Reading: Forms of Takeover

1. Forms of Takeover

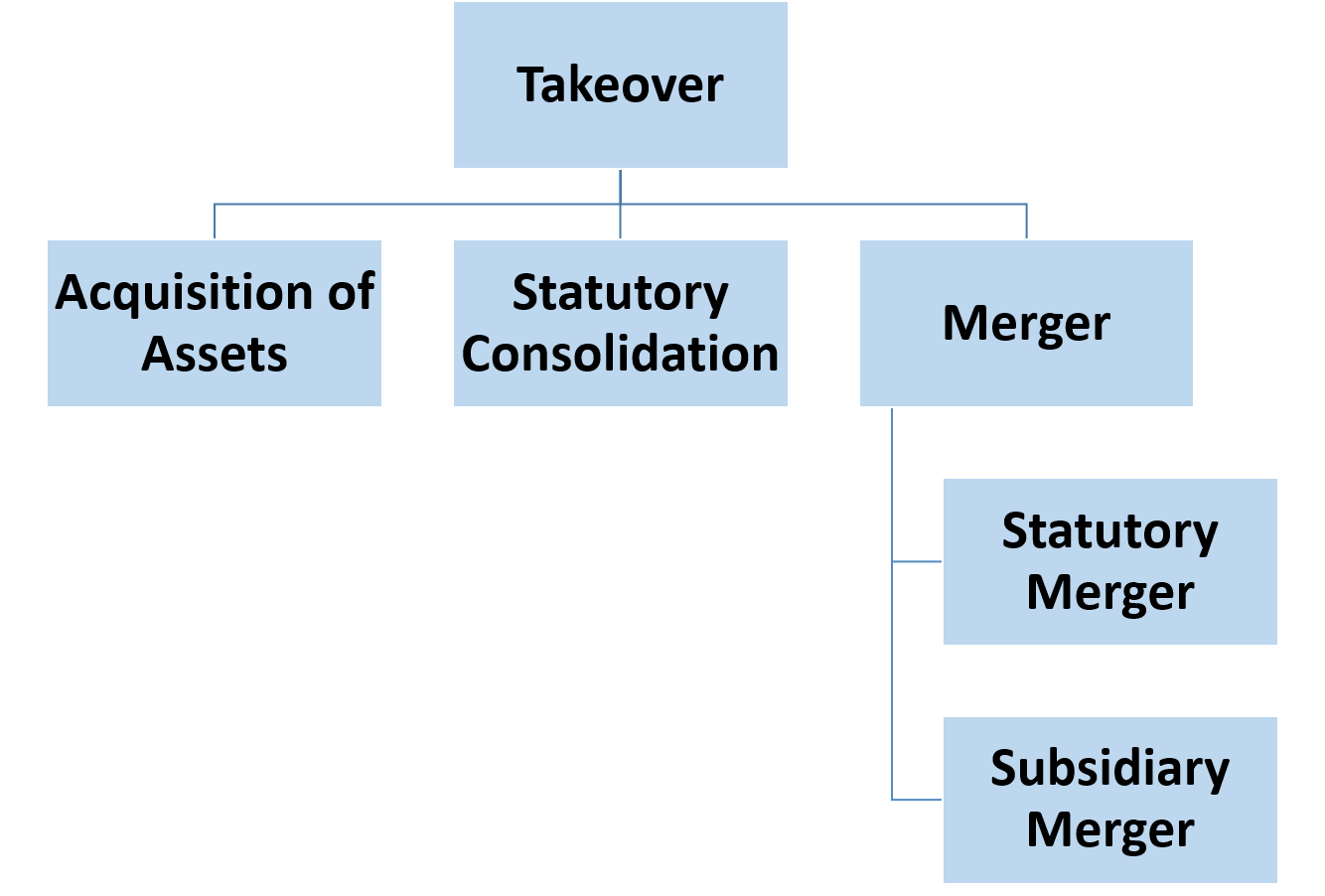

There is not one single way to acquire a company and the various forms of takeover have important financial and institutional differences. This section therefore presents the main forms of takeover and their key characteristics. Broadly speaking, a takeover can be executed via acquisition of assets, a consolidation, or a merger:

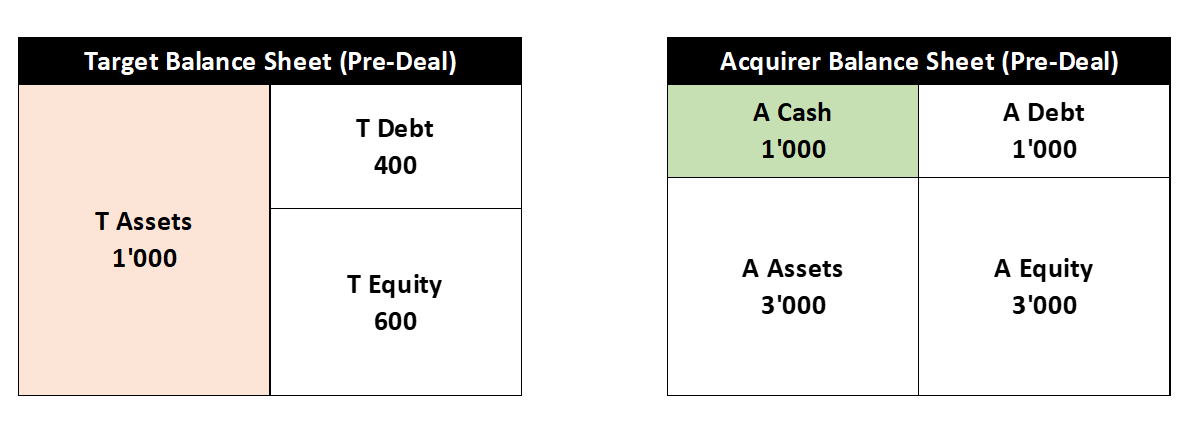

In what follows, we present these different forms of takeover using a simple example of an acquiring firm A that is interested in taking over the target firm T. Before the deal, let us assume that A and T have the following balance sheets at market values:

The target firm T has assets with a market value of 1'000. These assets are backed with 40% of debt (400) and 60% of equity (600). In contrast, the acquiring firm is four times as large and has a cash balance of 1'000 and operating assets of 3'000, for a total value of 4'000. It is financed with 25% of debt (1'000) and 75% of equity (4'000).

The following sub-sections now investigate the various deal forms listed above:

- Asset acquisition

- Statutory consolidation

- Merger:

- Statutory merger

- Subsidiary merger