Reading: Towards a Payout Policy

Completion requirements

View

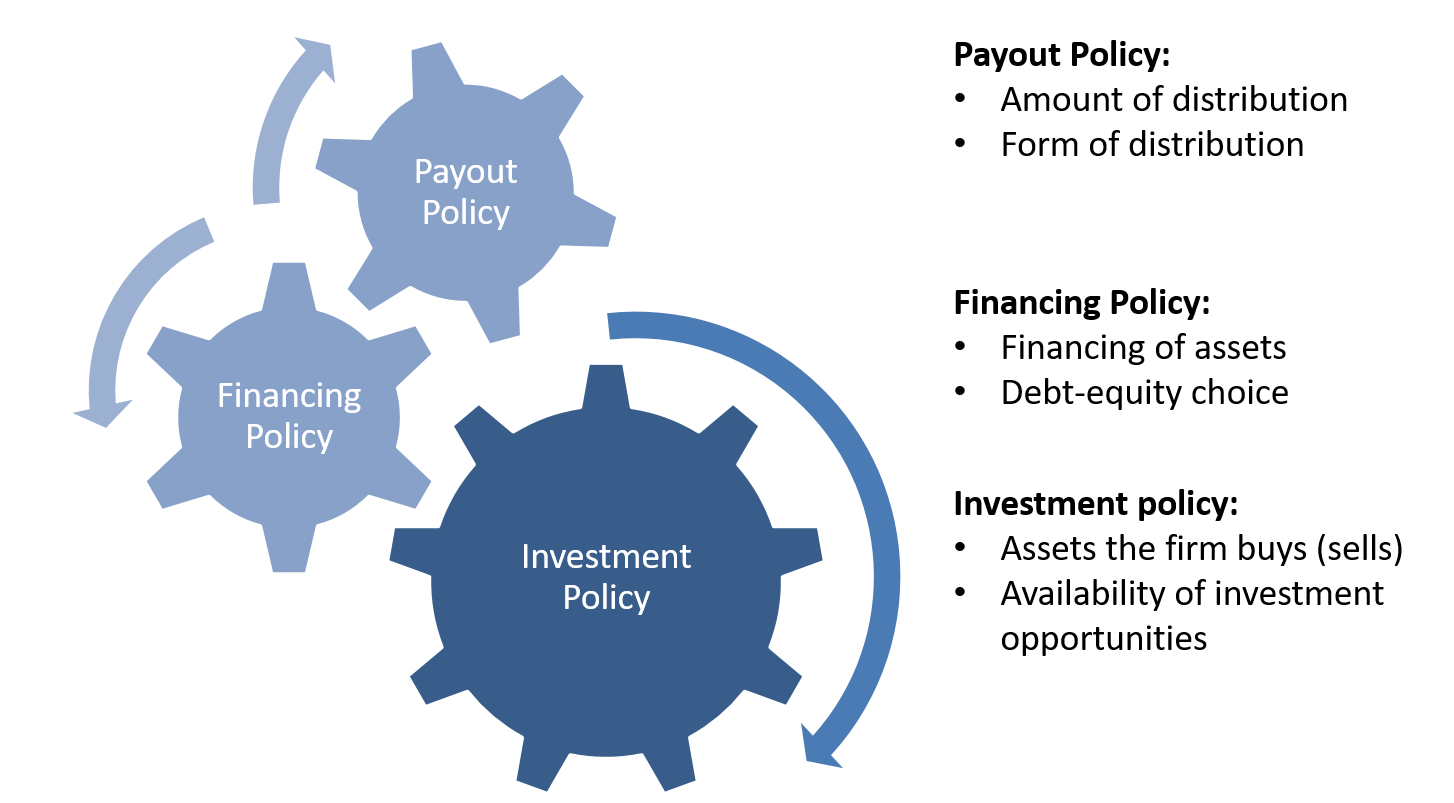

3. Investment Policy, Financing Policy, and Payout Policy

All these considerations make clear that the firm's payout policy cannot be considered in isolation. It is strongly interlinked with the firm's investment policy as well as its financing policy, as the following figure illustrates:

While the three policies cannot be defined independently, different firms (and firms at different stages of their lifecycle) often have different priorities. To illustrate this, let us briefly look at the typical priorities of listed mature firms, privately held family firms, and new ventures, respectively.

Listed mature firms

- In mature firms, especially those with good capital market access, the investment policy is (or should be) in the spotlight.

- These firms should follow the "NPV-rule" and invest as long as the reinvestment return (ROIC) exceeds the cost of capital (WACC).

- If the operating cash flow is insufficient to support the investment needs, these firms should raise external money (financing policy) and limit payout (payout policy).

- In contrast, if the business generates more money than can be used for value-enhancing investments, firms should return funds more aggressively (payout policy), possibly in combination with a tax-optimized capital structure (financing policy).

- As we have discussed before, the latter situation is more typical of mature firms: Firms, on average, run out of significant new growth opportunities as they grow older. Therefore, payout policy should become increasingly important over time.

Privately held (family) firms

- In privately held firms, the financing policy is often crucial.

- Many of these firms are reluctant to borrow money from banks to finance new projects, in part also because debt financing increases the owner's risk, forces her to disclose information to the bank, and often brings about a set of strict debt covenants that limit the owner's freedom.

- The firms might be even more reluctant to raise external equity, as this would imply a dilution of the ownership structure and a potential loss of control.

- In many instances, this restricted financing policy therefore implies that the operating cash flow is the sole source of funds to support the firms investment and payout policy.

- Especially in the context of family-controlled firms, the payout policy often has similar (or even higher) relevance. This is particularly true if there are external family shareholders whose sole source of income (from the company) comes through dividends.

- The restricted financing and payout policies can have far-reaching implications for the firms investment policy!

- If the sources of funds are limited to operating cash flows and shareholders are hungry for dividends, there might be insufficient funds available to finance growth and thereby secure the firm's ability to pay dividends in the future.

- In many industries, inability to grow is a death sentence!

- A famous case in point is the McIlhenny family, the owners of Tabasco, who, for a long time, has put significant emphasis on the firm's payout policy. Allegedly, the CEO of the company eventually informed the family during a family retreat that they had a simple choice:

- Cut dividends and start to invest in growth so as to expand the profit-generating capacity of the firm and secure its ability to pay dividends in the future.

- Maintain the dividends, in which case the firm would soon lose its ability to make any payouts. Under this scenario, the CEO therefore advised the family to invest their money in psychologist fees through a family assistance program aimed at helping family members adjust to their new, less affluent, reality.

- As a result of this dire outlook, the firm moved away from its (possibly excessive) focus on payouts and, instead, put significant emphasis on an investment strategy that secured future growth.

New Ventures

- Finally, in new ventures, the financing "policy" is often crucial.

- These firms are characterized by negative operating cash flows and significant investment needs. Moreover, because of a lack of revenues, track record, and tangible assets, their (debt) capital market access is generally limited.

- The ability to tap into external (equity) financing is therefore one of the key success factors, and it determines to what extent the firm can pursue its investment opportunities.

- Payouts to shareholders should obviously be kept at a minimum.

- The way firms are financed early on will often shape the incentives and behaviors of the managers and shareholders for years to come. Therefore, founders have to be very careful when negotiating financing deal terms early on. The module Deal Structuring addresses this fascinating topic in great detail.