Reading: The Relevance of Payouts

Completion requirements

View

5. Payout and Value

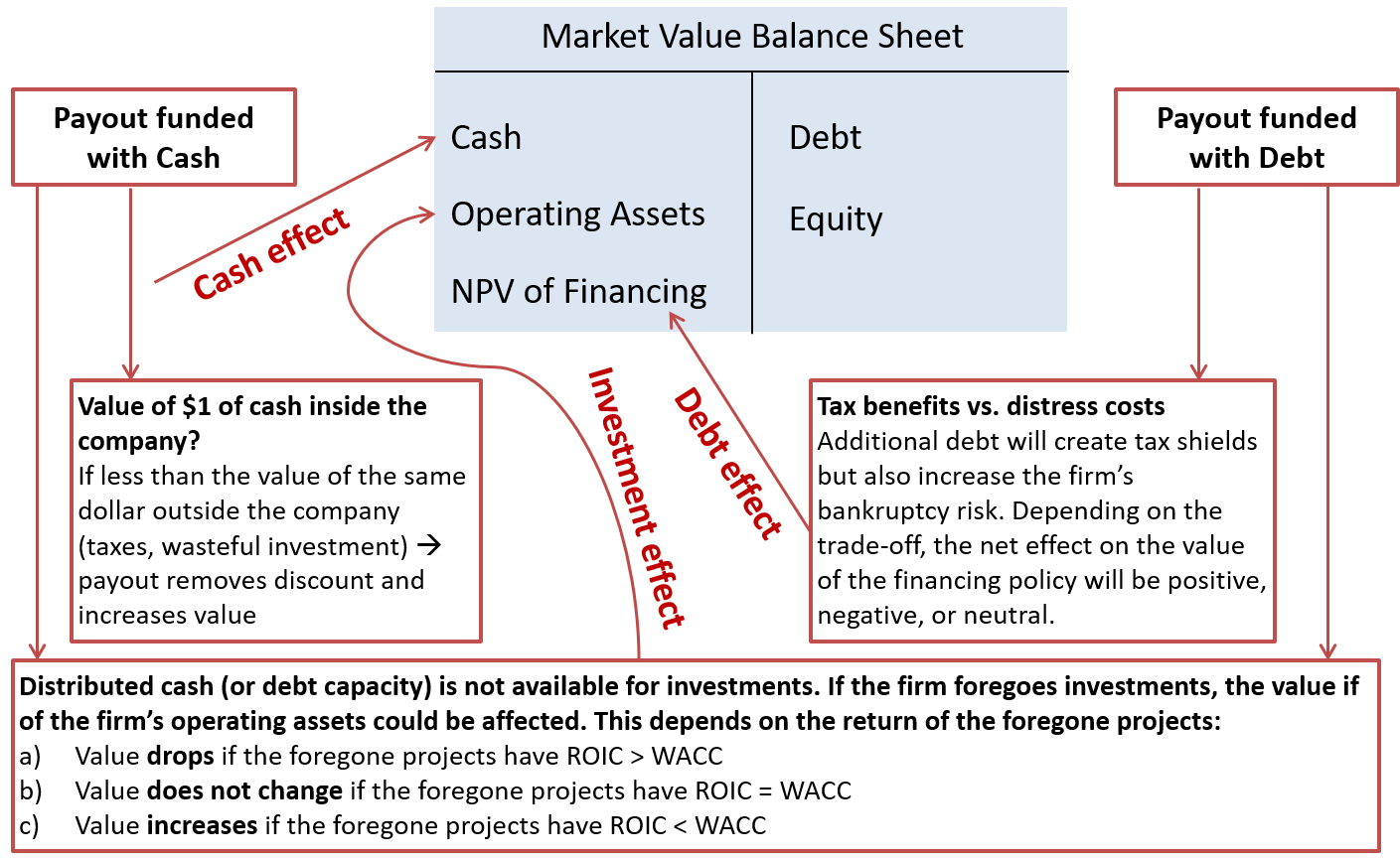

By now, we have discussed many important aspects surrounding the value relevance of payout decisions. We have seen that payout decisions per se are value neutral. We have also seen, however, that they have important side-effects that could (and in reality often do) affect firm value. These side effects are threefold:

- Cash effect: If payout is funded with cash, the key question is whether a dollar of cash is more valuable inside the company than outside the company. If corporate cash holdings are valued at a discount (relative to their external value) payouts reduce that discount and improve firm value.

- Debt financing effect: If payout is funded with debt, the question is whether the additional debt tax savings are smaller or larger than the additional costs of financial distress (see the module Capital Structure Decisions). If the benefits exceed the cost, leveraged payouts enhance firm value. In contrast, if the costs exceed the benefits, leveraged payouts reduce firm value.

- Investment effect: Finally, regardless of how payouts are financed, the distributed cash (ore the foregone debt capacity) is no longer available for corporate investments. If the firm foregoes investments as a result, there could be the following value implications:

- Firm value DROPS if the foregone investments have ROIC > WACC

- Firm value is UNAFFECTED if the foregone investments have ROIC = WACC

- Firm value INCREASES if the foregone investments have ROIC < WACC

The following graph, which is adapted from Damodaran, summarizes these three effects of cash payouts on firm value: