Reading: Acquisition Price and Value

3. Stock Deal

Let's look at the other end of the deal spectrum, where the acquiring firm pays the target shareholders with own shares.

For the sake of comparison, let us assume that the offer price remains the same, namely a total consideration of $900 million or $30 per share of the target company. However, instead of paying cash, the acquiring firm issues new shares and uses these shares as acquisition currency. The main question is: How many new shares will the acquiring firm issue for the target shareholders? Let us look at this question in detail.

Post-Merger Valuation (EA*)

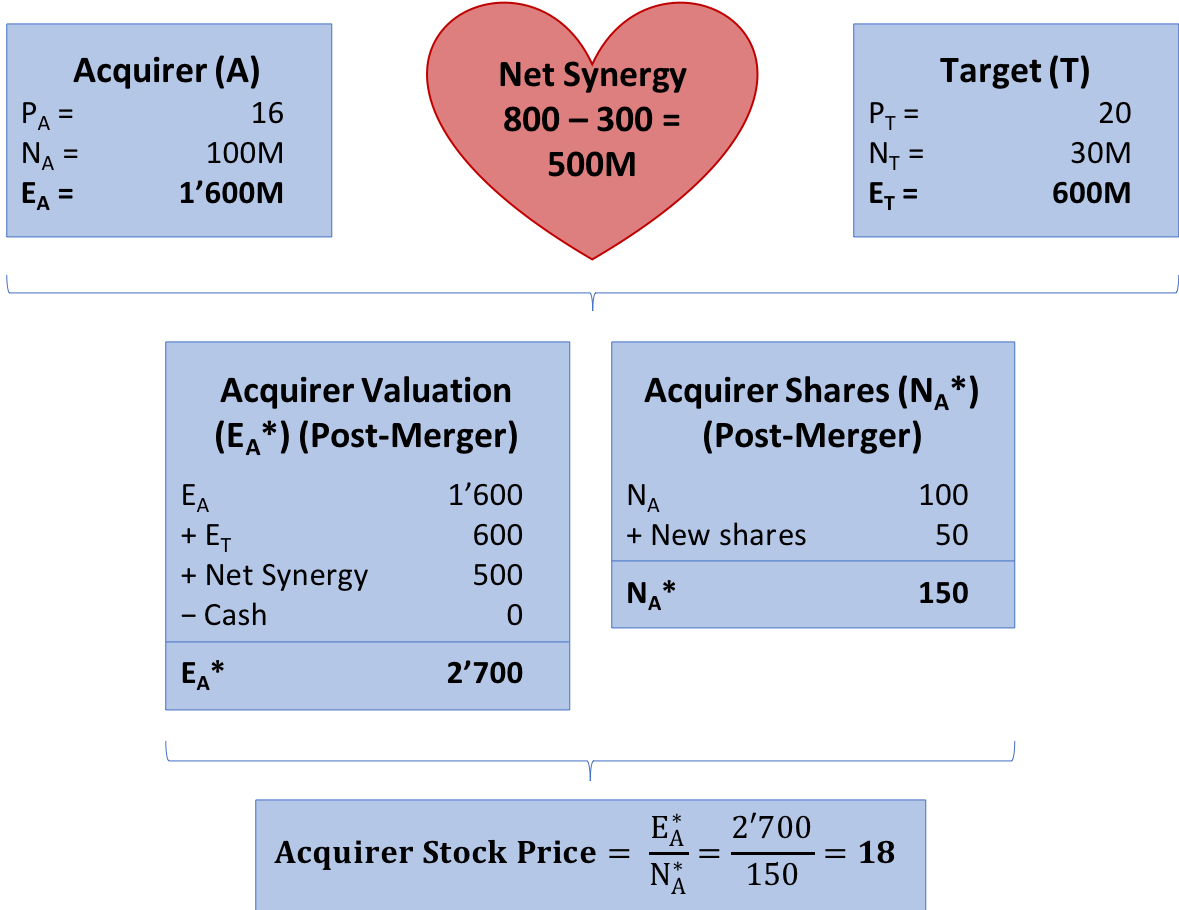

Unlike in a cash deal, there is no cash outflow to the target shareholders that reduces the value of the acquiring firm. Therefore, after the transaction, the equity value of the acquiring firm will be 2'700 million (instead of 1'800 million in the case of the cash deal):

Equity Value Merged Firm = EA* = Stand-Alone ValueA + Stand-Alone ValueT + Net Synergy – Cash Payment = 1'600 + 600 + 500 – 0 = 2'700.

Post-Merger Shares Outstanding (NA*)

What changes, however, is the number of shares outstanding. After the deal, the target shareholders will require an ownership stake in the company with a total vale of $900 million. Given a post-merger equity value of 2'700 million according to the computations above, the target shareholders therefore require an ownership stake of 33.33%, which we denote with the greek letter λT:

Required Ownership in A for T Shareholders \( = \lambda_T = \frac{\text{Offer price}}{E^*_A} = \frac{900}{2'700} = 0.3333 \)

Consequently, the 100 million shares that are currently owned by the Acquirer's shareholders will account for 66.67% of the merged company's ownership structure (= 1 - 0.3333). If 100 million shares represent 66.67% of the post-merger ownership structure, the ownership stake of 33.33% that goes to the target shareholders represents 50 million newly issued shares:

Newly Issued Shares of A to T Shareholders \( = N_A \times \frac{\lambda_T}{1-\lambda_T} = 100 \times \frac{0.3333}{1-0.3333} = 50 \)

Therefore, given that the target company currently has 30 million shares outstanding, the so-called Share Exchange Ratio, the number of shares of the merged company the target shareholders receive per share of the target company, is 1.667:

Share Exchange Ratio \( = \frac{\text{Newly Issued Shares to T}}{N_T} \) = \( \frac{50}{30} = 1.6667 \)

For each share of the target company, the acquiring firm therefore pays 1.6667 newly issued shares. After the merger, the acquiring firm will have 150 million shares outstanding (NA*):

Post-Merger Shares Outstanding \( = N_A^* = N_A + \text{Newly Issued Shares to T} = 100 + 50 = 150 \)

Post-Merger Stock Price

With this information, we are now ready to compute the post-merger stock price. With a valuation of $2'700 million and 150 million shares outstanding, the stock price remains at 18:

Acquirer's Post-Merger Stock Price \( = P^*_A = \frac{E^*_A}{N^*_A} = \frac{2'700}{150} = 18 \)

The following graph summarizes the valuation that results from the cash only transaction:

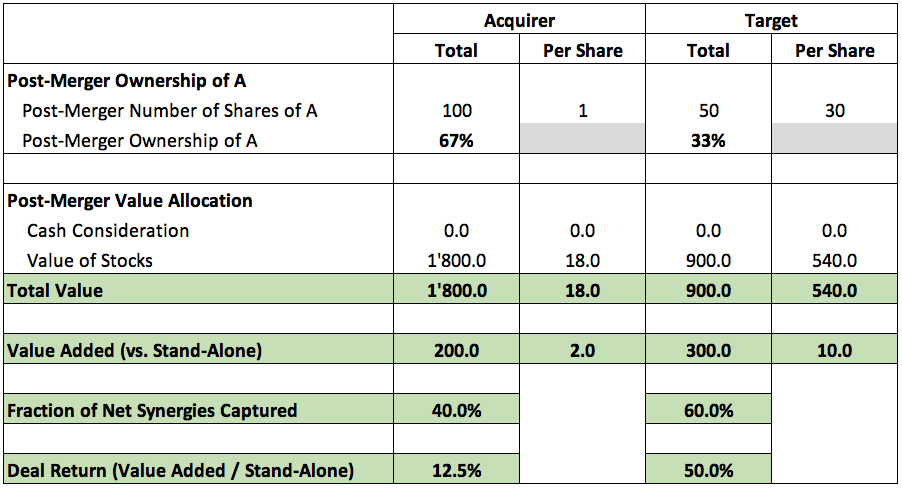

And the following table summarizes the value allocation that results from this stock deal:

The main takeaways of this deal form are:

- The stock deal does not actually cost anything in terms of hard currency to the acquiring company, as it simply prints new shares of its own stock.

- Because of these newly issued shares, however, the ownership stake of A's original shareholders is diluted. While they controlled 100% of A before the deal, their post-merger ownership stake drops to 66.67%.

- After the deal, the target shareholders will own a minority stake (33.33%) in the merged company. They remain fully exposed to the risks of the merged company.

- Because the payment is in stocks of the acquiring firm, the target shareholders' return not "safe." If the market disagrees with the management's assessment of the deal's value creation, the target shareholder's return will be affected. With a stock deal, the acquirer shares the risk of differing market expectations (and a different outcome) with the target shareholders (in both directions).

- In terms of value allocation, the stock deal is equivalent to the cash deal. 60% of the synergies go to the target company and the target shareholders earn a return of 50%. As we will see later, this equivalence is true as long as the management expectations about the deal correspond to the market expectations.