Reading: Introduction to Diversification

3. A Simple Example

Let us consider a student who decides to sell ice cream on campus (with the necessary permissions, of course). For simplicity, let us assume that on sunny days, the ice-cream business is good and generates a return of 10%. In contrast, if the weather is bad, ice cream is in low demand so that the business generates a return of 0%. Good and bad weather are equally likely.

The following table summarizes the returns of the ice-cream business as a function of the weather:

| Good weather (probability 0.5) |

Bad weather (probability 0.5) |

Expected return | |

| Ice cream return | 10% | 0% | 5% |

If good weather and bad weather have equal probability (0.5 each), the expected return is 5%:

Average return = 0.5 × 0.1 + 0.5 × 0 = 0.05 = 5%.

On average, the student will therefore earn a return of 5%. However, on any individual day, the return will never be 5%. It will be 10% if the weather is good and 0% if the weather is bad.

Now the student is concerned about this weather risk. She decides to expand her product shelf. To do so, she throws out half of the ice creams.

But what to put in the other half of the (former) ice cream truck?

- If her goal is to reduce the weather risk, she ideally picks something that sells when the weather is bad.

- She would be ill-advised to add items such as sun lotion, cold drinks, or other flavors of ice cream, as all these goods have similar sales-cycles as the original ice cream business. They sell well if the weather is good, and they sell poorly if the weather is bad. Put differently, the sales of all these goods exhibit a strong positive correlation.

- To diversify the weather risk, she should look for goods that sell well if the weather is bad. For example, she could add umbrellas, rain boots, or snow shovels to her product shelf. This way, she will be able to make money regardless of the weather: On sunny days she sells ice cream and on rainy days she sells umbrellas.

More formally, let us assume that she allocates the available 50% of the shelf space to umbrellas and that the umbrella business generates a return of 0% on sunny days and 10% on rainy days. The following table summarizes the risk and return of her diversified business as a function of the weather:

| Shelf space | Return good weather (probability 0.5) |

Return bad weather (probability 0.5) |

Expected return | |

| Ice creams | 50% | 10% | 0 | 5% |

| Umbrellas | 50% | 0 | 10% | 5% |

| Total | 100% | 5% | 5% | 5% |

Interpretation:

- On a day with good weather, her expected return drops from 10% to 5%: Because she only allocates 50% of her shelf space to ice cream, only 50% of her business earn a return of 10%, the rest earns no return:

\(R_{good}=w_{\text{ice}} \times R_{\text{ice}}+w_{\text{umbrella}} \times R_{\text{umbrella}} \) \( = 0.5 \times 0.1 + 0.5 \times 0.0 = 0.05 = 5\% \)

- In contrast, if the weather is bad, the expected return increases from 0% to 5%:

\(R_{bad}=w_{\text{ice}} \times R_{\text{ice}}+w_{\text{umbrella}} \times R_{\text{umbrella}} \) \( = 0.5 \times 0.0 + 0.5 \times 0.1 = 0.05 = 5\% \)

- Therefore, regardless of the weather, her expected daily return will be a constant 5%!

In this (highly simplified) example, the student could use the concept of diversification to completely eliminate the weather risk without giving up any of the expected return. The trick was to combine the original asset (ice creams) with an asset that has perfectly negatively correlated returns (umbrellas).

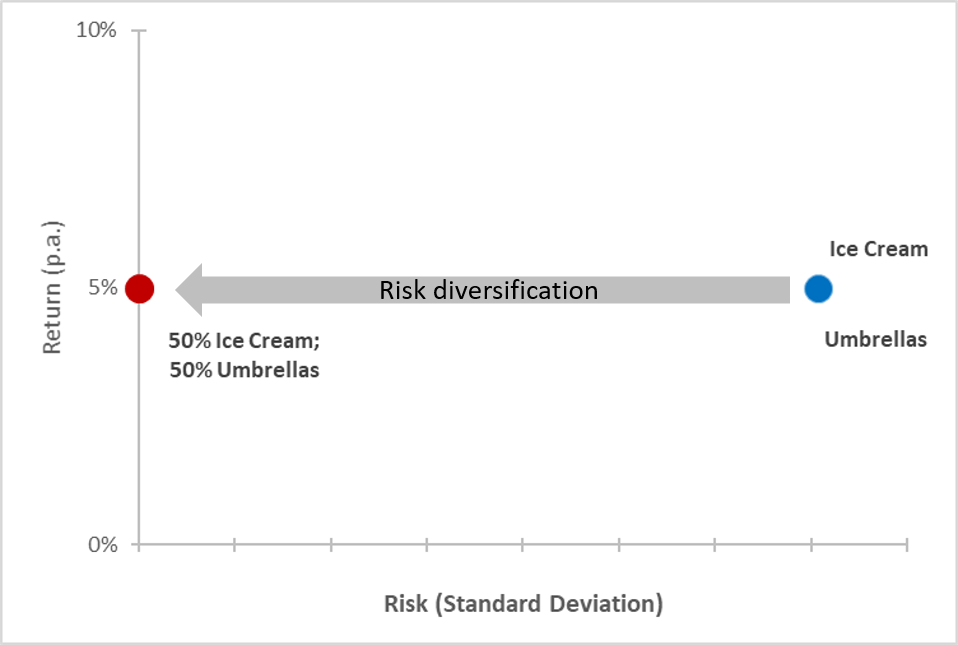

The following figure shows the impact of diversification:

- Originally, the student was in the blue asset, with an average expected return of 5% and a certain risk (10% or 0%), depending on the weather.

- Then the student combined the ice cream with an other asset with identical expected return (5%) and identical risk (0% or 10%).

- Because the risks of the two assets run in perfect opposite directions, the resulting portfolio with 50% ice cream and 50% umbrellas has an expected return of 5% with zero risk!

While not fully realistic, this simple example has shown the power of diversification. The next step is to put these considerations on theoretically more solid grounds and to discuss some more formal aspects of the concept of risk diversification.