Reading: The Going Public Process

Completion requirements

View

7. Dropbox Summary

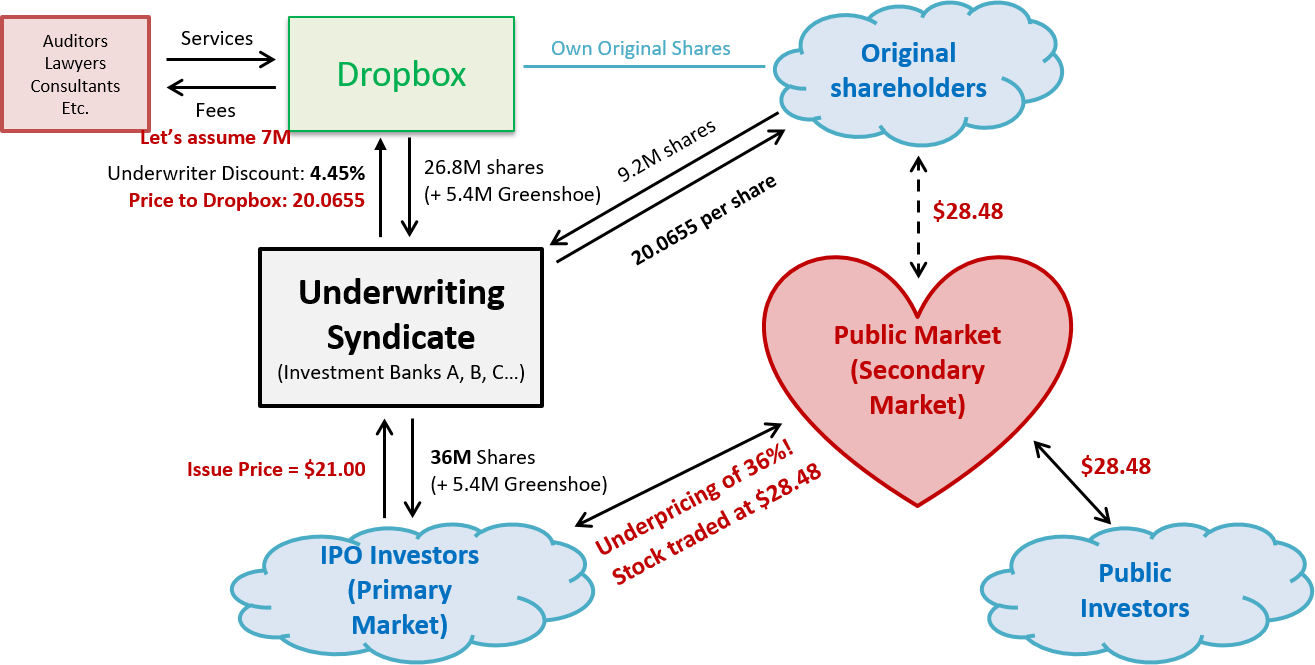

To close the discussion of the IPO process, let us go back to Dropbox's IPO in March 2018 on the NASDAQ. Here are some key characteristics of the offering, most of which are from the firm's Final Prospectus:

- IPO date: March 23, 2018 on NASDAQ

- Total number of shares sold (excluding greenshoe): 36 million

- Newly issued Dropbox shares: 26.8 million

- Shares sold by existing shareholders: 9.2 million

- Greenshoe option: 5.4 million new shares (exercised)

- Underwriting discount: 4.45%

- Issue price: Original price range of $16 - $18. Issue price fixed at $21.

- Closing price on the first day of trading on NASDAQ: $28.48

The following graph summarizes the rough structure of Dropbox's IPO:

The main takeaways are as follows:

- Gross proceeds: In total, the underwriters placed 41.4 million shares (including the greenshoe option) at a price of $21. The gross proceeds from the IPO were therefore 869.4 million.

- Underwriter discount: With an underwriter discount of 4.45%, the syndicate bought the shares from Dropbox and the original shareholders at a price of $20.0655 (= 21×(1 − 0.0445)). In total, the underwriter discount therefore amounted to $38.7 million (= 41.4×(21 − 20.0655)).

- Net proceeds to Dropbox and original shareholders: After of the underwriter discount ($38.7 million) Dropbox and its original shareholder collected proceeds of $830.7 (= 869.4 − 38.7). Assuming that the fees for external auditors, lawyers, etc. were approximately $7 million, the firm's net proceeds are therefore around $823.7 million (= 830.7 − 7).

- Proceeds to original investors: Assuming the original investors are subject to the underwriter discount as well (often, the issuer pays their underwriter discount), original shareholders receive a total of $184.6 million (= 9.2 × 20.0655).

- Proceeds to Dropbox: The remaining proceeds, 639.1 million (= 823.7 − 184.6), go to Dropbox.

- Proceeds to original investors: Assuming the original investors are subject to the underwriter discount as well (often, the issuer pays their underwriter discount), original shareholders receive a total of $184.6 million (= 9.2 × 20.0655).

- First-day return (Underpricing): The IPO investors bought at $21 on the primary market; the stock closed at $28.48 at the end of the first trading day on NASDAQ. The first-day return therefore amounts to approximately 36% (= 28.47/21 − 1).

- Money left on the table: Expressed in dollars, the IPO investors made $309.7 million (= 41.4×(28.48 − 21)) on the first day of trading.

- Total cost of going public: The difference between the total value offered to the IPO investors and the net proceeds collected by the selling shareholders is $356 million. These are the total costs of the IPO!

- Total value offered to IPO investors: 41.4 million shares at a post-IPO price of $28.48 = $1'179.1 million

- Net proceeds collected: $823.7 million (see above).

- Total cost of going public = 1'179.1 - 823.7 = $355.4 million

- Of which direct costs to external advisors: $7 million (assumption)

- Of which underwriter discount: $ 38.7 million

- Of which money left on the table: 309.7 million.

- Total value offered to IPO investors: 41.4 million shares at a post-IPO price of $28.48 = $1'179.1 million

These numbers show that an IPO is an expensive way to raise money. For each dollar offered to the IPO investors, the selling shareholders collect less than 70 cents (= 823.7 / 1'179.1). Looked at it from this perspective, the cost of an IPO are, therefore, more than 30% of the offered value (=355.4/1'179.1) or more than 43% of the raised capital (355.4/823.7).