Reading: Introduction to Financial Planning

A solid financial plan is the basis of every valuation exercise and every significant management decision. The financial plan allows us to identify the firm's capital needs as well as its ability to generate cash. It also unveils the various sources and uses of funds. This section shows how to set up a financial plan.

1. The Cash Flow Cycle

Ultimately, we want to develop a framework that allows us to assess the financial viability of a firm, to estimate the fair market value of the firm and its financing instruments (usually debt and equity), and to understand how specific decisions such as mergers and acquisitions, share repurchases, or changes in the financing policy affect value.

As the modules "Foundations of Finance" discuss in great detail, the basic principle behind our considerations is fairly simple: The market value of any financial asset corresponds to the present value of all future net cash flows the owner of that asset expects to collect.

The analysis therefore focuses on two main questions:

- How much cash will the asset (or the management decision) generate in the future?

- What's the value of cash collected in the future?

This module focuses on the first question. The second question is the topic of the modules Time Value of Money, Risk, Return, and the Cost of Capital, as well as Cost of Capital and Valuation.

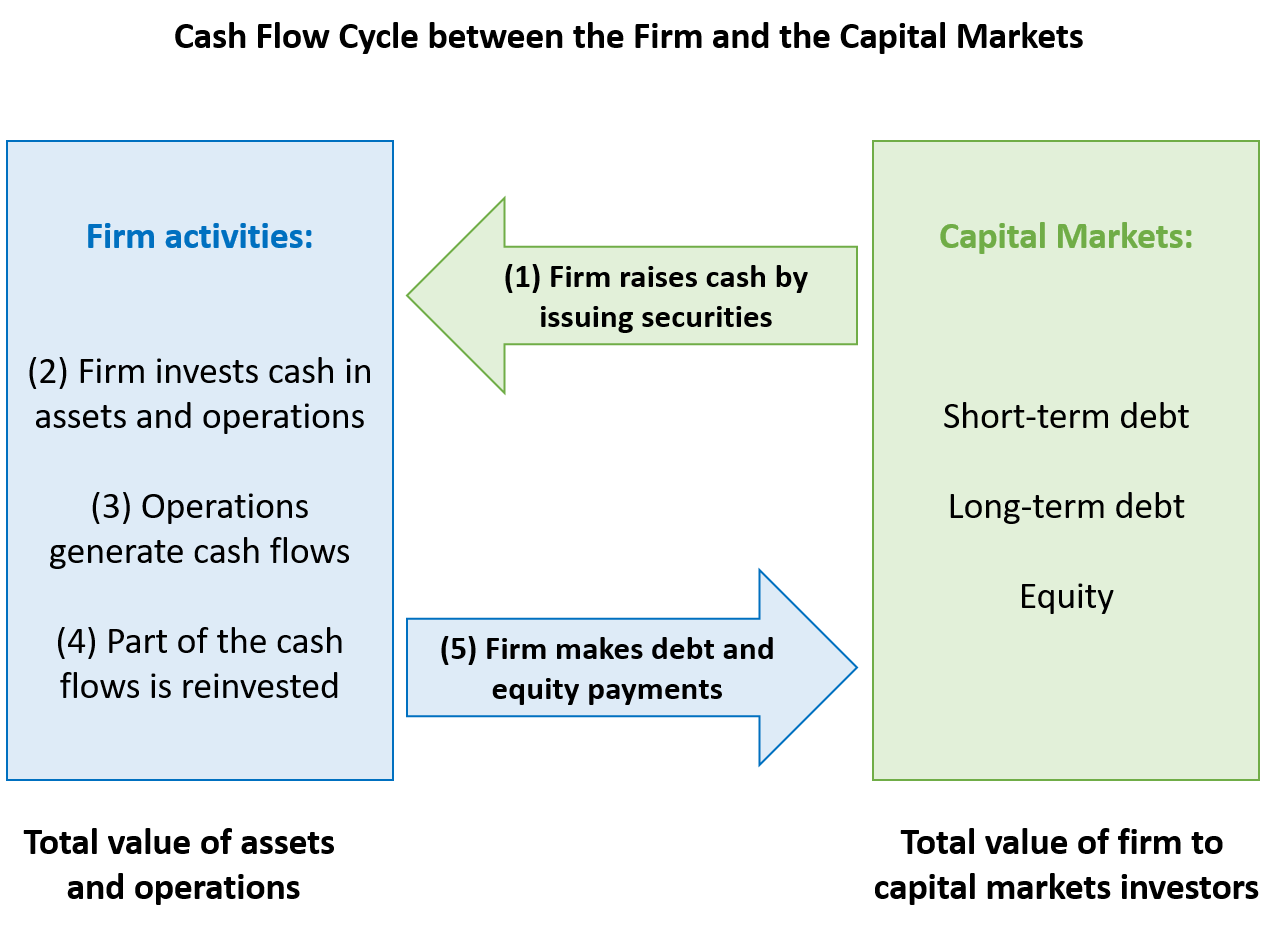

At the firm level, the financial plan should contain the relevant information about the firm's future ability to generate cash. To answer the first question above, we therefore have to be able to compile and understand financial plans. This means that we have to know the basic principles of accounting as well as the financial statements. And we need to understand the cash flow cycle between capital markets and the firm in question. Put differently, we need to be able to determine:

- How much cash the firm raises from capital markets by issuing securities.

- How the firm invests this cash in real assets.

- How much cash the firm generates from operating these assets.

- How much of the generated cash is reinvested in the business.

- And how much cash will be returned to the providers of capital via debt and equity payments.

The following graph summarizes this simplified cash flow cycle between the firm and the capital markets:

Using the logic outlined above, financial market participants will therefore compare the cash they invest in the firm (step 1 in the graph above) with the cash they receive from the firm (step 5 in the graph above) to find an answer to the first main question raised above.