Reading: Forms of Takeover

Completion requirements

View

3. Statutory Consolidation

In a statutory consolidation, a new corporate entity is created and the two merging companies cease to exist.

A prominent example of a statutory consolidation was the Daimler-Chrysler deal back in 1998, when the German Daimler-Benz AG and the U.S. Chrysler Corp. joined forces in the newly created DaimlerChrysler AG.

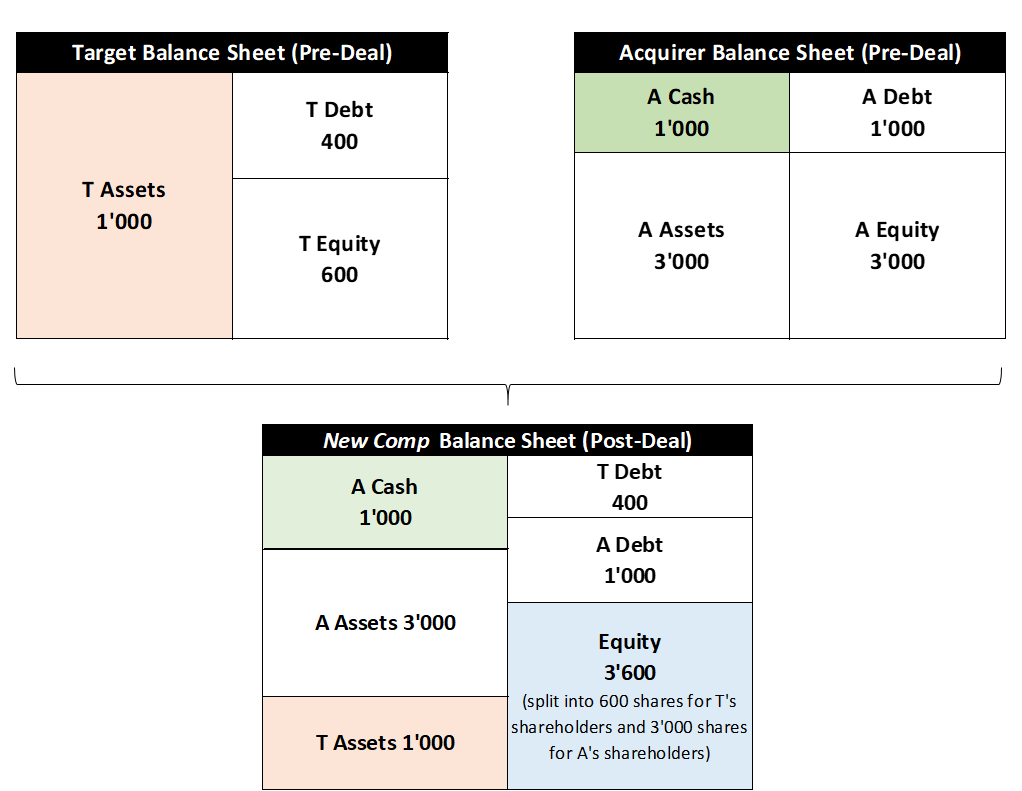

In our example, a possible structure of a statutory consolidation could be as follows:

- A and T join to form a new company New Comp

- New Comp issues 3'600 shares

- The original shareholders of the target company T receive 600 of New Comp's shares and the original shareholders of the acquiring company A receive 3'000 of New Comp's shares. Structured this way, the post-consolidation value allocation to the shareholders of A and T corresponds to their pre-consolidation valuation.

- Companies A and T are dissolved.

Consequently, after the transaction, the balance sheet of New Comp looks as follows:

The original assets and liabilities of A and T are absorbed by New Comp so that the overall value of New Comp (5'000) corresponds to the sum of the pre-consolidation values of A (4'000) and T (1'000).

The main takeaways for this deal form are:

- The way we have structured the deal, there are no cash payouts. In a sense, a statutory consolidation therefore does not cost anything (apart from transaction costs).

- The original companies cease to exist and a new corporate structure is created.

- The original shareholders of A and T now jointly own New Comp. Because A was larger than T (equity value of 3000 vs. 600), the shareholders of A will 83.3% of New Comp and the shareholders of T will own 16.67% of New Comp. T's original shareholders will therefore become minority shareholders in New Comp.