Reading: Portfolio with Multiple Assets

5. Market Portfolio and the Capital Market Line

Now we are almost done. Before we take the last important steps, let us briefly review where we stand:

- We have started out in a world with risky assets. There, we have identified the Efficient Frontier, which demarks the portfolios with the best possible risk-return characteristics.

- Then we introduced the risk-free asset. We have seen that we can combine the risk-free asset with any risky asset to obtain a linear risk-return trade-off.

We have derived this linear trade-off for one specific combination of assets, namely the risk-free asset together with risky stocks (Asset A in our discussion). The open question that remains is simple: Is this the best we can do?

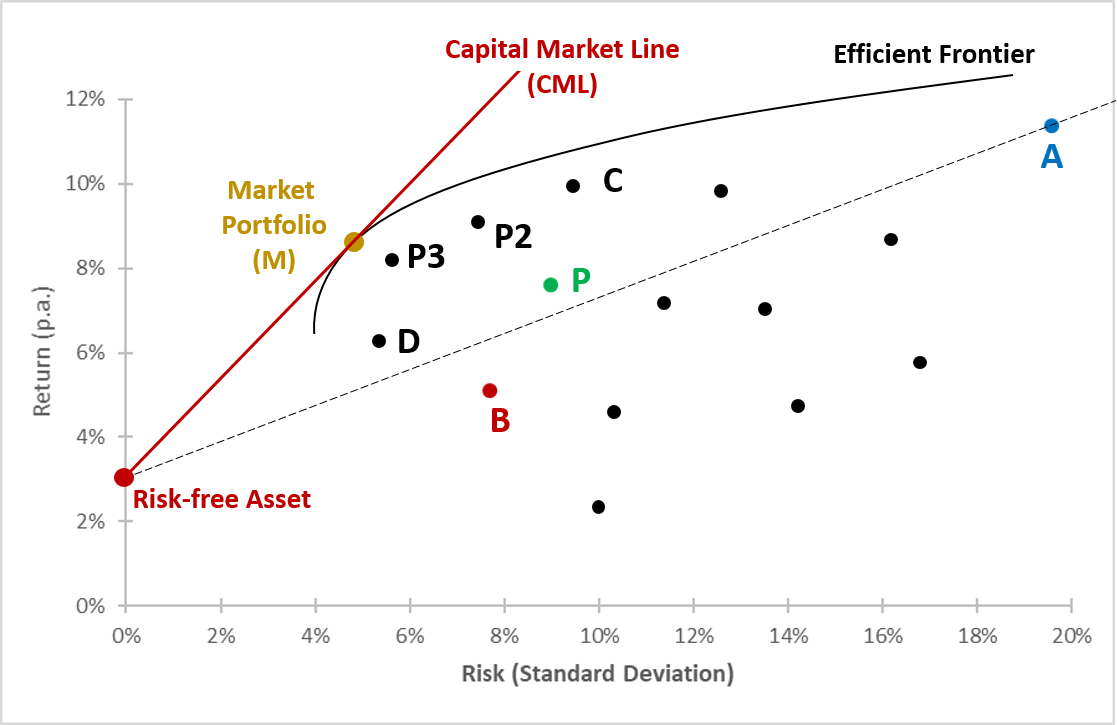

The following graph combines the main takeaways from the two bullets above, namely the efficient frontier (solid black line) and the linear risk-return trade-off between the risk-free asset and asset A (dashed line).

When we look at this graph, we see that the combination of the risk-free asset with asset A is clearly not the best we can do! There are many other portfolios that offer a much better risk-return pattern (they are above the dashed line)!

Given the risk-free asset, we therefore need to find a risky asset that leads to a better risk-return trade-off. Graphically speaking, we are looking for a portfolio of risky assets that maximizes the slope of the straight line! The best we can do is to combine the risky asset with the portfolio on the efficient frontier that is labeled Market Portfolio (M). No other combination offers a better risk-return pattern.

The portfolio combinations that lie on the straight line through the risk-free asset and the market portfolio dominate all other portfolio combinations. This red line is the best possible diversification outcome that investors can achieve. It is the so-called Capital Market Line (CML).

While the discussion was, admittedly, rather dense and complex, it has allowed us to dramatically simplify the investment choices.

- Instead of investing in individual risky assets, investors should solely invest in the market portfolio (which, by definition, contains all risky assets).

- To accommodate their individual preferences for risk, investors can then allocate a smaller or larger portion of their wealth to this market portfolio—the rest goes to the risk-free asset.

- Risk-averse investors will allocate more to the risk-free asset and less to the market portfolio.

- Risk-loving investors, in contrast, will allocate more to the market portfolio and less to the risk-free asset.

- As risk preferences change (or the risk environment changes), investors can "simply" adjust their wealth allocation to the market portfolio and the risk-free asset. They do not need to search for alternative assets.