Reading: Financing and Firm Life Cycle

1. Financing and Firm Life Cycle

Since early-stage equity financing is a key topic in another module, this module will mostly focus on debt and equity financing at later stages of the corporate life cycle. Still, to get a better understanding of the interplay of the various sources of financing over time, the following graph provides a rough outline of the typical financing instruments that are available at different stages of the corporate life cycle:

- The blue blocks summarize internal sources of financing,

- the green blocks summarize equity instruments,

- and the red blocks summarize debt instruments.

The next subsections will then briefly explain these different sources of internal and external financing.

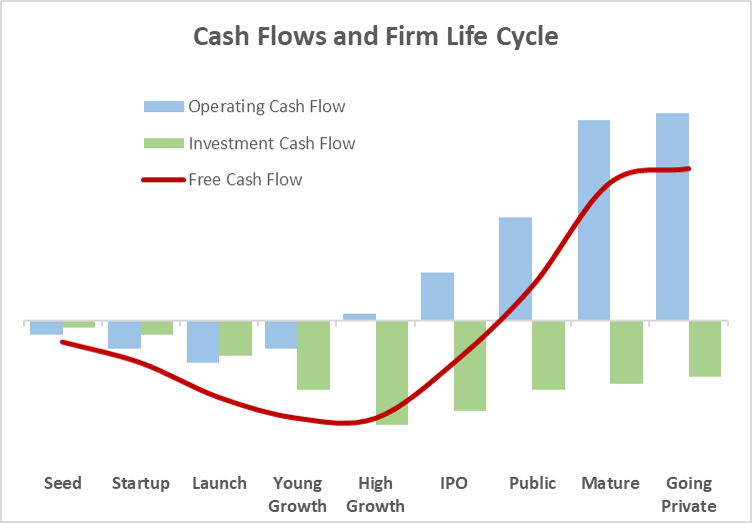

The typical cash flow patterns that are associated with these life cycle stages are summarized below. The blue bars reflect the firm's operating cash flows, the net cash balance that results from the firm's actual operating business activities. The green bars indicate how much the firm typically invests. Together, these two cash flows constitute the firm's free cash flow. The free cash flow is the most important cash flow figure:

- A negative free cash flow means that the firm requires external financing (or excess cash) to support its operating and investment activities.

- In contrast, a positive free cash flow indicates that the firm generates more money with its business than what is tied up in its investment activities. This money can, in principle, be returned to investors.

The typical pattern is that many firms have negative free cash flows well into their growth phase.

- Early on, negative operating cash flows tend to be the main use of cash (salary payments, etc.)

- As sales kick in, operating cash flows could turn positive rather early in the growth phase. This factually marks the point where the firm reaches break even.

- However, due to the significant investment needs that are associated with growth, free cash flows tend to remain negative until growth slows down.

- During that time, firms therefore need to rely on external financing (or cross-subsidies).

- Once growth has been financed, many firms can sustain their business with internally generated funds and can, in fact, start returning money to their investors.