Reading: Towards an Optimal Capital Structure

4. Trade-off Theory

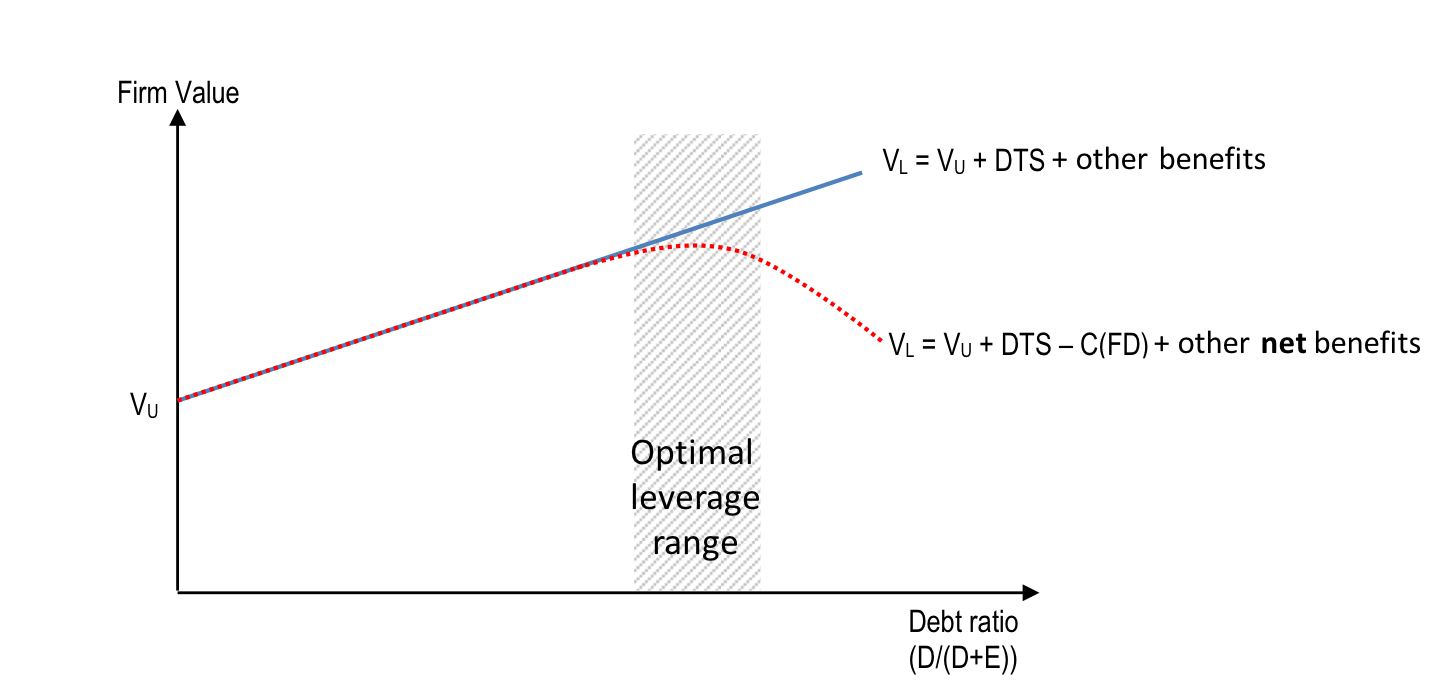

An alternative capital structure theory is the trade-off theory, which states that firms balance the costs and benefits of debt and equity to determine the optimal leverage. In its original form, which goes back to Kraus and Litzenberger (1973), the trade-off was between the interest tax savings and the dead-weight costs of financial distress that higher leverage brings about. According to this so-called "static trade-off theory" the optimal leverage is found when the marginal tax savings equal the marginal bankruptcy costs.

But in principle, the trade-off can be (and often is) extended to other factors, including the ones that we have discussed on the previous pages. Accordingly, firms consider this broader range of factors to determine the optimal leverage range. Their financing policy then aims at adjusting the capital structure towards that target range. This version of the trade-off theory is often called the "dynamic trade-off theory."

While the static version of leverage has clear flaws, also empirically (for example, U.S. firms used debt also before there was a corporate income tax), the dynamic version seems to be sufficiently general so that it is hard to reject it empirically.