Reading: Acquisition Price and Value

1. Acquisition Price and Value Implications

The purpose of this section is to provide a fairly simple model to understand:

- how a chosen deal structure determines the value of the deal,

- the allocation of that value, as well as the allocation of cash, ownership, and risk.

With this simple model, we can predict how the market should react to the announcement of a deal, and it helps us understand why the market might have reacted differently.

To develop this model step by step, let us consider the following stylized example:

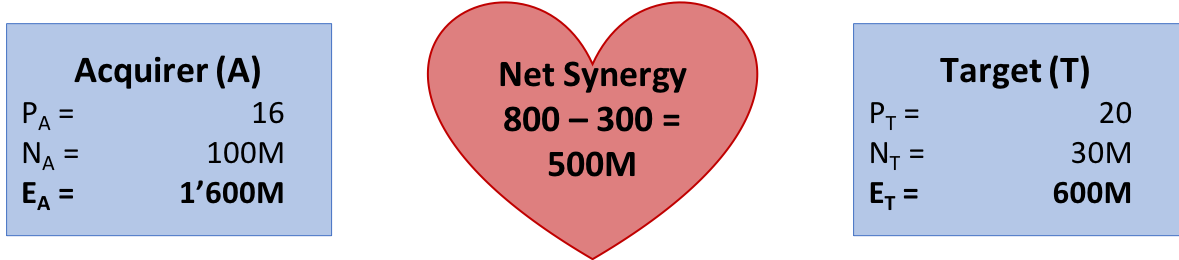

- The acquiring firm A has 100 million shares outstanding that currently trade at a price of $16 each. The acquirer's stand-alone valuation, therefore, is 1.6 billion.

- The target firm T has 30 million shares outstanding that are currently trading at a stock price of $20 each. The target's stand-alone valuation therefore is 600 million.

- By merging, the firms expect to generate synergies with a total value of $800 million. At the same time, the merger will be costly to integrate and the expected merger integration costs have a present value of $300 million (after taxes). Consequently, the expected net synergies are $500 million (= 800 - 300).

The following figure summarizes the situation before the merger:

Based on this information, we can determine the relevant purchase price range:

- Minimum offer price: $600 million

- Maximum offer price: $1'100 million, namely the stand-alone value (600) plus all expected net synergies (500M).

Offer price

Now let us assume that the parties agree on an acquisition price of $900 million. Put differently, the acquirer pays a takeover premium of 300 million on top of the target's stand-alone valuation. This premium corresponds to 60% of the expected synergies. The remaining expected synergies, namely 200 million, will go to the acquirer:

- Target NPV = Offer price – Stand-alone Value = 900 – 600 = 300 million

- Acquirer NPV = Maximum Offer Price – Offer Price = 1'100 – 900 = 200 million.

Announcement Effects

If the deal creates an additional value of 300 million for the target shareholders and 200 million for the acquiring shareholders, the market values of the two firms should adjust accordingly after the announcement of the transaction:

- Post-Announcement Target Value = ET' = Stand-alone ValueT + Target NPV = 600 + 300 = 900 million

- Post-Announcement Acquirer Value = EA'= Stand-alone ValueA + Acquirer NPV = 1'600 + 200 = 1'800 million

Consequently, right after the announcement of the deal, the stock prices of the two firms should go to 30 for the target (PT') and 18 for the acquirer (PA'), respectively:

- Post-Announcement Target Stock Price \( = P'_T = \frac{E'_T}{N_T} = \frac{900}{30} = 30 \)

- Post-Announcement Acquirer Stock Price \( = P'_A = \frac{E'_A}{N_A} = \frac{1'800}{100} = 18 \)

Price Composition

So far, we have determined that the acquire will pay $900 million for the target firm, which corresponds to $30 per share of the target company. The next step is to determine how that acquisition price will be paid. The following subsections look at various price compositions, namely:

- A cash-only deal: Target shareholders receive a cash consideration

- A stock-only deal: Target shareholders receive shares of the acquiring company

- A cash-and-stocks deal: A deal in which the target shareholders receive a part of the acquisition price in cash and the rest in stock.