Reading: Net Cash Flow Basics

Completion requirements

View

1. Introduction

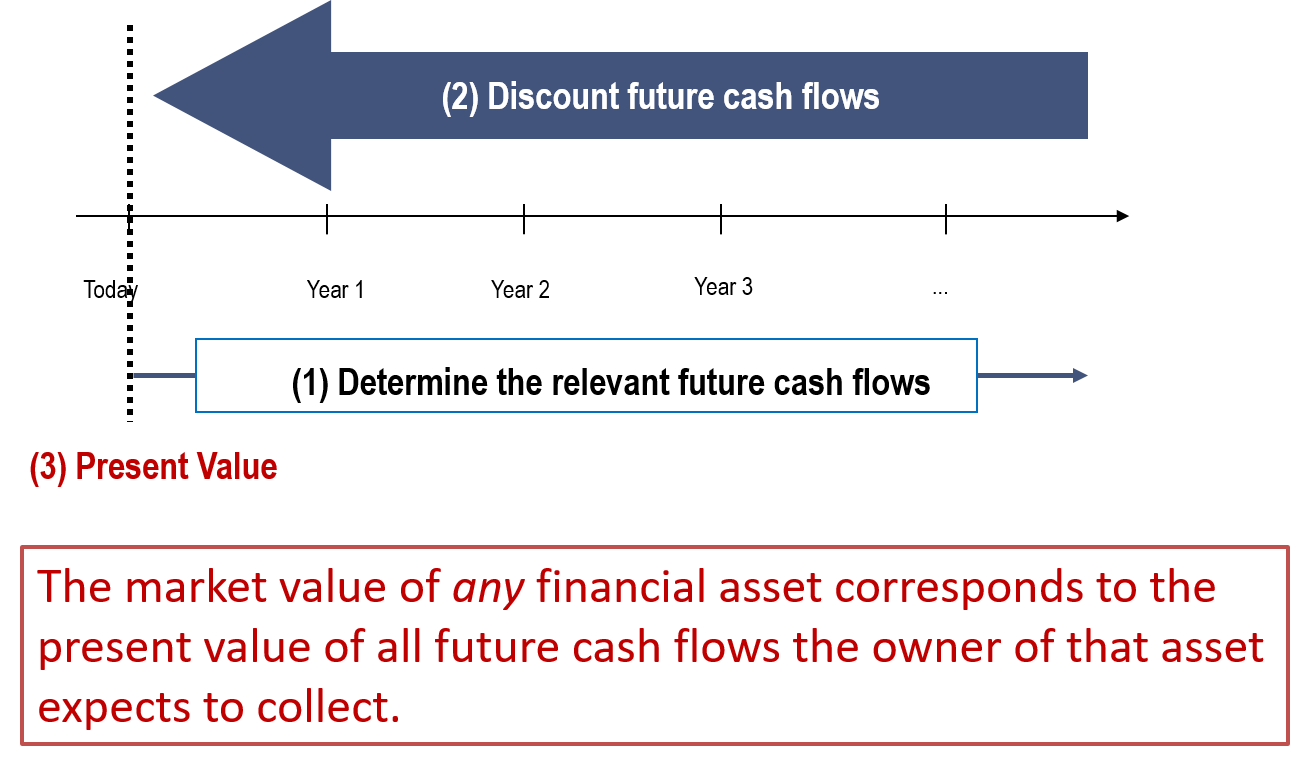

The module NPV and other Investment Decision Criteria has shown that we need to estimate "relevant future cash flows" and "discount rates" to determine the financial value of a project or investment decision.

This module discusses in more detail what the "relevant future cash flows" are and how we can estimate them. Undeniably, this is the most important step in any capital budgeting exercise. The module Risk, Return, and the Cost of Capital then shows how to estimate discount rates.

The Ultimate Goal...

Before looking into the details of the computation of these cash flows, it makes sense to take one step back and recollect what we are actually looking for:

- For capital budgeting, we are generally interested in the total financial value of a project.

- The "relevant future cash flows" should therefore reflect the total amount of money that the providers of capital can expect to earn with the project.

- Consequently, the cash flow should capture the amount of cash that is left for the providers of capital after all other relevant stakeholders have received a fair compensation. This cash flow is called the project's Net Cash Flow.

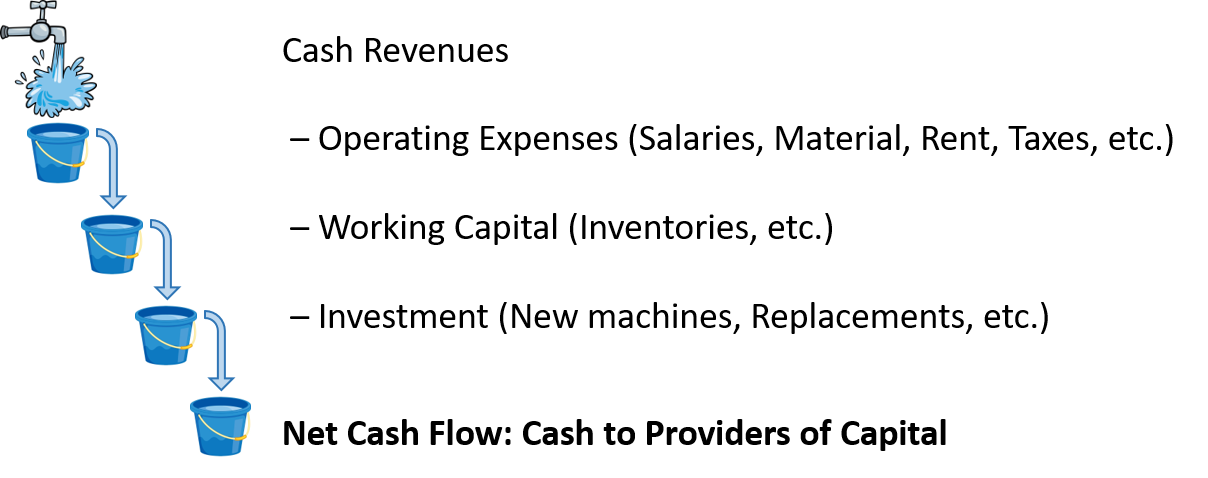

- The following waterfall illustrates the logic of the Net Cash Flow:

The Net Cash Flow indicates how much cash a project generates after its operating expenses have been covered (e.g., salaries to employees, purchase of materials, rent payments, taxes, etc.) and after the necessary assets have been put in place and maintained (e.g., purchase of inventory, purchase of property, plants, or equipment).