Reading: Introduction

1. Introduction

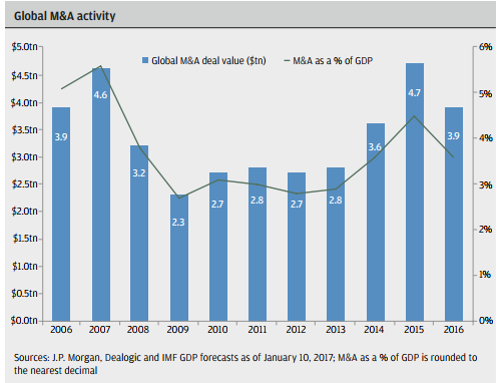

This section focuses on important financing considerations surrounding mergers and acquisitions (M&A). M&A transactions have tremendous economic relevance. The following graph summarizes the global M&A activity over the years 2006 - 2016 and shows that the global M&A deal volume is around $4 trillion per year, which corresponds to roughly 5% of GDP.

Another way to understand the relevance of M&A is to look at the U.S. stock market, where each year, approximately 1 out of 12 companies delist. In almost 70% of the cases, the delisting reason is an M&A transaction.

Potential Benefits of M&A Transactions

M&A deals facilitate the relocation of resources to management teams or corporate structures that are better at managing these resource. As such, these transactions play an important role in Schumpeter's "Creative Destruction." M&A can be a valuable strategic alternative at various stages of a firm's life cycle:

- Quicker market access: Instead of building distribution networks organically, M&A can accelerate market access for the products of the buyer and the seller:

- For example, when Procter & Gamble (P&G) acquired Gillette in a $57 billion deal back in 2005, the complimentary distribution networks of the merged companies allowed them to introduce new products into new markets at a faster pace.

- Market access is also an often-cited argument for the acquisition of small innovative firms by more mature companies. The mature companies can use their established sales and distribution structures to push the products of the newly acquired companies to the market. This is a popular strategy in the pharmaceutical industry, where global players often buy companies with freshly approved drugs.

- For example, when Procter & Gamble (P&G) acquired Gillette in a $57 billion deal back in 2005, the complimentary distribution networks of the merged companies allowed them to introduce new products into new markets at a faster pace.

- Access to strategic resources: M&A can also give firms faster and/or cheaper access to key resources, skills, or technologies.

- A case in point is Google's acquisition of Motorola Mobile in 2011 for $12.5 million. Motorola Mobile had more than 20'000 patents that Google could use to protect vendors of its Android operating system. Shortly after the acquisition, Google sold Motorola Mobile to Lenovo but kept most of the firm's intellectual property.

- Also Apple is famous for using M&A transactions to react quickly to market trends. For example, the firm bought Siri in 2010 to improve its mobile operating system. Similarly, it acquired Beats Electronics in 2014 in reaction to a market trend away from purchasing and downloading content, which is iTunes' business model, to streaming.

- Consolidation of industry: At more mature stages of the firm and industry life cycle, excess capacity is a typical phenomenon. Excess capacity means that the incumbent firms can produce more than what the market actually demands. The result typically is that prices drop. By means of merger, larger combined entities can share their fixed costs and shut down individual plants that become redundant.

- Company succession: Finally, M&A can be an important strategic option at the end of the firm's (or the entrepreneur's) business life cycle. Properly structured, an exit via M&A generally carries the largest valuation and is often also the quickest to execute. Therefore, selling the company might be a viable exit option for entrepreneurs who no longer want to be involved with the business and whose primary interest is a significant cash considerations.

M&A challenges

While M&A is a fascinating and economically important form of corporate restructuring, adding value with M&A is easier said than done, at least for the buyer. As we will discuss in the last section of this module, expected merger synergies are often overestimated and merger integration costs are often underestimated. Moreover, the evidence is that a large part of the anticipated net benefits from the merger often goes to the seller, not the buyer.

Taken together, as a rule of thumb, the expected synergy gains must amount to at least 50% of the target firm's stand-alone value in order for the deal to create value for the acquiring company!