Reading: The Relevance of Taxes

4. The Weighted Average Cost of Capital (WACC)

4.1. Summary

In this section, we have introduced the WACC, which incorporates the tax-effects of financing in the computation of the cost of capital. Formally, the WACC can be computed as follows:

WACC = \( k_D \times (1-\tau) \times \frac{D}{D+E} + k_E \times \frac{E}{D+E} \)

Depending on the firm's financing policy, it can be shown that the WACC can be estimated more directly using the equations below.

If the firm pursues target debt levels (in currency):

WACC = \( k_A \times (1- \tau \times \frac{D}{D+E}) \)

In our example:

WACC = \( 0.12 \times (1- 0.35 \times \frac{2'500}{2'500+1'625}) \) = 9.45%

This is the same WACC as we have computed before under the specific financing policy.

If the firm pursues a target debt ratio (in %):

WACC = \( k_A - k_D \times \tau \times \frac{D}{D+E} \)

In our example:

WACC = \( 0.12 - 10 \times 0.35 \times \frac{2'500}{2'500+1'479} \) = 9.80%.

Which, again, is the same WACC as in our previous computations.

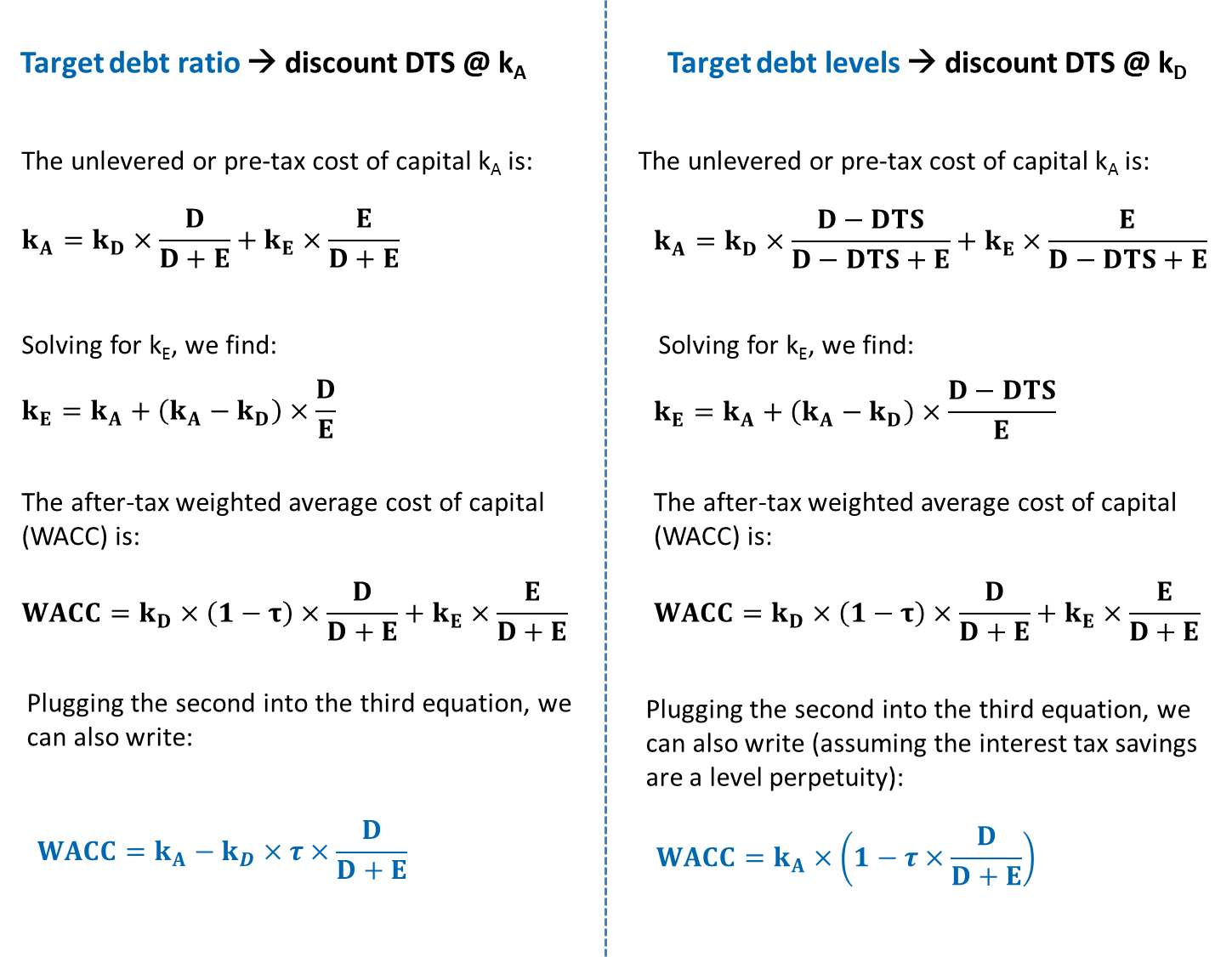

The following figure summarizes the most important equations in the estimation of the cost of capital, distinguishing again, between the two standard financing policies: