Reading: Internal Rate of Return (IRR)

5. IRR Challenges

5.1. Borrowing or Lending?

Example 3

Suppose we can choose between the following 2 projects A and B:

The column to the right shows that project A has an IRR of 14% whereas project B has an IRR of 35%. Which project should we take?

The initial reaction could be to follow the standard IRR rule and vote for project B, as project B has a much higher return (35%) than project A (14%). Why is this initial reaction wrong?

Projects A and B have fundamentally different cash flow patterns!

- Project A is a standard investment project: We invest money today (cash outflow) and receive money in the future (cash inflows). For such an investment project, a high IRR is good because it tells us that the invested capital is expected to generate a high return.

- Project B, in contrast, is a borrowing project: We receive money today (cash inflow) and return money in the future. For such a borrowing project, a high IRR is bad news because it implies that we have to pay a high interest rate on the borrowed money!

A high rate of return is only desirable when we invest money. In contrast, when we borrow money, we want to look for opportunities with low rates of return! Consequently, the IRR-rule is not the same for borrowing and investment projects. Depending on whether we are dealing with a borrowing or an investment project, the revised IRR rule is:

- Borrowing projects: Accept investment proposals that offer IRRs that are smaller than the cost of capital

- Investment projects: Accept investment proposals that offer IRRs in excess of the cost of capital.

As we will see later, it is not always easy to determine whether a proposal has the characteristics of a borrowing or lending project. This is something we have to keep in mind when using the IRR rule!

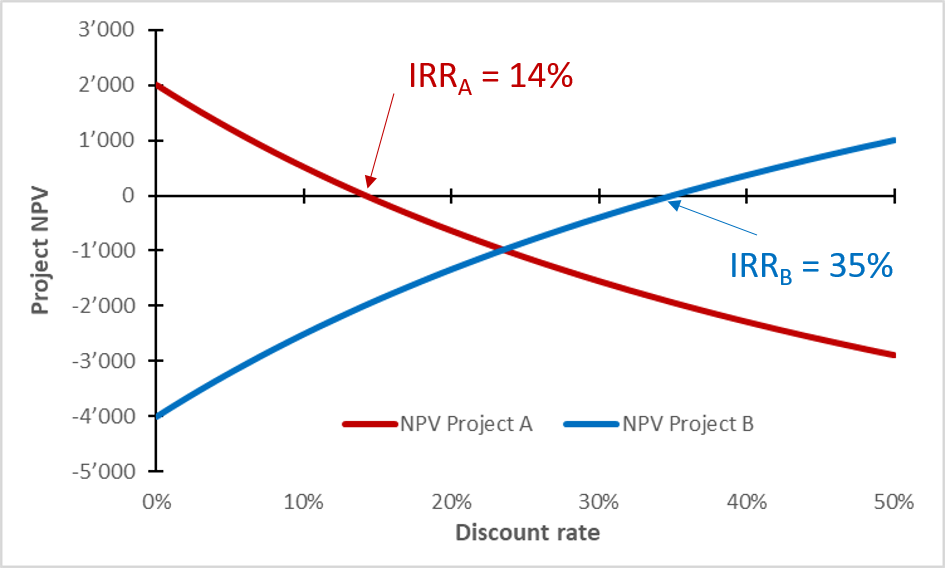

The NPV rule is immune to this problem. The following graph plots the NPV profile of the projects A and B as a function of the discount rate:

- Consistent with the considerations above, we see that the NPV of the investment project A drops when the discount rate increases, as the future cash inflows become less valuable today. We should only invest in project A if the cost of capital is below 14%. In that case, project A has a positive NPV.

- Project B, in contrast, becomes more valuable as the discount rate increases. Higher discount rates lower the present value of our future "debt" repayments. However, the IRR of 35% indicates that the cost of capital would need to be larger than 35% to justify project B. If the cost of capital is lower (that is, if we can borrow at a lower rate than 35%), we should not take project B!