Reading: IPO Mechanics

4. Post-IPO Ownership Structure and Shares

D: Post-IPO Ownership Structure

Now that we know the Post-IPO Value of the firm's Equity (Step B) as well as the total value offered to the primary investors (Step C), we can compute the fractional ownership stake the primary investors will claim in exchange for their capital contribution:

\( \text{Ownership to Primary Investors} = \frac{\text{Market Value Offered}}{\text{Post-IPO Equity Value}} \) \(= \frac{426.6}{740.0} = 0.5765 \)

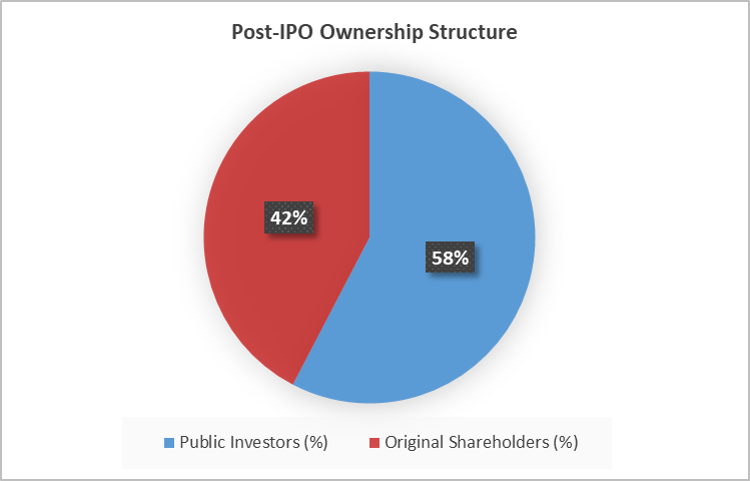

Put differently, the value the primary investors receive ($426.6M) corresponds to 57.65% of the expected Post-IPO Equity Value of the firm ($740.0M). After the IPO, the primary investors will therefore control almost 60% of the firm's equity. The ownership stake of the original shareholders, who controlled 100% of the shares before the IPO, will consequently drop to 42.35% (= 1 − 0.5765) after the IPO.

The following graph summarizes the firm's post-IPO ownership structure:

We can use this information to be a bit more specific with respect to how exactly the public investors acquire an ownership stake of almost 60%. To see this, remember that they acquire shares from selling shareholders (28.99% of the net proceeds go to selling shareholders) as well as newly issued shares from the company (the remaining 71.01% of the net proceeds go to the issuing firm; 57.97% for shares from the original offering and 13.04% for shares in connection with the greenshoe option). When we apply these weights to the overall post-IPO ownership stake of the public investors, we see the channels through which they acquire ownership:

| % of Total Proceeds | % Ownership Offered | |

| Shares Issued by Firm | 71.01% | 40.94% |

| ... Of which from Original Offering | 57.97% | 33.42% |

| ... Of which from Greenshoe Option | 13.04% | 7.52% |

| Shares sold by Selling Shareholders | 28.99% | 16.71% |

| Total Ownership Offered to Public Shareholders | 100.00% | 57.65% |

The bottom line of the table shows that the total proceeds (100%) will account for an ownership stake of 57.65%, as previously discussed. Since 71.01% of these proceeds go to the issuing firm (top line), the ownership stake that is associated with newly created shares from the issuing firm is 40.94% (= 0.7101 × 0.4094). Similarly, since 28.99% of the proceeds go to the selling shareholders, the number of shares sold by these shareholders account for 16.71% of the firm's post-IPO ownership (= 0.2899 × 0.1671).

The column to the right of the table summarizes the various sources of ownership for the primary investors.

E: Number of Shares Issued and Sold

The next question is how many shares the firm will actually issue and how many shares will be sold by the original investors. The preceding table shows that the newly issued shares will account for 40.94% of the firm's post-IPO ownership structure. Consequently, the currently outstanding 20 million shares will account for the remaining 59.06% of the post-IPO number of shares outstanding. With this knowledge, we can therefore derive the total number of shares outstanding after the IPO as well as the number of newly issued shares:

\( \text{Post-IPO Number of Shares} = \frac{\text{Pre-IPO Number of Shares}}{(1-\text{Ownership to Newly Issued Shares})} \) \( = \frac{20}{1-0.4094} = 33.86 \)

\( \text{Newly Issued Shares} = \text{Post-IPO Number of Shares} - \text{Pre-IPO Number of Shares} \) \( = 33.86 - 20.00 = 13.86 \)

Taken together, the firm will therefore issue 13.86 million new shares so that the total number of shares outstanding will increase from 20 million to 33.86 million after the IPO.

Using the same logic as in step D above, we can now back out the exact number of shares that will be offered through the specific channels. The following table shows the results:

| % of Proceeds | Number of Shares | |

| Total Number of Shares Placed with Primary Investors | 100.00% | 19.52 |

| Shares Issued by Firm | 71.01% | 13.86 |

| ... Of which from Original Offering | 57.97% | 11.32 |

| ... Of which from Greenshoe Option | 13.04% | 2.55 |

| Shares sold by Selling Shareholders | 28.99% | 5.66 |

So far, we have determined that the firm will issue 13.86 million new shares to the primary investors. From above, we know that newly issued shares account for 71.01% of the IPO's net proceeds. Consequently, the total number of shares that will be placed with the primary investors is 19.52 million (= 13.86/0.7101). The difference, 5.66 million shares (= 19.52 - 13.86) reflects the number of shares that will be sold by existing shareholders.

With these rather extensive calculations, we could back out the actual number of shares that will be issued and sold during the IPO. This was the last piece of information that was missing to compute the issue prices of the shares.