Reading: Acquisition Price and Value

2. Cash Deal

The simplest form of takeover is a cash-only deal, in which the target shareholders receive the full consideration in cash.

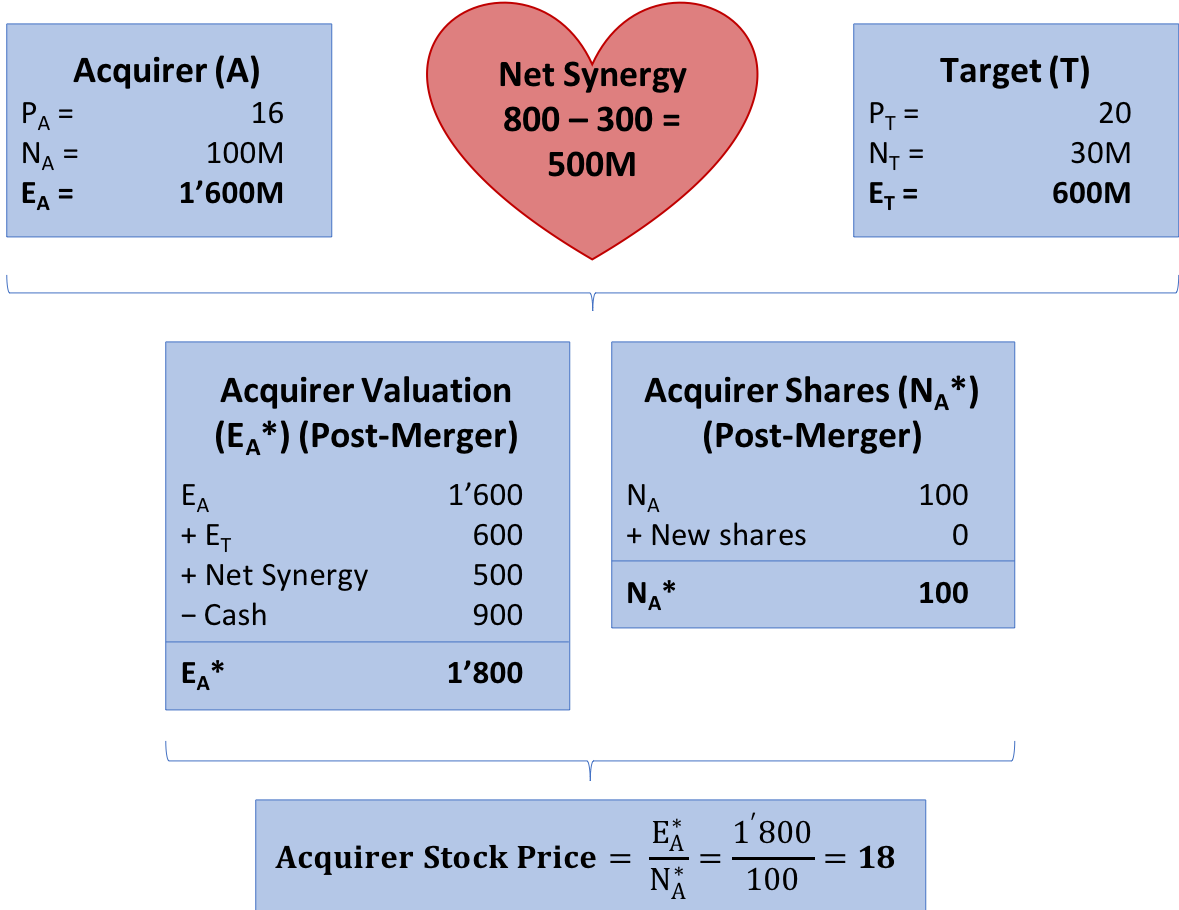

In our example, the target shareholders receive a total consideration of $900 million or $30 per share. If paid in cash, the corresponding cash outflow will reduce the value of the acquiring firm accordingly. Therefore, after the transaction, the equity value of the acquiring firm will be 1'800 million:

Equity Value Merged Firm = EA* = Stand-Alone ValueA + Stand-Alone ValueT + Net Synergy – Cash Payment = 1'600 + 600 + 500 – 900 = 1'800.

Since the acquiring firm's number of shares outstanding does not change, it's post-merger stock price remains at 18:

Acquirer's Post-Merger Stock Price \( = P^*_A = \frac{E^*_A}{N^*_A} = \frac{1'800}{100} = 18 \)

The following graph summarizes the valuation that results from the cash only transaction:

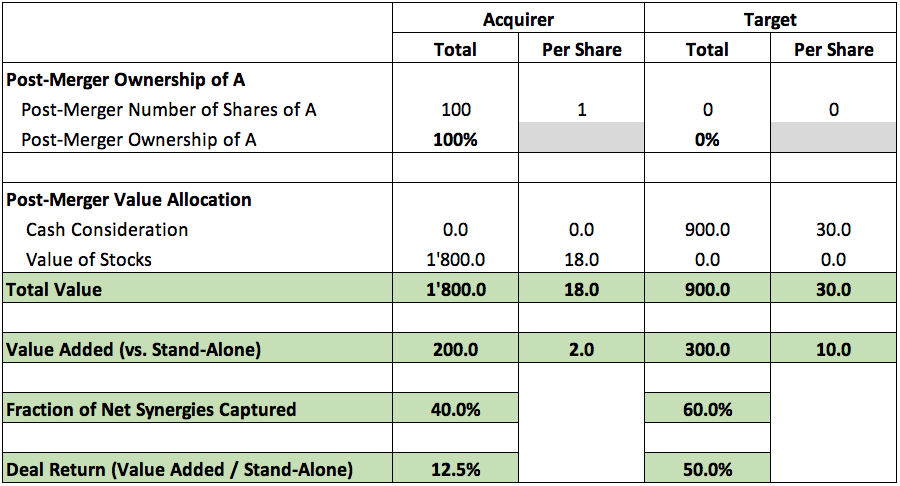

And the following table summarizes the value allocation that results from this cash deal:

The main takeaways of this deal form are:

- The original shareholders of the acquiring firm maintain full control over the company. There is no equity dilution from issuing stock to the target shareholders.

- After the deal, the target's original shareholder have cash only and therefore do not participate in the future growth opportunities of the company. In exchange, they are also not exposed to the risks that the merged company has.

- Because the payment is in cash, the target shareholders' return is "safe," in the sense that it does not depend on the market's assessment of how valuable the deal actually is. As we will see later, it need not necessarily be the case that the market agrees with the management projections of the net synergies. With a cash deal, the acquirer bears the full risk of differing market expectations (in both directions).