Reading: Introduction

Completion requirements

View

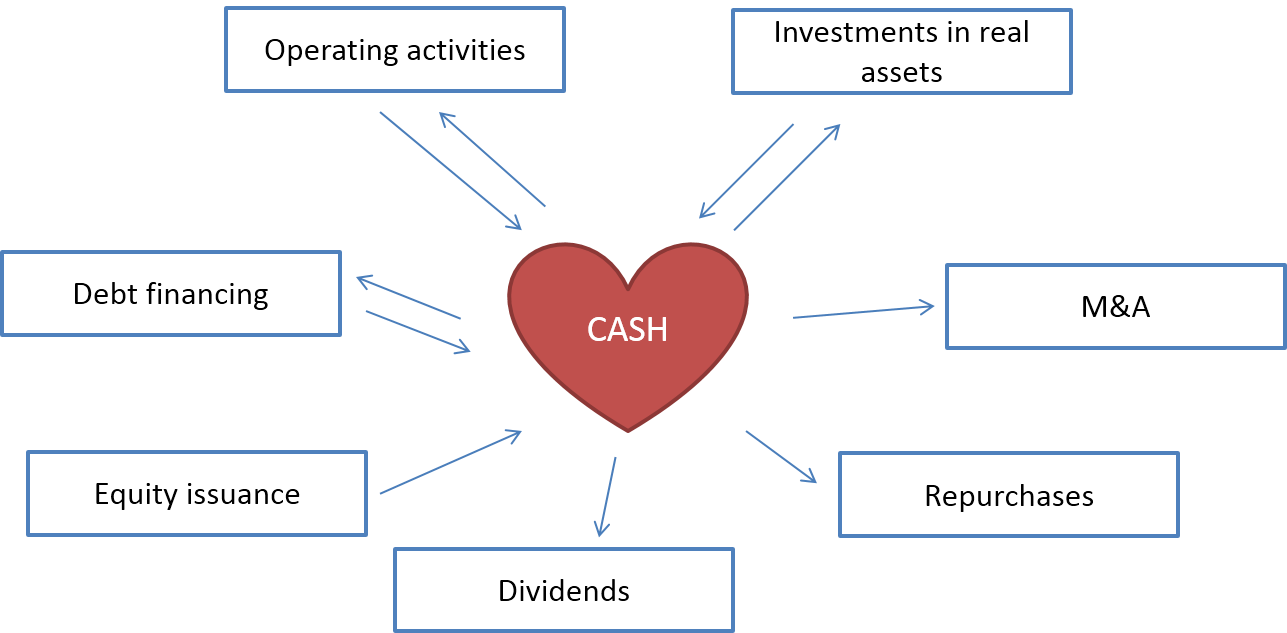

1. Sources and Uses of Funds

The timing and the amount of the firms' various sources and uses of funds are at the heart of corporate finance and the corporate financial policy:

Many of the elements in this graph are discussed in great details in other modules. In particular:

- Financial Planning focuses on the firm's operating activities and investments and shows how to estimate the associated cash flows.

- Capital Structure focuses on the trade-off between debt and equity financing.

- Financing Growth discusses the process of issuing debt and equity, also in the context of M&A deals.

This module focuses on the firm's Payout Policy. The key questions we will address are:

- How much cash should the firm return to its shareholders?

- How should the firm return cash (dividends or repurchases)?

- Does payout matter?

- Is there a systematic approach to these considerations that deserves the name "policy?"

In this introductory section, we give a brief overview of the overall relevance of corporate payouts. We also introduce the most important forms of payout: Dividends and share repurchases.