Reading: Debt Policy in a Perfect World

5. Implications for the Cost of Capital

5.2. Leverage and the Cost of Equity

If, as in the preceding example, debt costs less (kD = 10%) than equity (kE = 14%): Why is it that firms do not fully finance their operations with debt? We have collected the relevant pieces of information to answer this question in the preceding sections:

- It is true that the cost of debt (kD) is lower than the cost of equity (kE). The reason is that debtholders enjoy a preferred return, which makes debt less risky than equity. We have seen this in our original example, where the debtholders received their fair compensation regardless of the future state of the world.

- We have also seen, however, that adding debt to the capital structure changes the riskiness of the firm's equity. Because shareholders have a residual claim, their risk increases as leverage goes up. In our original example, the expected return on equity increased from 12% to 14% because of leverage.

We can see this more formally if we rearrange the equation from the previous page and solve it for the cost of equity, kE:

\( k_E = k_A + (k_A - k_D) \times \frac{D}{E} \)

This summarizes in a formal way our conclusion from before: Shareholders bear two types of risk for which they want compensation.

- Operating risk: kA, the first argument in the above expression, is the compensation for this operating risk

- Financing risk: The second argument in the above expression summarizes the shareholders' compensation for financing risk.

Since the cost of assets (kA) is larger than the cost of debt (kD)—remember that debtholders have a preferred return and are therefore less exposed to business risk—leverage increases the cost of equity! This is the famous Modigliani-Miller Proposition II.

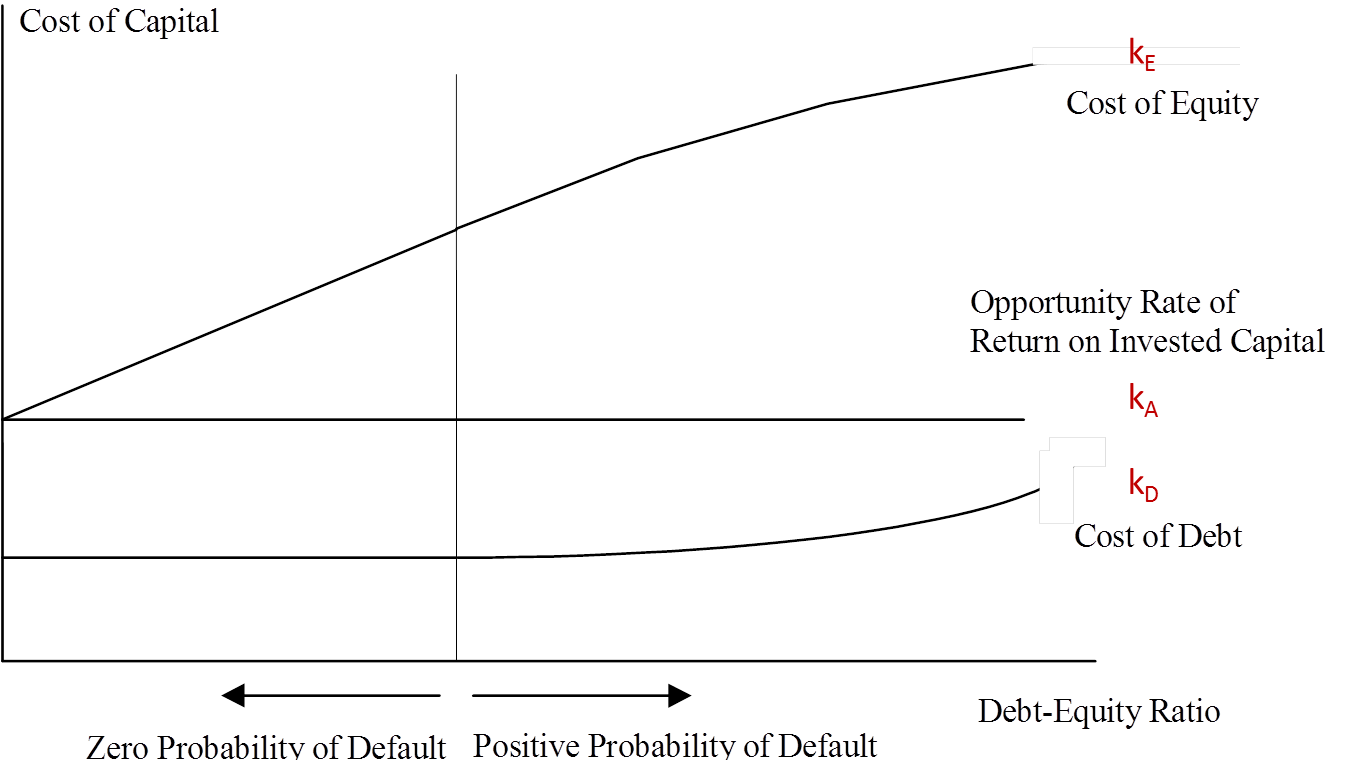

The following graph summarizes this proposition. It shows the cost of the various sources of capital (vertical axis) as a function of the firms debt-to-equity ratio (horizontal axis):

- The cost of assts (kA) is unrelated to the firms financing policy, as shown by the flat line between the cost of debt and the cost of equity.

- The cost of equity (kE) increases with leverage. The reason is that the shareholders require an additional compensation for the financial risk that debt financing imposes on them.

- As long as the firm is able to guarantee the contractual debt obligations, debt is risk free and the cost of debt (kD) is therefore unrelated to the firms operating risk and financing policy. However, as leverage becomes sufficiently large, the firm will no longer be able to guarantee these payments and the firm faces a positive probability of default. Debtholders require a compensation for this financing risk, which is why, eventually, the cost of debt also increases with leverage.

Application

To close this topic, let us briefly go back to our example and apply these considerations. In our previous example, the firm's overall cost of capital (kA) was 12%. To adjust the capital structure, the firm borrowed 2'500 (D) at a cost of debt (kD) of 10%. The resulting equity value (E) was 2'500. When we plug this information in the equation above, we find a cost of equity under the revised capital structure of 14%:

\( k_E = k_A + (k_A - k_D) \times \frac{D}{E} = 0.12 + (0.12 - 0.10) \times \frac{2'500}{2'500} \) = 14%.

This is the same average expected rate of return as the one we have computed before. The following graph illustrates this change in financing policy and the implications for the cost of capital:

In words:

- The shareholders expected return increases from 12% (blue star) to 14% (red star).

- This increase does not mean that the firm adds more value for the shareholders.

- It simply reflects the fact that the new financing policy with 50% of debt increases the riskiness of the equity claim.

- On top of the compensation for the business risk (kA), the shareholders now require an additional compensation for the financing risk they bear.

- The firm's overall cost of capital does not change for the firm. Put differently, the total return the firm has to earn for its providers of capital remains the same.