Reading: Towards a Payout Policy

2. From Funding Requirements to Payout

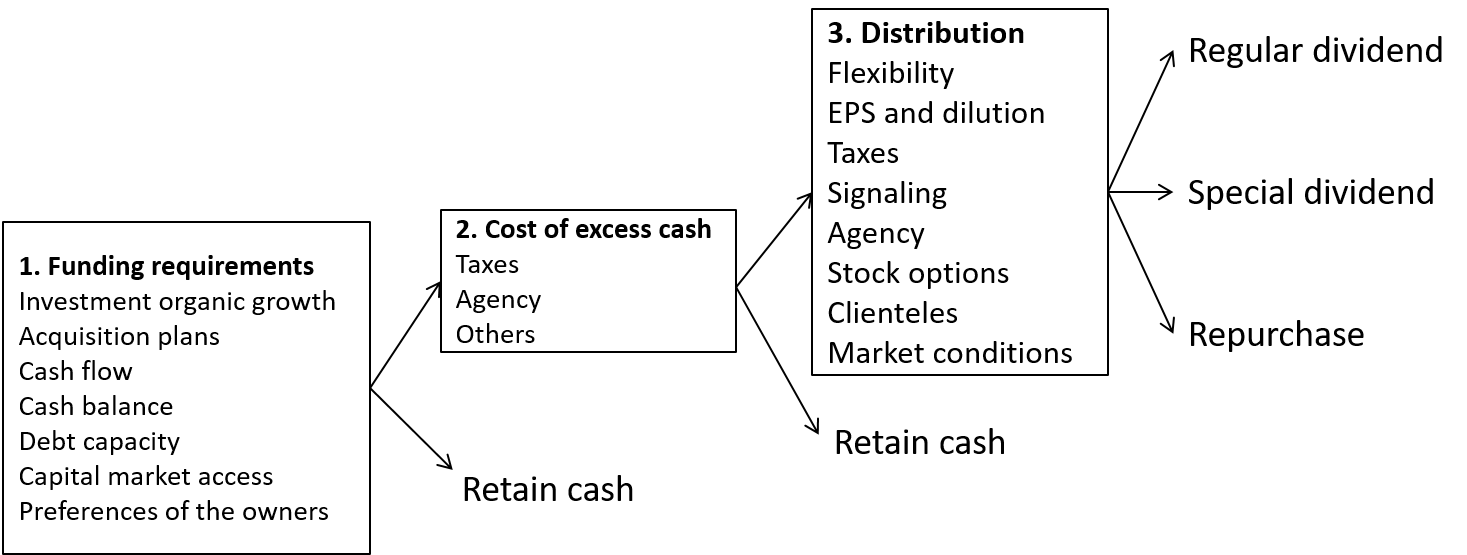

When thinking about the payout policy, it often makes sense to structure the thoughts around the following three dimensions:

- Funding requirements of the firm

- Costs of excess cash held inside the firm

- Costs and benefits of the alternative forms of distribution.

The following graph summarizes these three dimensions:

Funding Requirements

In many instances, a good starting point is the identification of the firm's funding requirements. Is the firm in net demand or in net supply of cash? Important considerations in this context relate to the sources as well as the uses of cash:

Uses of cash:

- The key consideration regarding the uses of cash is the availability of valuable (ROIC > WACC) investment opportunities, both in the context of organic growth and acquisition plans.

- For mature firms often a less relevant question is whether the operating business is able to sustain itself financially, i.e., whether the operating cash flow is positive.

- Especially in the context of family-controlled businesses, the preferences of the owners could also be an important use of cash, in the sense that family shareholders expect regular dividend payments to support their lifestyles.

Sources of cash:

- Closely related is the question of the cash sources that are available to firms.

- Internal cash sources: Is the operating business cash positive and are there cash balances from past retained earnings?

- External cash sources: Are there unused debt capacities (i.e., is the firm able to borrow more debt without jeopardizing its financial health)? And does the firm have access to the capital market in general if it is in need of funding?

The answers to these questions should allow managers to determine to what extent the firm has and will have excess cash balances, that is, cash balances that could be returned to shareholders without harming the firms operating activities, investment policies, and financial obligations.

- If the firm has such excess cash balances, it should consider returning them to shareholders.

- In contrast, if all the cash is required to support the firm's operations and investment strategy, paying out cash could harm firm value, which is why cash retention might be the economically more reasonable decision.

Cost of Excess Cash

It is important to note that having excess cash does not necessarily imply that the firm should return it to shareholders. Before making such a decision, we need to understand the costs of holding excess cash inside the firm. For exmple:

- Do such excess cash balances bring about negative tax effects, for example because the corporate income tax rate exceeds the income tax rate of the relevant shareholders? Or is it actually more tax efficient to retain these funds and invest them at the market rate?

- Equally importantly, does excess cash change the behavior of managers, in the sense that they become financially less prudent and start wasting money on NPV-negative projects?

All these question have been discussed extensively in the section that dealt with the basic relevance of payout decisions and the value of cash holdings inside the firm.

- If excess cash is less valuable inside the firm than outside the firm, it should be returned to shareholders as quickly as possible.

- In contrast, if excess cash is at least as valuable inside the firm than outside the firm, retaining these funds is not necessarily bad.

Form of Distribution

If the firm or its owners conclude that there is excess cash and that there are adverse effects to retaining it inside the firm, the question then is how to distribute the funds to shareholders. The sections Dividends vs. Share Repurchases as well as Why do Firms Pay Dividends? have dealt extensively with this question.

The bottom line is that the firm should assess the costs and benefits of the various payout alternatives. There is no general rule that one form of payout is strictly better than the other. However, as the above-mentioned sections have shown, dividends and share repurchases have markedly different characteristics and implications. Generally speaking, the main advantages of share buybacks are:

- Higher flexibility

- Tend to increase EPS and help fight ownership dilution

- Receive favorable tax treatment

- Facilitate executive compensation

- Send a signal to the market that the firm could be undervalued.

In contrast, the main advantages of dividend payments are:

- Signal the market financial health

- Could be favored by investors who want to instill self-control

- Could be a substitute for fixed-income securities at times of low yields

By balancing out the advantages and disadvantages of the various forms of payout, managers should be able to determine whether the right approach is to increase ordinary dividends, pay an extraordinary dividend, repurchase shares or choose a combination of these methods.