Reading: Adjusting the Capital Structure

3. Coping with Excess Cash

3.2. Step 1: Current Valuation

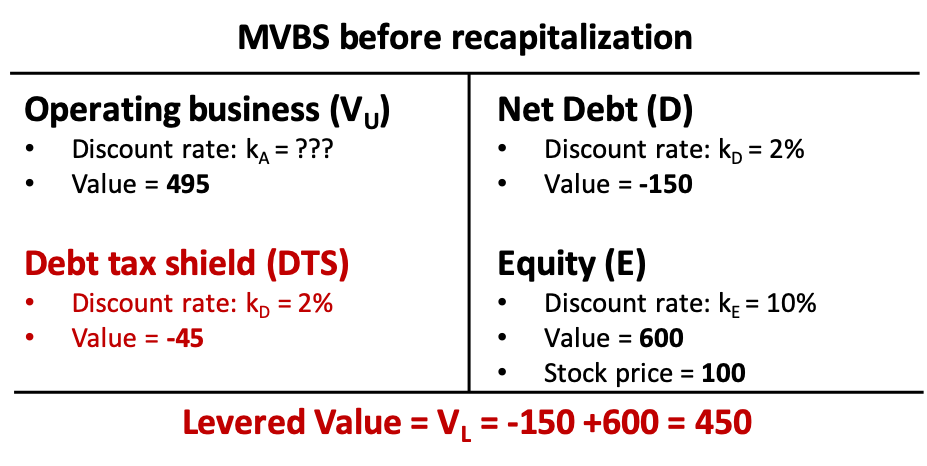

Pear's current valuation is:

- Market value of equity (E) = 600 billion

- Net debt (D), using the definition from the preceding page: Net debt = Debt - Excess cash = 0 - 150 = -150.

Currently, the "levered" value of the firm, therefore, is 450 billion:

VL = D + E = -150 + 600 = 450.

Remember from before that the levered value reflects the value of the firm's operating assets are (the unlevered value, VU) as well as the tax implications of the current financing policy (the debt tax shield, DTS):

VL = VU + DTS.

What about the DTS? Under the current financing policy with excess cash of 150 billion, the firm earns an annual interest income of 3 billion. Sticking to the terminology from before, the firm's current interest expenses are therefore -3 billion:

Interest expenses = D × kD = -150 × 0.02 = -3

The interest earned on excess cash therefore increases the firm's annual taxable income by 3 billion each year. At a tax rate of 30%, this implies additional taxes of 0.9 billion per year. Sticking again to the terminology from before, the firm's annual interest tax savings are therefore -0.9 billion:

Interest tax savings = Interest expenses × τ = -3 × 0.3 = -0.9 billion

Since we assume constant net debt levels "forever," the appropriate discount rate for the annual interest tax savings is the cost of debt, kD. Under this assumption, the present value of Pear's future tax savings, DTS, is -45 billion:

DTS = \( \frac{\text{Annual tax savings}}{k_D}=\frac{-0.9}{0.02} \) = -45.

Consequently, the firm's unlevered value (VU) is 495 billion:

VU = VL - DTS = 450 - (-45) = 495 billion.

With this, we have all the necessary information to compile Pear's market value balance sheet (MVBS) under the current financing policy:

Interpretation:

- Pear's operating business is currently valued at 495 billion (VU). Put differently, 495 billion would be the market value of the firm's equity if the firm had no net debt outstanding.

- The actual market value of equity, however, is 600 billion. How can the difference of 105 billion be explained?

- In addition to its operating business, the firm holds excess cash of 150 billion (negative net debt). However, this excess cash is not valued at 150 billion but only at 105 billion!

- The reason is that the firm has to pay taxes on the interest eared on this excess cash. Assuming a level perpetuity, the present value of all future taxes related to the firm's excess cash is 45 billion (= 150 × 0.3).

- Consequently, net of taxes, the excess cash has a value of 150 - 45 = 105 billion if it is held on Pear's balance sheet.

- If the firm returned its excess cash of 150 billion to shareholders, the market value of equity would therefore only drop by 105 billion (i.e., the after-tax value of the cash that is currently reflected in Pear's equity value). Shareholders would therefore gain 45 billion (assuming they are tax exempt).

Before investigating how the levered recapitalization affects the firm's valuation, let us quickly compute the cost of capital under the current financing structure.