Reading: Acquisition Price and Value

6. Example

The basic relations that we have discussed in the preceding sections turn out to be fairly useful to understand the mechanics of M&A transactions and to better understand how and why the market reacts to the announcement of such deals.

In what follows, we practice these mechanics using the acquisition of the software company MuleSoft by the cloud computing company Salesforce in March 2018 for approximately $6.5 billion.

Stand-Alone Valuations

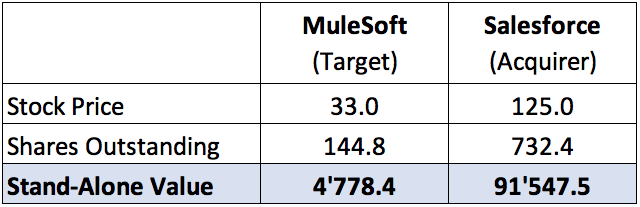

Before the acquisition the target company MuleSoft had approximately 144.8 million shares outstanding that were trading at a price of $33 each, for a market value of equity of approximately $4.8 billion. The acquiring company Salesforce had approximately 732.4 million shares outstanding that were trading at a price of $125 each, for a market capitalization of roughly $91.5 billion. The following table summarizes the stand-alone valuations of the two companies (in millions):

Offer Price and Takeover Premium

On March 20, 2018, the companies announced that Salesforce has extended the following offer to the shareholders of MuleSoft:

- Cash consideration: $36.0 per share of MuleSoft

- Stock consideration: 0.0711 shares of Salesforce per share of MuleSoft.

Based on Salesforce's pre-announcement stock price of $125, the deal was therefore valued at $44.89 per share or approximately $6.5 billion for MuleSoft's equity:

Total consideration per share = Cash per share + Share exchange ratio × PSalesforce = 36 + 0.0711 × 125 = 44.89

Total consideration = Total consideration per share × Shares outstanding = 44.89 × 144.8 = 6'500.

The total consideration of $44.89 per share corresponds to a premium of 36% over MuleSoft's pre-announcement stock price of $33 or a total takeover premium of roughly 1.7 billion:

Takeover premium (%) \( = \frac{\text{Offer Price}}{\text{Pre-announcement Stock Price}} - 1 = \frac{44.89}{33.00} - 1 = 36\% \)

Takeover premium ($) \( = \text{Target shares outstanding} \times (\text{Offer price} - \text{Pre-announcement Stock Price}) \) \(= 144.8 \times (44.89 - 33.00) = 1'723 \)

Therefore, based on the announced deal terms, the shareholders of MuleSoft stand to gain approximately $1.7 billion from the transaction.

Assuming that Salesforce's management does not knowingly pursue deals that destroy value, it follows that Salesforce's minimum expected net synergies from the deal must also be $1.7 billion. Put differently, the deal only adds value for Salesforce (and its shareholders) if the resulting synergies exceed $1.7 billion. If that is the case, Salesforce's stock price should increase upon the announcement of the deal. If not (at least in the market's expectations), the stock price will drop.

Market Expected Net Synergies

From the actual stock price reaction we can learn how the market assesses the synergy potential of the deal. As it turns out, Salesforce's stock price dropped by approximately 8.5% from $125.0 to $114.4 in the days after the announcement of the deal. Given 732.4 million shares outstanding, this stock price movement implies that approximately $7.8 billion of Salesforce's equity value were wiped out:

Market-expected Deal Value AddedSalesforce = (Post-announcement Stock Price − Pre-announcement Stock Price) × Shares Outstanding = (114.4 − 125.0) × 732.4 = −7'763.

Consequently, it seems that the market was significantly less optimistic about the deal than Salesforce. In fact, the market's (short-term) assessment was that the MuleSoft deal leads to a significant value destruction!

Because the overwhelming portion of the acquisition price (namely $36) was paid in cash, this differing market view on the deal's synergy potential barely affected the shareholders of MuleSoft. Upon the announcement of the deal, MuleSoft's stock price rose to $44.1, which exactly corresponds to the stock price one would expect given the offered cash consideration and the post-announcement value of Salesforce's stock.

To see this, remember that Salesforce offered 0.0711 of its own shares on top of the cash consideration of $36 per share of MuleSoft. At a post-announcement stock price of $114.4 (see above), the stock portion of the takeover consideration therefore has a value of approximately $8.1:

Market Value of Stock Consideration = Share Exchange Ratio × Post-announcement Stock PriceSalesforce = 0.0711 × 114.4 = 8.1.

Therefore, the actual market value of the total consideration is $44.1 instead of the announced $44.89:

Total Consideration (per Share) = Cash Consideration + Market Value of Stock Consideration = 36.0 + 8.1 = 44.1.

The following figure summarizes the post announcement valuation of the two companies and the resulting market-expected deal values and returns:

In total, the combined market value of the two companies dropped by approximately $6.16 billion upon the announcement of the deal:

- MuleSoft's market value increased by $1.61 billion

- Salesforce's market value dropped by $7.77 billion

Given a combined value of 96.3 billion before the announcement (=4.8 + 91.5), this corresponds to a combined deal return of -6.4%.