Reading: The Accounting Framework

A solid financial plan is the basis of every valuation exercise and every significant management decision. The financial plan allows us to identify the firm's capital needs as well as its ability to generate cash. It also unveils the various sources and uses of funds. This section shows how to set up a financial plan.

4. Linking the Balance Sheet and Income Statement

The balance sheet and income statement are not independent financial statements.

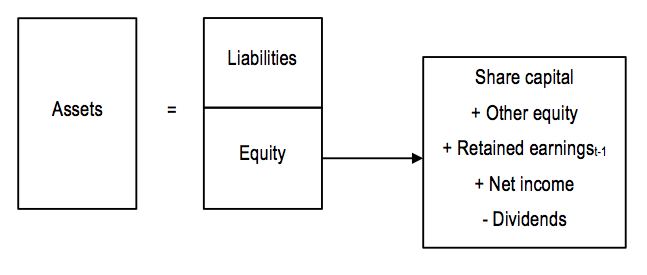

The part of the net income, which is not distributed as a dividend to the shareholders, is added to the firm's retained earnings, which are part of the equity. Therefore, the retained earnings at the end of any year t correspond to the retained earnings at the end of the previous year (t-1) plus the part of the net income earned during that year, which has not been paid out as dividends:

Retained earingst = Retained earningst-1 + Net incomet - Dividendst

The following figure summarizes the basic accounting equation:

In the case of firm X from the previous example, we know from before that the net income in Year 1 was 2'800. At the same time, we also know that the retained earnings have increased by 1'400 from 8'100 at the end of Year 0 to 9'500 at the end of Year 1. This implies that 1'400 of that year's net income was retained in the company whereas the rest (2'800 - 1'400 = 1'400) was paid out as dividends to the shareholders.