Reading: Foundations of NPV Rule

Completion requirements

View

2. Example

The CEO of a company has to decide how to use the firm's available cash balance of $20 million. She has the following two alternatives:

- Invest in a project that generates a payoff of $25 million in one year. Today's required investment for this project is the full $20 million and the cost of capital is 10%.

- Return the money (or parts of it) to the investors and invest the remaining balance in the alternative asset that generates an annual return of 10%.

For simplicity, let us assume that the $20 million is the firm's only asset and that there are 100'000 shares outstanding.

To find out what is in the best interest of the company's shareholders, the CEO consults with two important investors:

- Uncle Fred: Fred is an elderly gentleman who wants to enjoy life. He urges the CEO to pay out the cash balance so that he can buy a yacht.

- Trisha: Trisha is a hard-working young professional who earns a good salary and has no time to spend money. She wants to keep the shares as an investment for retirement and therefore urges the company to invest for the long run.

What should the CEO do? Can she make both shareholders happy? And what about other shareholders who might have different preferences?

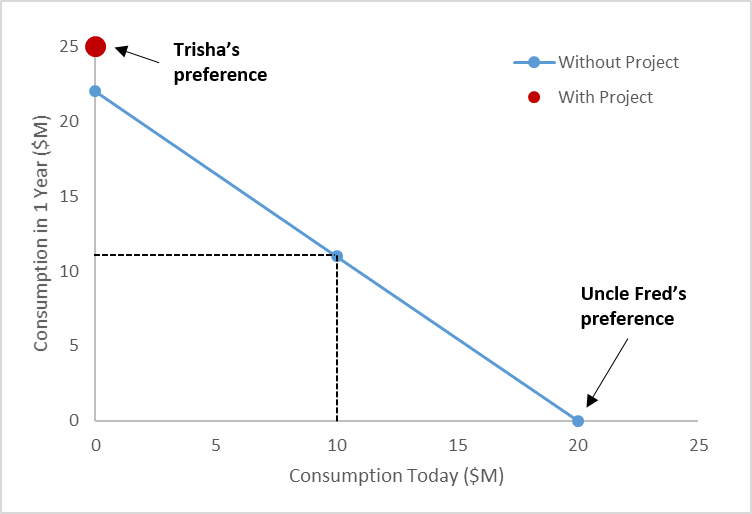

The following graph summarizes the current situation:

- On the horizontal axis, it shows today's cash payout (consumption) and on the vertical axis, it shows the cash payout (consumption) in one year.

- The blue line shows the trade-off between consumption today and consumption in 1 year if the firm does not invest in the project:

- In the extreme, it can pay out the full $20 million today so that there will be no more payout in 1 year. This is the point to the bottom right of the graph, which reflects uncle Fred's preference.

- In the other extreme, the firm can withhold payout today and put the full 20 million in the alternative asset at a rate of return of 10%, so that total payout in 1 year will be $22 million [= 20 × 1.1].

- The firm could also chose a payout policy in between these two extremes. For example, it could return $10 million today and invest the remaining $10 million at 10%, for a payout of $11 million in 1 year [10 × 1.1].

- In contrast, the red dot shows the corresponding trade-off if the firm takes the project. In this case, there is no payout today and the expected payoff is $25 million in 1 year. This is Trisha's preference.

Let us now see how the NPV rule can help the investors to agree on the firm's appropriate investment plan, and what the necessary conditions are.