Reading: Understanding and Valuing Debt and Equity

2. Payoffs to Debt and Equity

To understand the fundamental differences between debt and equity, it is helpful to look at the cash flow patterns of the two financing instruments. The easiest way to do so is to consider a simple firm that uses debt financing.

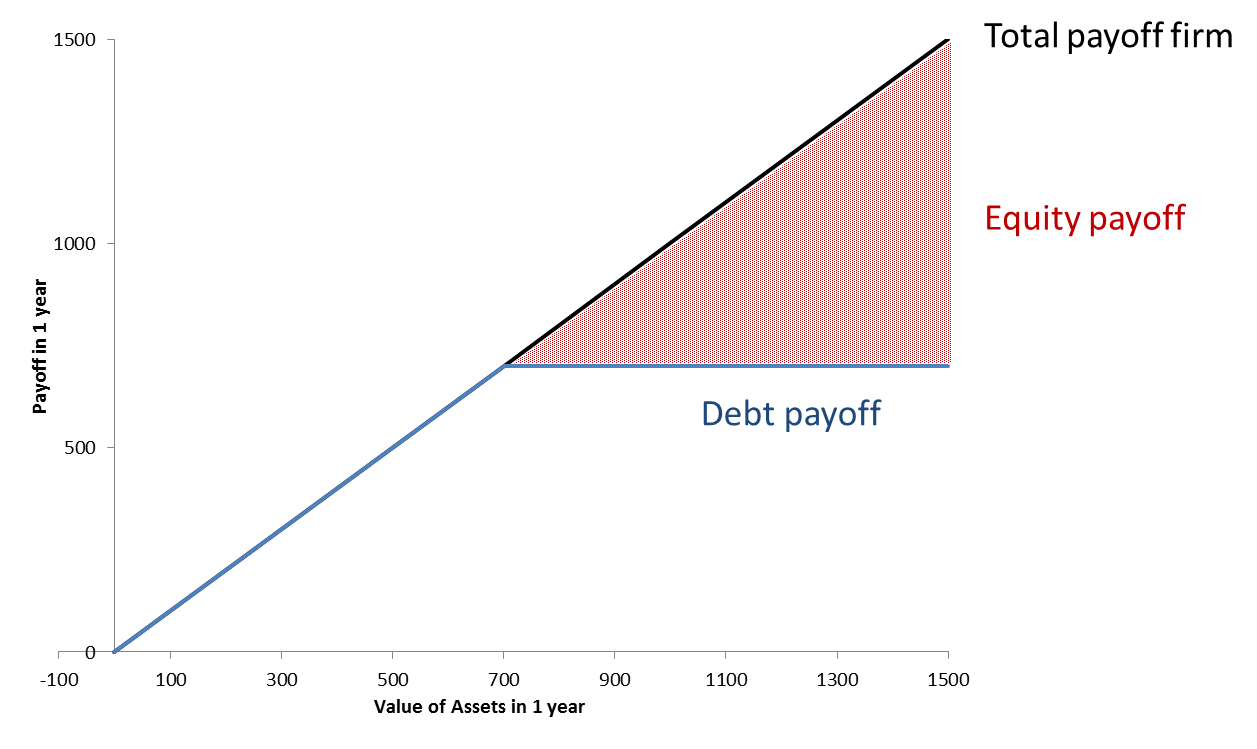

Suppose the firm in question has debt of 700 outstanding that matures in 1 year. The following graph summarizes the payoffs to the firm's debt- and equityholders in one year. The horizontal axis shows the value of the firm's assets in 1 year (firm value) and the vertical axis shows the payoffs to the respective providers of capital in one year.

The interpretation of the graph is as follows:

- As we have seen, capital structure choices determine how the value of the firm's assets is split between the providers of capital. The total payoff to the debt- and equityholders therefore corresponds to the value of the firm's assets. Consequently, this total payoff is the diagonal in the above chart (black line).

- Debtholders have a liquidation preference. Their claims have seniority over those of the equityholders. In our example, up to a firm value of 700, the full payof goes to the debtholders (blue line). Once the debtholders have received their contractual compensation, the do not further participate in the firm's proceeds. The blue line is capped at 700.

- Shareholders have a residual claim. They receive the full payoff after the claims of the debtholders have been satisfied. In the above graph, up to a firm value of 700, shareholders receive nothing. If the firm value exceeds the debtholders' claim, shareholders receive the difference, as indicated by the red area in the above graph.

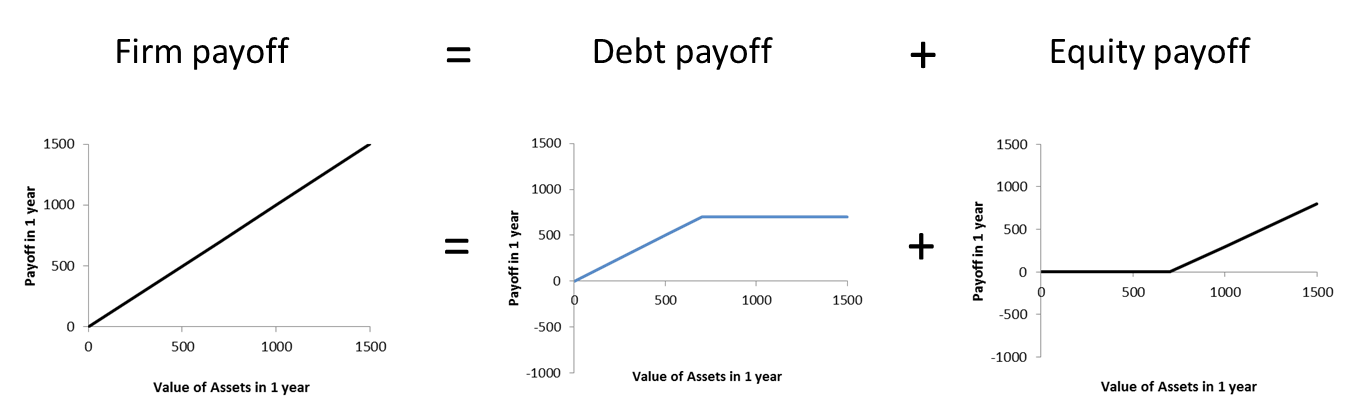

The following graph shows in more detail the decomposition of the firm payoff into the debt and equity payoffs. The conclusions remain the same:

- Debtholders receive maximum downside protection but no upside participation

- Equityholders, in contrast, have no downside protection but maximum upside participation.

Looking at debt and equity this way allows us to better understand the incentive implications of debt financing and to see how the value of debt and equity are related. These are the topics of the next pages.