Reading: The Relevance of Taxes

4. The Weighted Average Cost of Capital (WACC)

4.2. Discussion

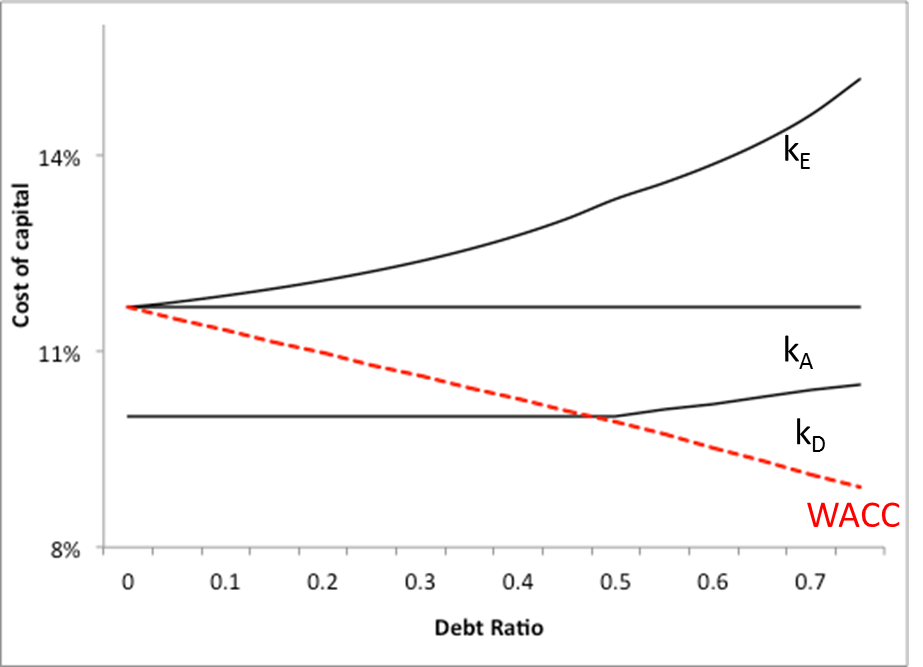

The preceding sections have shown that tax implications favor debt financing. The reason is that the tax-deductibility of interest expenses factually lowers the cost of capital. The easiest way to see this is by looking at one of the WACC expressions from the previous page:

WACC = \( k_A - k_D \times \tau \times \frac{D}{D+E} \)

Without debt financing (D = 0), the expression implies that the WACC corresponds to the overall cost of capital (kA). As leverage increases (D becomes larger), the interest tax savings we subtract from kA increase as well. The following graph illustrates this relation:

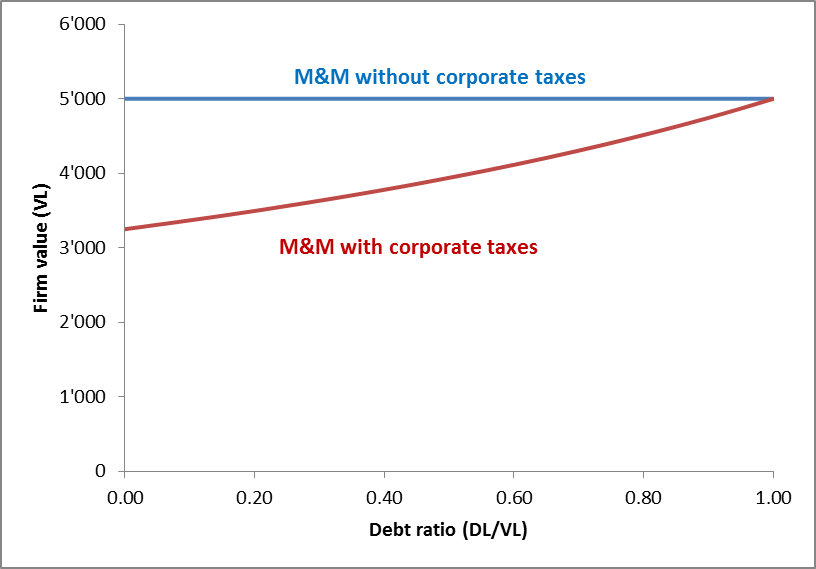

Because debt financing lowers the cost of capital, it INCREASES the value of the firm. The following graph illustrates this relation between leverage and firm value:

- The blue line shows one of the main takeaways from our discussion of the relevance of debt policy in a perfect world (without taxes). There, we have seen that the value of the company is unrelated to its financing policy (the first proposition from Modigliani and Miller).

- The red line shows the very same relation if we drop the assumption of no corporate taxes. It therefore summarizes the main takeaways from this section of the module.

- A fully equity financed company enjoys no debt tax shields. Consequently, its valuation is (1-τ) times the valuation of the firm that pays no taxes (in our case, that valuation was 3'250).

- As the degree of debt financing increases, the firm enjoys increasingly larger debt tax shields. The result is a positive relation between leverage and firm value.

- In the extreme of a fully debt financed company, the interest tax shields perfectly offset the firm's operating taxes. In such a hypothetical firm, the interest expenses are equal to the firm's EBIT, so that the pre-tax income is 0.

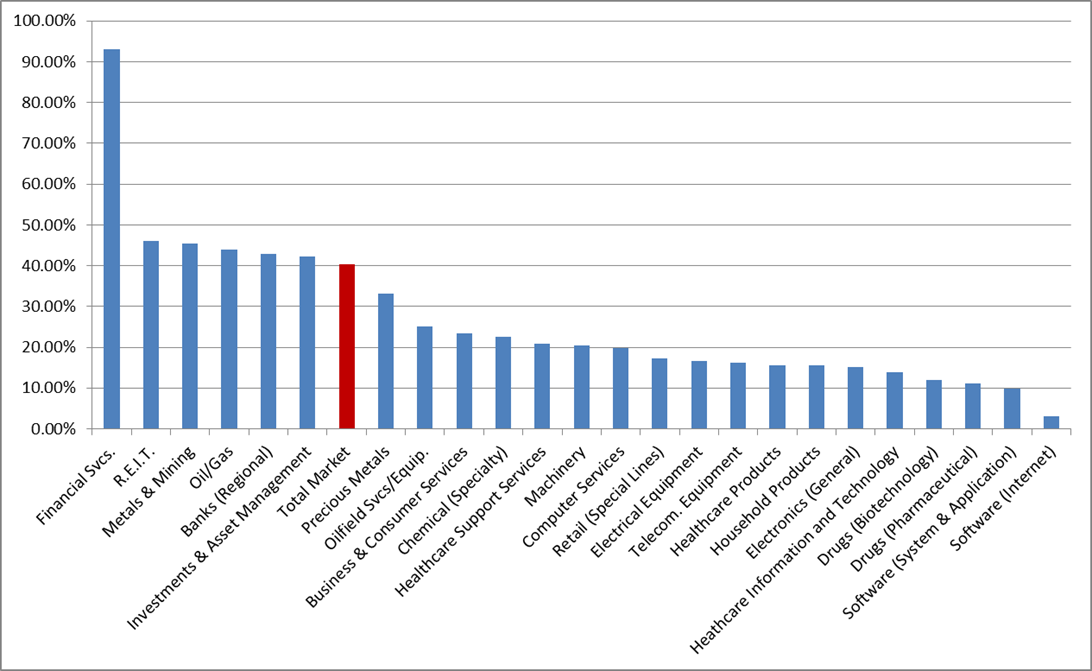

The implication of these considerations would seem to be that firms should borrow as much as possible to enjoy maximum debt tax shields. Clearly, this recommendation is at odds with reality, where we observe fairly conservative debt ratios in many firms, as shown in the following graph:

The obvious follow-up question, therefore, is: What are we missing? The answer is that debt financing might have side effects other than corporate taxes. The course sections "Understanding and Valuing Debt and Equity" and "Towards an Optimal Capital Structure" take a closer look at these other side effects.

Before we turn to this important topic, however, we need a better understanding on how firms can actually adjust their capital structure. This will be the topic of the next course section.