Reading: Financing Alternatives

1. Introduction

During their fiscal year 2016, Seattle-based Starbucks Inc. made capital expenditures of approximately USD 3 billion, according to the firm's annual report. Where did the money for these investments come from? More generally speaking: How can and do firms fund their capital needs?

The following figure summarizes the basic financing alternatives that firms have: Firms can either finance their project with internally generated funds or by tapping into external sources of financing.

Internal financing:

- Cash from operations: If a firm is sufficiently mature, its existing projects often generate more cash than they absorb. The firm can retain these cash flows and reinvest them into new projects. In the case of Starbucks mentioned above, the firm has generated an operating cash flow of approximately USD 4.6 billion in 2016.

- Cash from divestments: Firms can also sell parts of their assets or business activities and use the proceeds to support their capital needs. In 2016, Starbucks divested assets with a total value of USD 0.8 billion.

External financing:

- Equity: A firm can use its own shares as a currency. It can issue new shares to investors and use the proceeds to finance projects. In 2016, Starbucks issued shares with a total value of approximately USD 0.15 billion, mostly in the context of executive compensation plans.

- Debt: A firm can also borrow money from banks or other investors. In exchange, it enters into a contractual obligation to make regular interest payments as well as repayments of the notional amount. Starbucks increased its debt outstanding by USD 1.25 billion in 2016.

- Other instruments: Finally, a firm can also issue financial instruments that are neither straight debt nor common equity, such as a convertible bond or preferred stock. We ignore these other instruments for the time being.

Now let us turn back to Starbucks to analyze its sources and uses of funds. Our analysis so far has identified the following sources of funds:

| Internal sources of funds | |

| Operating cash flow | 4.60 billion |

| Cash from divestments | 0.80 billion |

| Total internal sources of funds | 5.40 billion |

| External sources of funds | |

| Equity issued | 0.15 billion |

| Debt issued | 1.25 billion |

| Total external sources of funds | 1.40 billion |

| Total sources of fund | 6.80 billion |

Put differently, the firm has generated a cash flow of USD 6.8 billion with its operating activities, divestitures, and external financing activities in 2016. How did the firm use this money? In the introduction to this section, we have mentioned that the firm has made capital expenditures of approximately USD 3 billion in 2016. But what about the remaining USD 3.8 billion?

It turns out that the firm has returned most of these funds to its shareholders: In 2016, Starbucks made dividend payments of approximately USD 1.2 billion and repurchased shares with a total value of approximately USD 2.0 billion. The firm's total uses of funds therefore amounted to USD 6.2 billion:

| Uses of funds | |

| Capital expenditures | 3.00 billion |

| Dividends to shareholders | 1.20 billion |

| Share repurchases | 2.00 billion |

| Total uses of funds | 6.20 billion |

The difference between the sources and the uses of funds of USD 0.6 billion (= 6.8 - 6.2) was retained in the company as an additional cash balance.

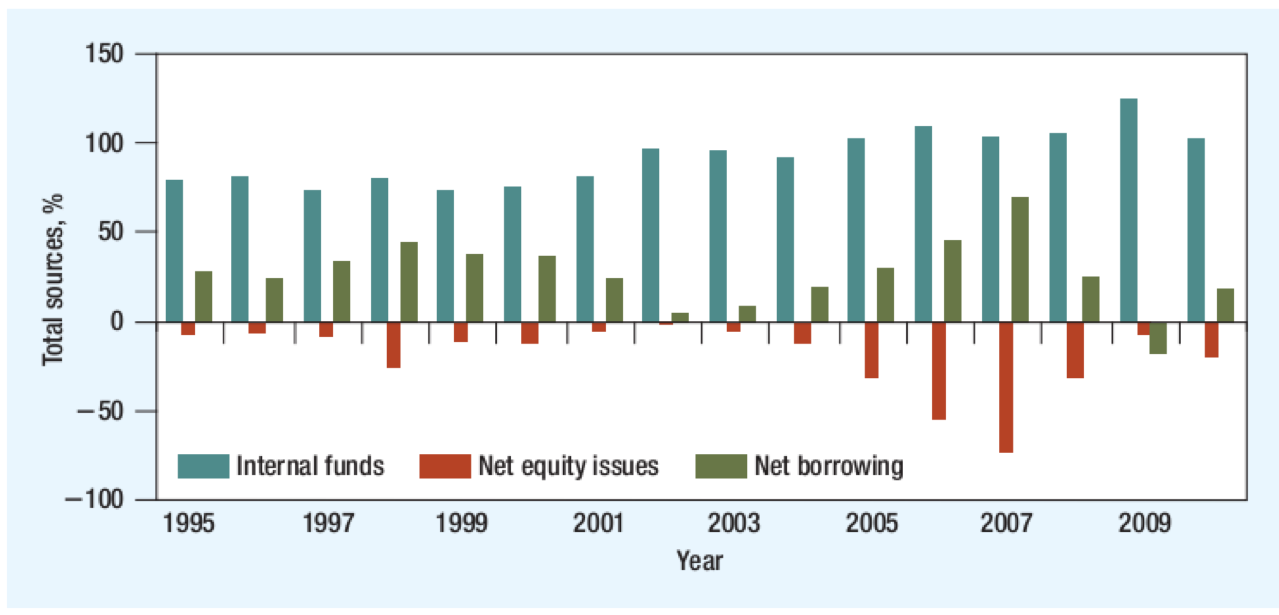

This example has shown the different internal and external sources of funds that firms can use to support their capital needs. We have considered a fairly mature company that generates considerable positive cash flows from current operations. The patterns that we have discovered are in fact fairly typical of mature companies. The following graph, which is from Brealey, Myers, and Allen (2011, p. 349), supports this claim. Similar to our first table above, it shows the composition of the sources of funds for U.S. listed firms over the period 1995 to 2010. The largest contribution by far comes from internal funds, whereas net borrowings (debt financing) are usually considerably smaller. Interestingly enough, net equity issues are negative throughout the observation period. This means that firms, on aggregate, return more money to their shareholders than they receive from them.

This figure, and the more detailed numbers that we have discussed in the context of Starbucks, raise a set of important follow-up questions, including:

- Why does a firm not invest all its operating cash flows into new projects?

- Why does a cash-rich firm borrow money?

- Why does such a firm borrow money to return it to shareholders?

- Why does a firm pay dividends and repurchase shares at the same time?

- etc.

These are some of the questions that we will address in this module. Before we do so, however, we have to discuss in a somewhat more structured way what the firm's capital structure is and how we can assess whether that structure is sustainable.