Reading: Introduction

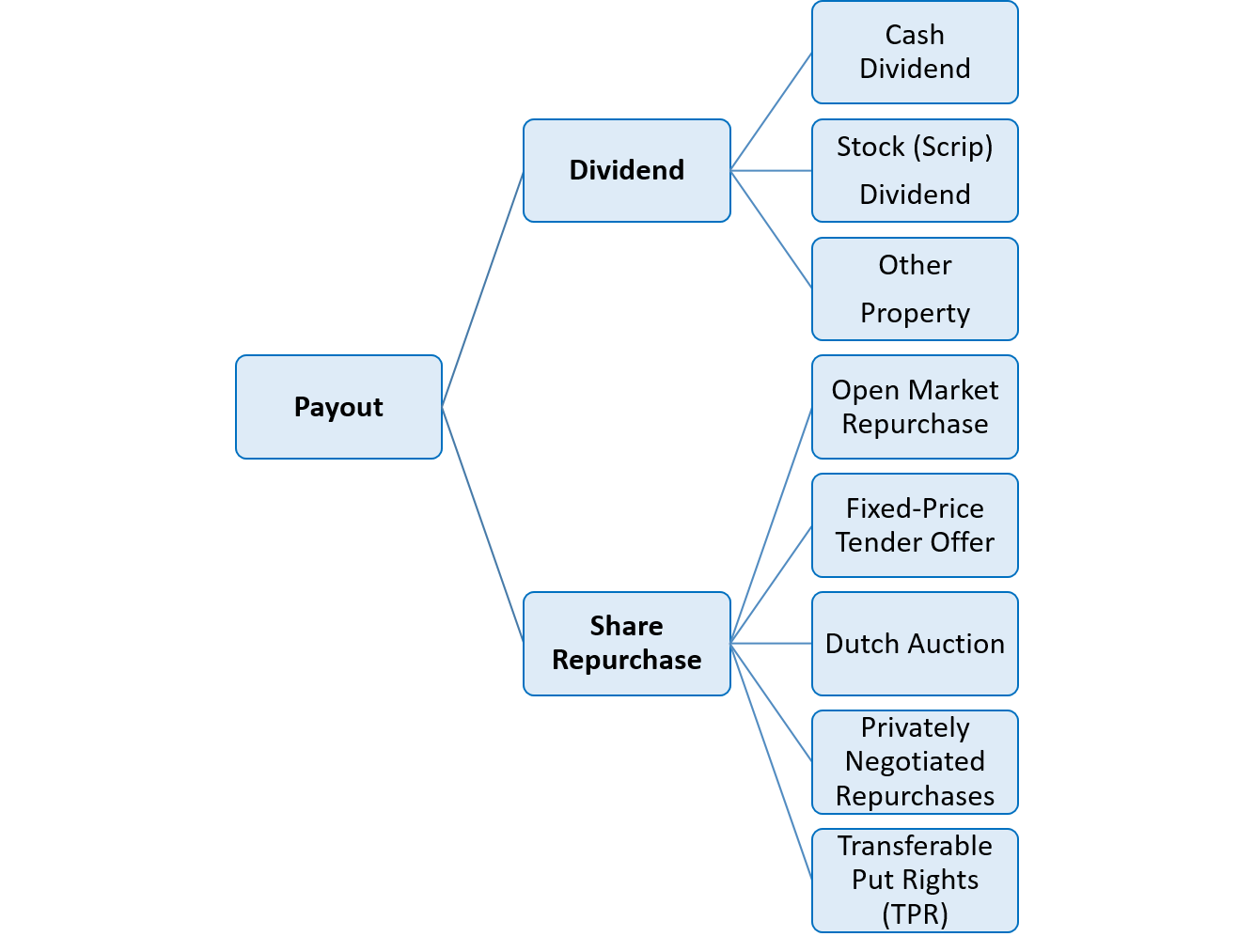

3. Forms of Payout

In principle, there are two ways how firms can return cash to their shareholders: They can either pay a dividend or they can repurchase shares. The following graph shows the basic forms of payout that are available to firms:

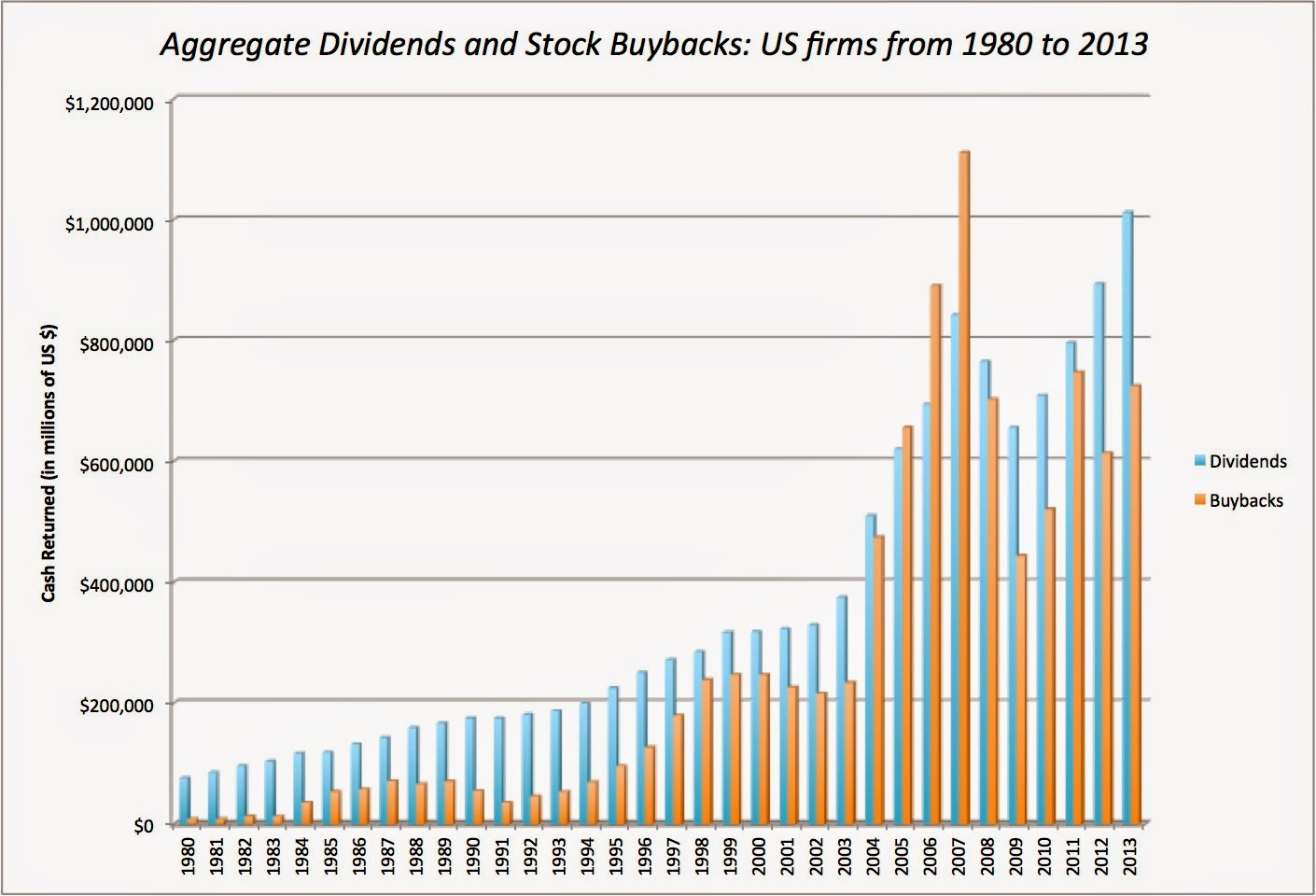

The section Payout Basics will discuss these various alternatives in more detail. The following graph shows the aggregate dividend (blue bars) and share repurchase (orange bars) volume for listed U.S. firms over the years 1980 to 2013 (Source: Damodaran).

Until the early 1980s, firms almost exclusively used dividends to return cash to their shareholders. The picture changed in 1982, when the Securities and Exchange Commission (SEC) issued the Rule 10B-18, which provides a "safe harbor" for companies that repurchase their shares of common stock. Under that rule, firms that meet specific conditions will not be deemed to have violated anti-fraud provisions (e.g., insider trading or stock price manipulation) when repurchasing shares. As long as they adhere to the required conditions, the rule therefore offers firms legal certainty when repurchasing shares.

Since then, buybacks have experienced a massive gain in importance. As we will discuss in more detail later on, the main reasons for the popularity of buybacks in the U.S. are:

- Buybacks are generally more flexible than dividends

- They receive preferential tax treatment

- They often lead to an accretion of earnings per share (EPS).

By now, the aggregate buyback volumes are more or less the same as the aggregate dividend volumes in the U.S.

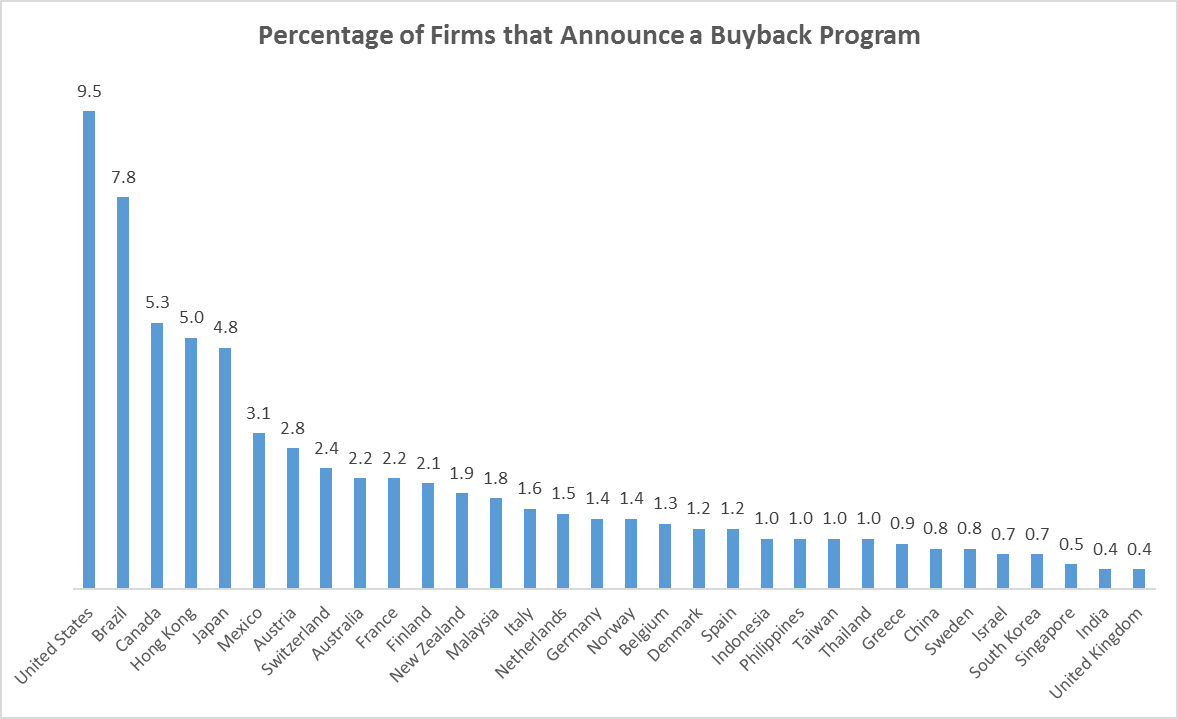

Due to regulatory changes in favor of buybacks, this form of distribution has also become increasingly popular outside the U.S. since the late 1990s. The following graph provides an international comparison of the percentage of firms that announce a buyback program in any given year. The data are from Manconi, Peyer, and Vermaelen (2017), who look at the implications of buyback announcements for shareholder value. According to their numbers, each year roughly 10% of all listed U.S. firms announce a buyback program. This makes the U.S. the country with the highest buyback frequency. The runner-up country is Brazil, where roughly 8% of all firms announce a buyback program each year, followed by Canada (5%), Hong Kong (5%), and Japan (5%). On the other end of the spectrum is the U.K., where less than 1 out of 200 firms announce such a program, on average.