Reading: Forms of Takeover

2. Asset Acquisition

In an asset deal, the acquirer purchases (some of) the the target's assets, usually in exchange for cash, but possibly in exchange for other assets or shares of the acquiring company.

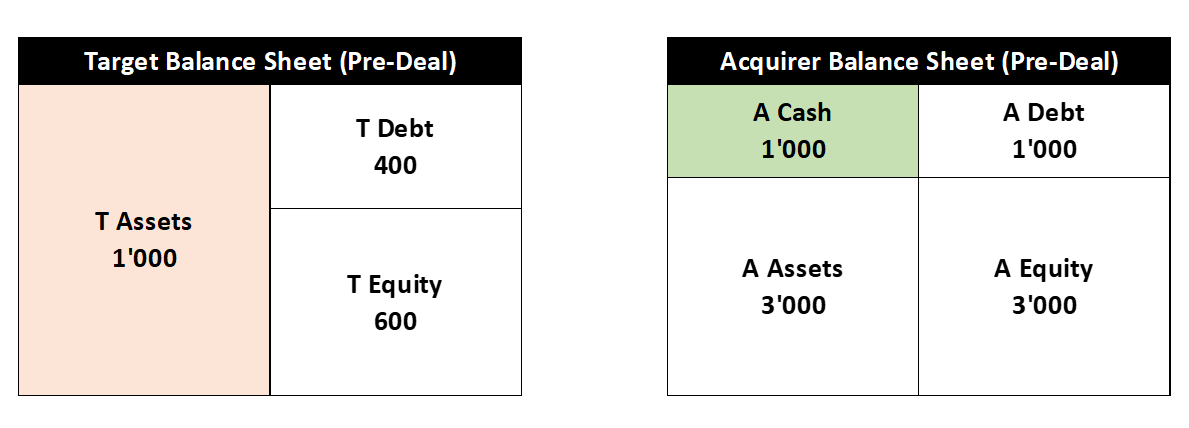

Let us consider the simplest form of an asset deal, where the target from above sells all its assets (valued at 1'000) to the acquiring company for cash. From before, we know that the balance sheets of the acquiring company (A) and the target company (T) look as follows:

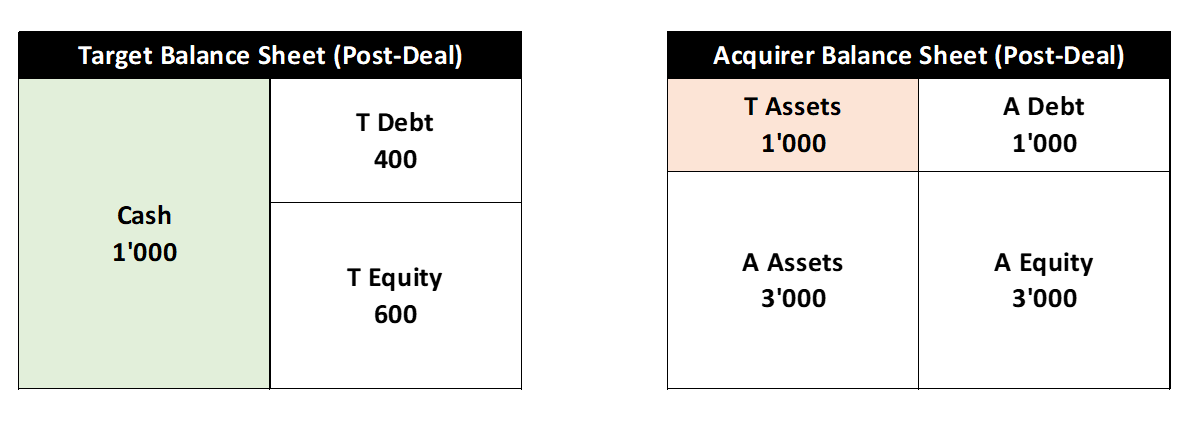

In an asset deal for cash, the acquiring company transfers its cash of 1'000 to the target company and assumes the target's assets instead. Therefore, after the deal, the balance sheets of the target and the acquiring companies look as follows:

The main takeaways of this deal form are the following:

- The acquiring company pays the full value of the target firm's assets of 1'000. Consequently, for the acquirer, the deal leads to a cash outflow of 1'000. With the chosen deal structure, the value of the acquiring firm (and its equity) therefore does not change.

- The acquirer assumes the target firm's assets, and not the target firm itself. Put differently, the ownership structure of the target firm does not change and the target firm survives as an independent entity.

- After the transaction, the only asset of the target firm is the cash balance of 1'000 (in a partial deal, some assets would obviously remain with the target).

- The shareholders of the target company receive no direct cash consideration, as the cash goes to the target company.