Reading: Adjusting the Capital Structure

3. Coping with Excess Cash

3.4. Step 3: Announcing the Recapitalization

How does the market react to the announcement of the 250 billion share repurchase program, which is partially financed with excess cash (150 billion) and new debt (100 billion)?

Under the new financing policy, excess cash drops to 0 and debt increases to 100 billion. Consequently, the firm's net debt will increase by 250 billion from -150 billion to 100 billion:

New net debt = D* = Debt - Excess cash = 100 - 0 = 100.

Given a cost of debt of 2%, the annual interest expenses will be 2 billion and the annual interest tax savings will be 0.6 billion:

Annual interest expenses* = D* × kD = 100 × 0.02 = 2 billion

Annual tax savings* = Interest expenses* × τ = 2 × 0.3 = 0.6 billion

Assuming, again, that the debt level will stay constant forever and the appropriate discount rate for the future tax savings is the cost of debt of 2%, the firm's new debt tax shield will be 30 billion:

\( DTS^* = \frac{\text{Interest tax savings}}{k_D} = \frac{0.6}{0.02} \) = 30 billion.

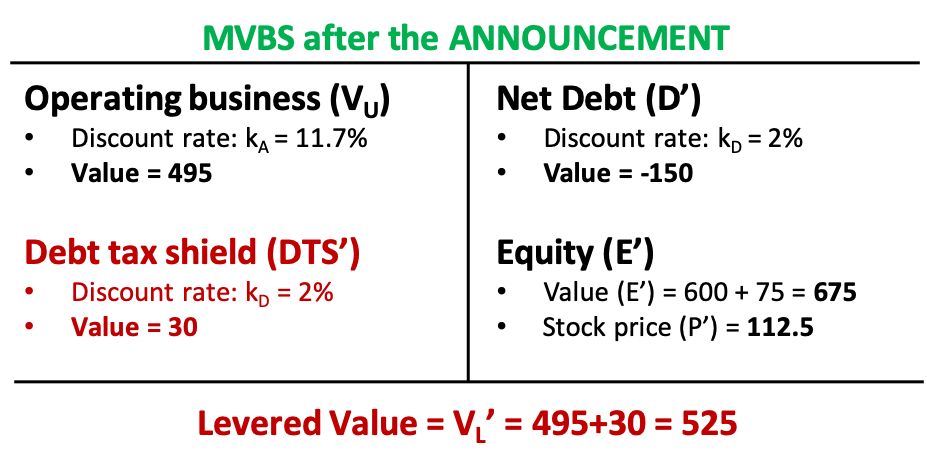

In words, the new financing policy (net debt of 100 billion) brings about interest tax savings of 30 billion. Upon the announcement of the recapitalization, the market incorporates this DTS into the valuation of the firm (DTS' = DTS* = 30 billion), so that the levered value of the company goes to 525 billion:

\( V_L' = V_U + DTS' = 495 + 30 \) = 525 billion.

Since, at the time of the announcement, net debt still is -150 billion, the post-announcement equity value (EL*) is 675 billion:

\( E_L' = V_L' + D' = 525 - 150 \) = 675 billion.

Firm and equity value both increase by 75 billion, which corresponds to the change in the firm's DTS from -30 billion under the current financing policy to 45 billion under the revised financing policy.

Finally, given 6 billion shares outstanding, the stock price will increase from 100 to 112.5 at the time of the announcement (P'):

\( P' = \frac{E_L'}{N} = \frac{675}{6} \) = 112.5.

Again, we would find the same conclusion by measuring the change in the debt tax shield (75 billion, from -45 to 30 billion) and expressing that change on a per-share basis:

Value-added per share = \( \frac{\text{Change in DTS}}{N} = \frac{75}{6} \) = 12.5.

The value added per share is 12.5, so the stock price should increase by that amount, from 100 to 112.5.

The following figure summarizes these considerations and shows the market value balance sheet (MVBS) of Pear after the announcement of the recapitalization: