS):

VL = VU + DTS = 3'250 + 875 = 4'125.

With a total amount of debt (D) of 2'500, as per our assumptions, the equity value (E) of the firm is, therefore, 1'625:

E = VL – D = 4'125 - 2'500 = 1'625.

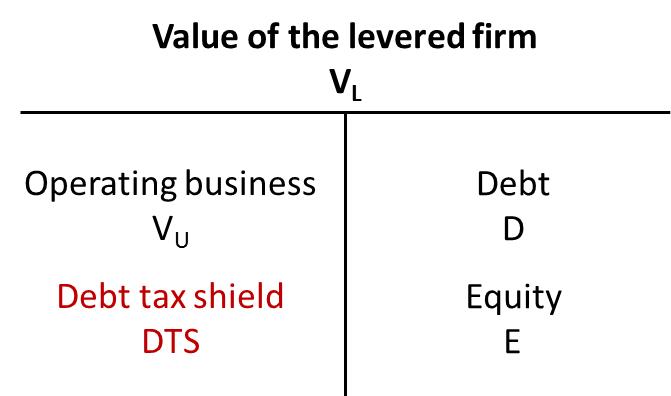

Consequently, in a world with taxes, a firm has two sources of value:

- The operating business, which generates the unlevered firm value, VU

- The financing policy. If the firm finances (parts of) its activities with debt, the annual interest payments lower the firm's tax bill. The present value of all these future interest tax savings is called the firm's debt tax shield (DTS).

The following figure summarizes the two sources of value for the levered firm:

Now that we understand the basic mechanics, we can turn to the question of how debt financing affects the cost of capital.