Reading: Alternative Going Public Strategies

2. Direct Public Offerings (DPOs)

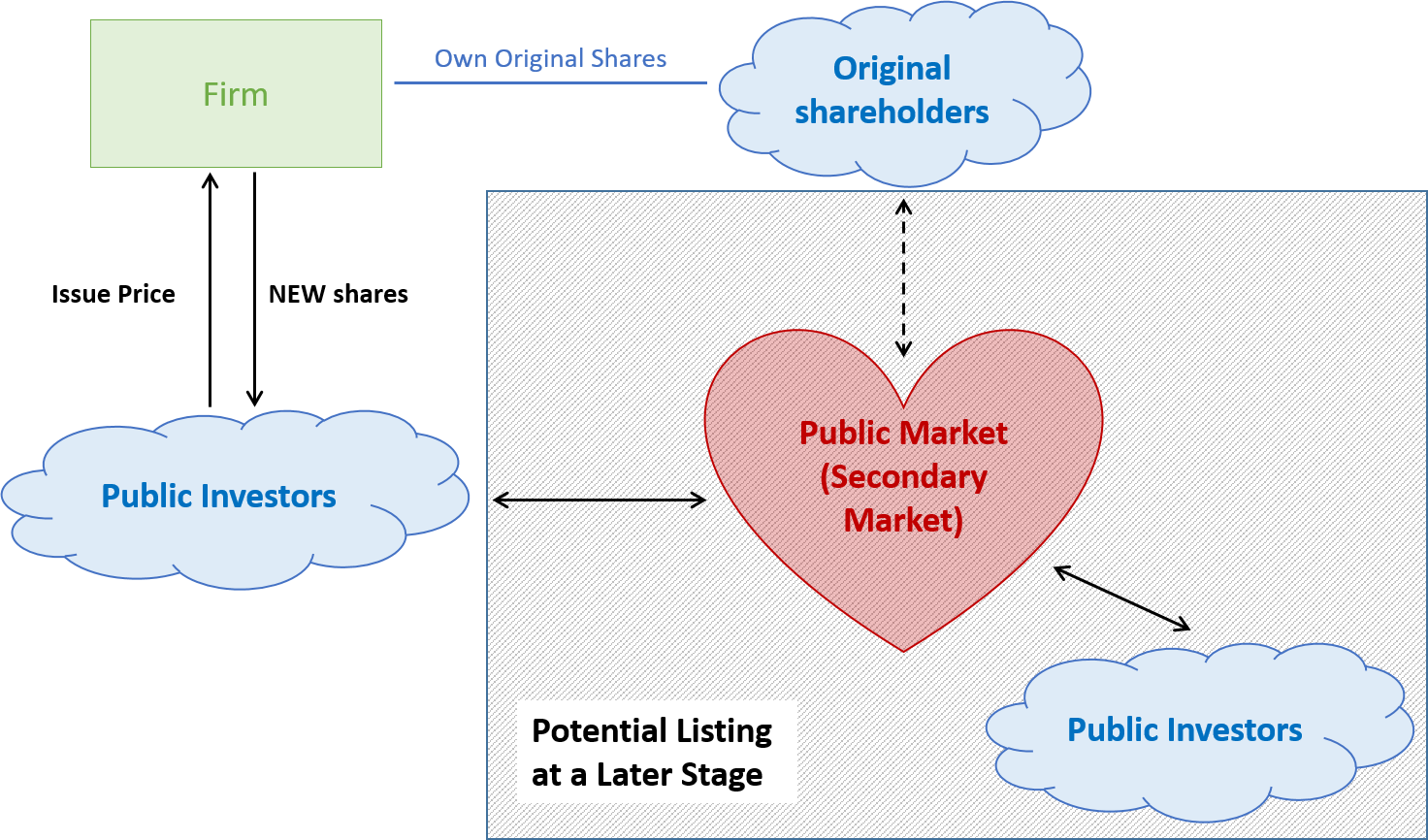

In a direct public offering (DPO), the issuing firm cuts out the middlemen (underwriting syndicate) and offers its securities directly to the public to raise capital. Since there are no middlemen, DPOs are, in principle, a much cheaper source of financing than the classic initial public offering via underwriting syndicate.

Importantly, the shares of firms that engage in a DPO are subsequently NOT traded on a public stock exchange. Therefore, they constitute illiquid securities and may expose the investing public to the associated illiquidity risks. Of course, firms that engage in a DPO could, at a later stage, opt for a Direct Listing and thereby list their shares on a public stock exchange.

The following graph shows the basic structure of a DPO: