Reading: The Relevance of Taxes

3. The Cost of Capital

3.2. Firms with Target Debt Ratios

Now let us look at the same considerations for a company that pursues a financing policy with a target debt ratio (e.g., 40% of firm value). As we have argued before, the appropriate discount rate for the interest tax savings of such a firm is the overall cost of assets, kA.

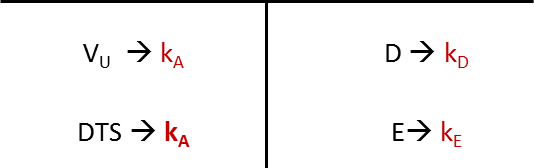

The following figure summarizes the relevant costs of capital for the different sources of value of such a company:

As we know from before, the total expected return generated by the left side of the balance sheet must correspond to the total expected return that the providers of capital claim:

\( V_U \times k_A + DTS \times k_A = D \times k_D + E \times k_E \)

Consequently:

\( (V_U + DTS) \times k_A = D \times k_D + E \times k_E \)

Because VU + DTS = VL = D + E, we can also write:

\( (D + E) \times k_A = D \times k_D + E \times k_E \)

Solving this expression for kA yields:

\( k_A = k_D \times \frac{D}{D+E} + k_E \times \frac{E}{D+E} \)

Solving the expression for kE yields:

\( k_E = k_A + (k_A - k_D) \times \frac{D}{E} \)

These are the very same equation as the ones that we have derived in the course section that looked at a world without taxes.

To practice these considerations, let us go back to our original example and modify it slightly: Let us assume that the firm still borrows 2'500 today, but that it will adjust the amount of debt outstanding going forward to maintain a constant debt ratio. What are the value implications of this change in financing policy?

- Because the future tax savings are less certain, the appropriate discount rate is kA.

- With annual expected interest tax savings of 87.5 and a kA of 12%, the present value of the DTS is 87.5/0.12 = 729.17.

- Given an unlevered firm value (VU) of 3'250 and an amount of debt of 2'500, the value of the firm's equity under the revised financing policy is:

E = VU + DTS - D = 3'250 + 729.17 - 2'500 = 1'479.17.

Consequently, the firm's cost of equity is 15.38%:

\( k_E = k_A + (k_A - k_D) \times \frac{D}{E} = 0.12 + (0.12-0.10) \times \frac{2'500}{1'479.17} \) = 15.38%.

To verify these computations, remember that the annual payment to shareholders is 227.5, according to the firm's income statement. If we capitalize these cash flows at a cost of equity of 15.38%, the value of the firm's equity is indeed 1'479.17:

Equity value = \( \frac{\text{Equity cash flow}}{\text{Cost of equity}} = \frac{227.5}{0.1538} \) = 1'479.17.