Reading: Understanding and Valuing Debt and Equity

1. Introduction

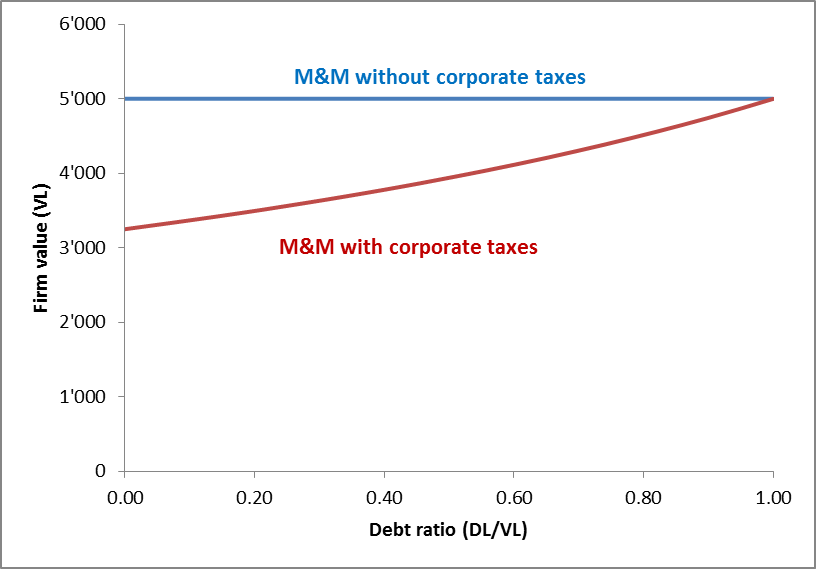

In the discussion about taxes, one of our main takeaways was that debt financing improves firm value because debt receives favorable tax treatment compared to equity. The policy implication would therefore seem to be that firms should make aggressive use of debt and finance as much of their business as possible with debt.

We have also seen, however, that this recommendation is at odds with reality, where many firms choose to rely heavily on equity financing.

Therefore, the logical follow-up questions are: What are we missing? Are firms irrational not to use more debt? Or are there other side-effects of debt financing that weigh in on the debt-equity choice?

The purpose of this section is to take a look at the other "side effects" of debt financing.